The global markets have experienced a turbulent week, with U.S. stocks mostly lower due to AI competition fears and mixed earnings results, while European indices reached new highs following interest rate cuts by the ECB. In such fluctuating conditions, investors often seek opportunities that balance risk and reward. Penny stocks, though an older term, still signify smaller or emerging companies that can offer substantial value when backed by robust financials. By focusing on these attributes, investors may uncover potential growth opportunities within this unique segment of the market.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$3.69 | HK$42.39B | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.525 | MYR2.61B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.395 | MYR1.1B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.89 | £482.95M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.70 | MYR414.16M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR285.47M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.65 | £178.85M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.10 | HK$698.27M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

| China Lilang (SEHK:1234) | HK$3.92 | HK$4.69B | ★★★★★☆ |

Click here to see the full list of 5,730 stocks from our Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Islamic Arab Insurance (Salama) PJSC (DFM:SALAMA)

Simply Wall St Financial Health Rating: ★★★★★☆

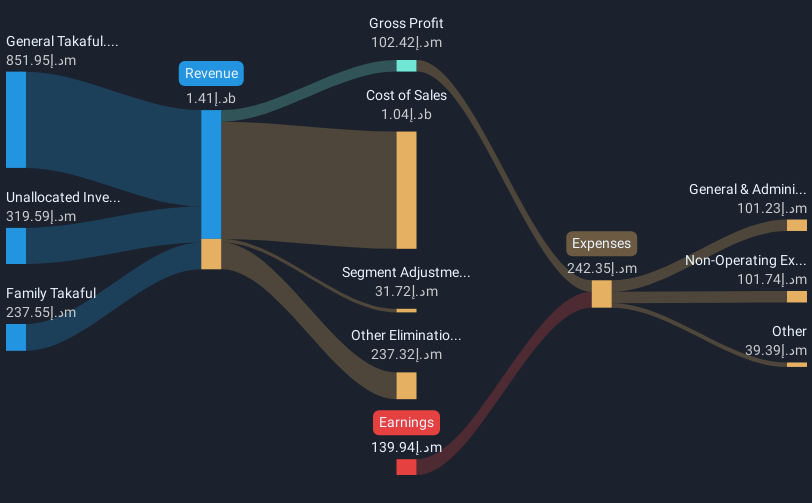

Overview: Islamic Arab Insurance Co. (Salama) PJSC, along with its subsidiaries, offers various general, family, health, and auto takaful solutions across Africa and Asia with a market cap of AED407.86 million.

Operations: The company generates revenue from Family Takaful amounting to AED237.55 million and General Takaful totaling AED851.95 million.

Market Cap: AED407.86M

Islamic Arab Insurance Co. (Salama) PJSC, with a market cap of AED407.86 million, offers takaful solutions across Africa and Asia. Despite being unprofitable, Salama reported an improvement in net income for the third quarter of 2024 to AED8.08 million from AED1.26 million a year ago, indicating some positive momentum in earnings per share growth from AED0.001 to AED0.01 over the same period. The company is debt-free and boasts sufficient cash reserves for over three years, although its short-term assets do not cover long-term liabilities of AED2.9 billion, presenting potential financial challenges ahead.

- Get an in-depth perspective on Islamic Arab Insurance (Salama) PJSC's performance by reading our balance sheet health report here.

- Examine Islamic Arab Insurance (Salama) PJSC's past performance report to understand how it has performed in prior years.

House of Investments (PSE:HI)

Simply Wall St Financial Health Rating: ★★★★★☆

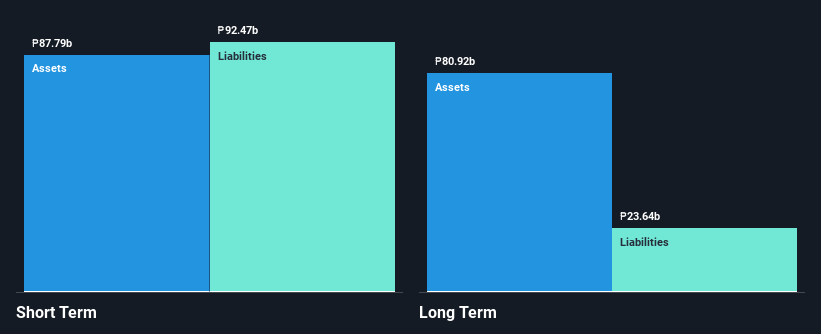

Overview: House of Investments, Inc. is an investment holding company operating in the automotive, property and property services, financial services, and education sectors in the Philippines and internationally with a market cap of ₱5.11 billion.

