- Hong Kong

- /

- Gas Utilities

- /

- SEHK:1193

With EPS Growth And More, China Resources Gas Group (HKG:1193) Is Interesting

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

So if you're like me, you might be more interested in profitable, growing companies, like China Resources Gas Group (HKG:1193). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

View our latest analysis for China Resources Gas Group

How Quickly Is China Resources Gas Group Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. China Resources Gas Group managed to grow EPS by 11% per year, over three years. That's a good rate of growth, if it can be sustained.

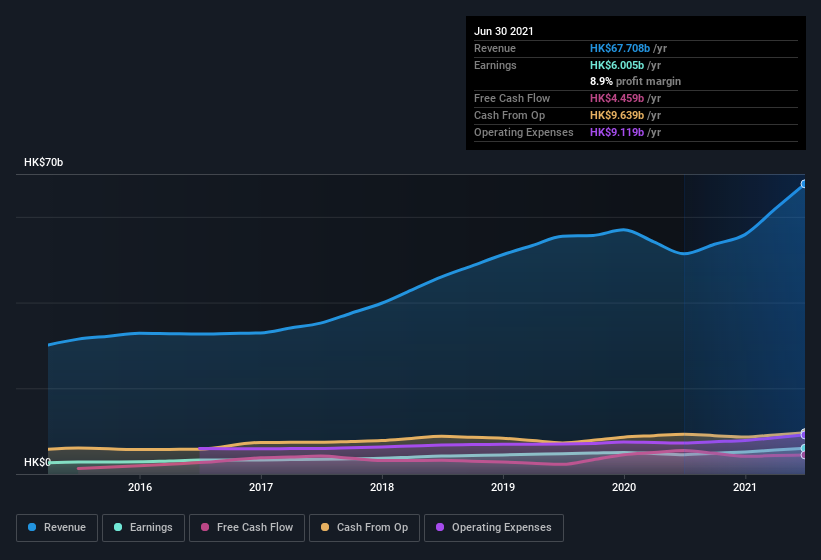

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note China Resources Gas Group's EBIT margins were flat over the last year, revenue grew by a solid 32% to HK$68b. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Fortunately, we've got access to analyst forecasts of China Resources Gas Group's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are China Resources Gas Group Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

It's a pleasure to note that insiders spent HK$20m buying China Resources Gas Group shares, over the last year, without reporting any share sales whatsoever. As if for a flower bud approaching bloom, I become an expectant observer, anticipating with hope, that something splendid is coming. Zooming in, we can see that the biggest insider purchase was by Non-Executive Chairman of the Board Chuandong Wang for HK$6.1m worth of shares, at about HK$40.45 per share.

Should You Add China Resources Gas Group To Your Watchlist?

As I already mentioned, China Resources Gas Group is a growing business, which is what I like to see. Not every business can grow its EPS, but China Resources Gas Group certainly can. The cherry on top is the insider share purchases, which provide an extra impetus to keep and eye on this stock, at the very least. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if China Resources Gas Group is trading on a high P/E or a low P/E, relative to its industry.

As a growth investor I do like to see insider buying. But China Resources Gas Group isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade China Resources Gas Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1193

China Resources Gas Group

An investment holding company, engages in the sale of natural and liquefied gas, and connection of gas pipelines.

Adequate balance sheet average dividend payer.