Operations: The company's revenue is primarily derived from the automotive sector at ₱5.90 billion, followed by education at ₱5.15 billion, and property and property services at ₱1.23 billion, with additional contributions from other services totaling ₱799.93 million.

Market Cap: ₱5.11B

House of Investments, Inc. has shown significant revenue growth, with sales reaching ₱25.64 billion for the first nine months of 2024, a substantial increase from the previous year. The company reported a net income of ₱1.20 billion compared to a net loss previously, indicating a strong recovery trajectory. Despite its low price-to-earnings ratio of 2.9x compared to the Philippine market average, House of Investments faces challenges with short-term liabilities exceeding assets by ₱4.7 billion and relies on large one-off gains impacting its earnings quality. Its seasoned management and board contribute positively to governance stability amidst these financial dynamics.

- Navigate through the intricacies of House of Investments with our comprehensive balance sheet health report here.

- Understand House of Investments' track record by examining our performance history report.

FAR International Holdings Group (SEHK:2516)

Simply Wall St Financial Health Rating: ★★★★☆☆

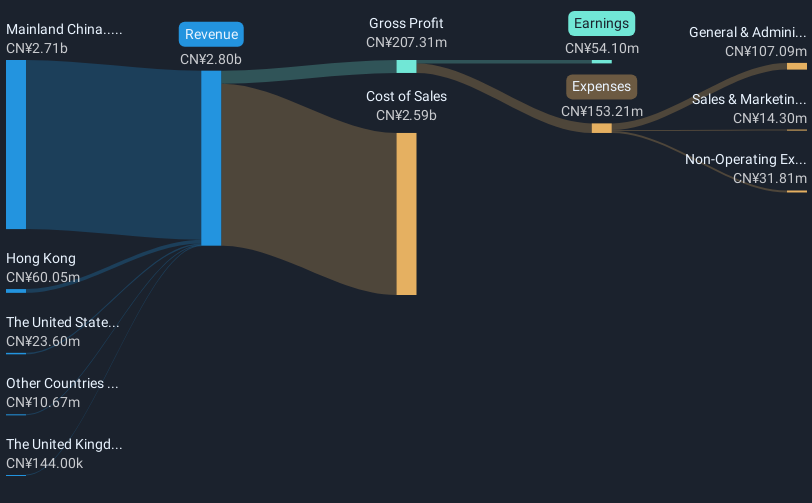

Overview: FAR International Holdings Group Company Limited is an investment holding company that offers cross-border e-commerce logistics services in Mainland China, Hong Kong, the United States, the United Kingdom, and other international markets with a market cap of HK$897 million.

Operations: The company generates revenue of CN¥2.80 billion from its air freight transportation segment.

Market Cap: HK$897M

FAR International Holdings Group demonstrates a mixed financial profile, with a market cap of HK$897 million and revenue of CN¥2.80 billion from its air freight transportation segment. The company has more cash than total debt, indicating strong liquidity, while short-term assets comfortably cover both short and long-term liabilities. Despite this, the company's earnings have declined by 6.8% annually over five years but rebounded significantly with 131.2% growth last year, surpassing industry averages. However, high non-cash earnings and negative operating cash flow raise concerns about earnings quality and debt coverage sustainability amidst volatile share prices.

- Click to explore a detailed breakdown of our findings in FAR International Holdings Group's financial health report.

- Evaluate FAR International Holdings Group's historical performance by accessing our past performance report.

Taking Advantage

- Take a closer look at our Penny Stocks list of 5,730 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2516

FAR International Holdings Group

An investment holding company, provides cross-border e-commerce logistics services in Mainland China, Hong Kong, the United States, the United Kingdom, and internationally.

Adequate balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives