As we enter January 2025, global markets are experiencing a mixed start to the year, with U.S. stocks closing out a strong 2024 despite recent volatility and economic indicators showing varying trends across regions. In this context, investors often look beyond major indices to explore opportunities in lesser-known areas like penny stocks. While the term 'penny stocks' might seem outdated, these smaller or newer companies can offer significant growth potential when backed by solid financials and balance sheet resilience.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.53 | MYR2.64B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.565 | A$66.23M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.41 | MYR1.14B | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.71 | £425.03M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.01 | £757.4M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.64 | HK$40.08B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.87 | £469.45M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.966 | £152.38M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.52 | £67.13M | ★★★★☆☆ |

Click here to see the full list of 5,820 stocks from our Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Bank Of Sharjah P.J.S.C (ADX:BOS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Bank Of Sharjah P.J.S.C., along with its subsidiaries, offers commercial and investment banking products and services in the United Arab Emirates, with a market capitalization of AED2.78 billion.

Operations: The company generates revenue from two main segments: Commercial Banking, which contributes AED328.96 million, and Investment Banking, which accounts for AED406.73 million.

Market Cap: AED2.78B

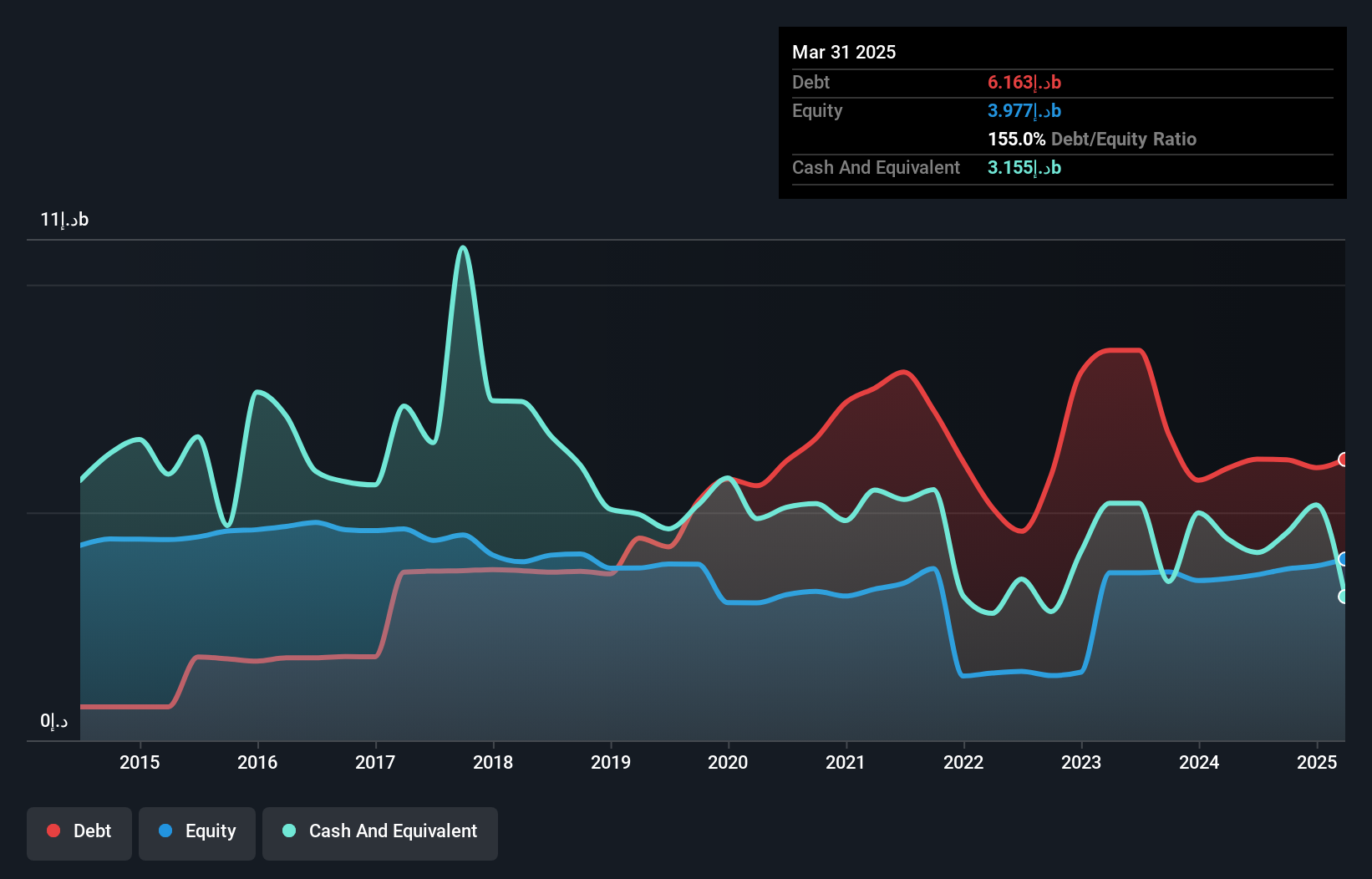

Bank of Sharjah P.J.S.C. demonstrates significant earnings growth, with net income rising to AED 124.9 million in Q3 2024 from AED 21.84 million the previous year, highlighting a substantial turnaround from past losses. The bank's revenue is primarily driven by its Commercial and Investment Banking segments, indicating diverse income streams. Despite this growth, the company faces challenges such as a high bad loans ratio of 8.3%, which may impact future stability. The management team is relatively new with an average tenure of 0.5 years, potentially affecting strategic continuity and execution efficiency moving forward.

- Navigate through the intricacies of Bank Of Sharjah P.J.S.C with our comprehensive balance sheet health report here.

- Examine Bank Of Sharjah P.J.S.C's past performance report to understand how it has performed in prior years.

Logory Logistics Technology (SEHK:2482)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Logory Logistics Technology Co., Ltd. offers digital freight transportation services and solutions in China with a market cap of HK$1.13 billion.

Operations: The company's revenue from the provision of digital freight businesses and related services amounts to CN¥6.26 billion.

Market Cap: HK$1.13B

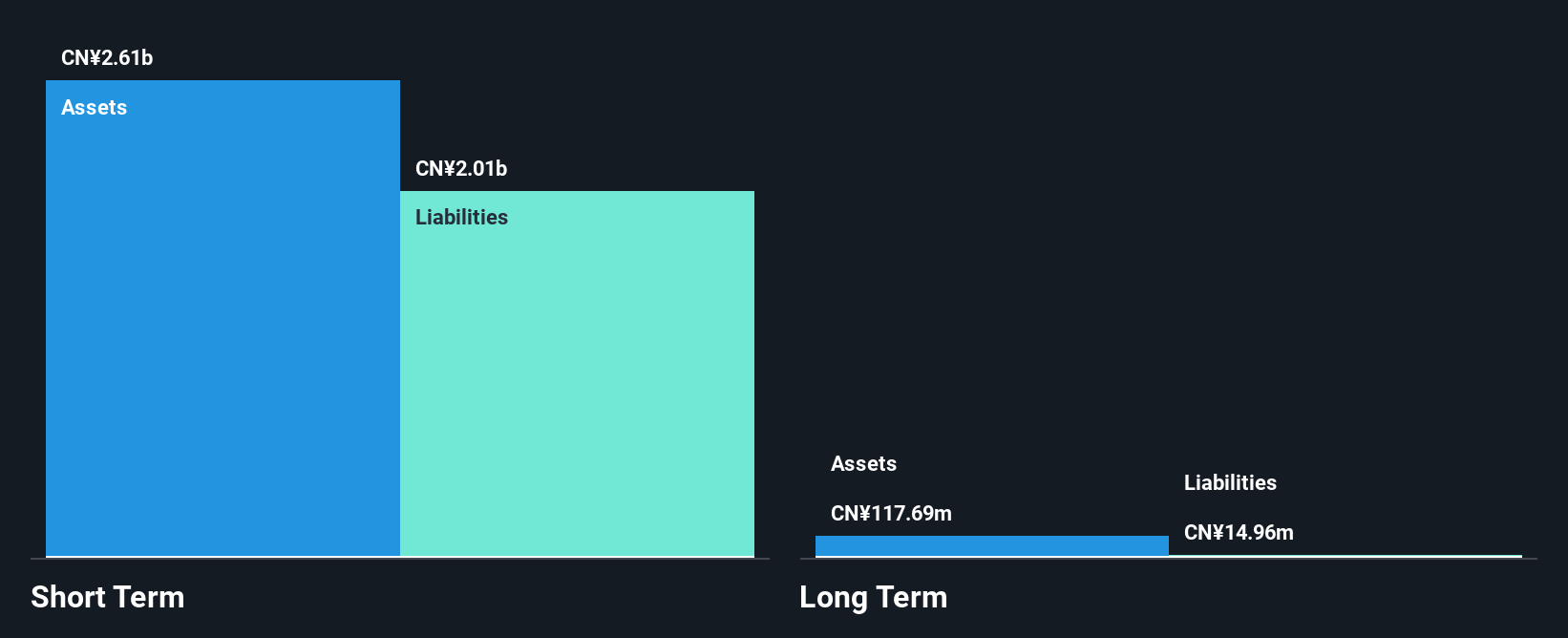

Logory Logistics Technology Co., Ltd. has shown a promising shift to profitability this year, with revenue from its digital freight business reaching CN¥6.26 billion. Its financial stability is supported by short-term assets of CN¥2.5 billion, exceeding both short-term liabilities and long-term obligations significantly, and it maintains more cash than total debt. The company's interest payments are well covered by EBIT at 9.6 times, although operating cash flow remains negative. Despite achieving profitability, the stock exhibits high volatility compared to most Hong Kong stocks, and its return on equity is low at 2.7%.

- Click here to discover the nuances of Logory Logistics Technology with our detailed analytical financial health report.

- Explore historical data to track Logory Logistics Technology's performance over time in our past results report.

Rojukiss International (SET:KISS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Rojukiss International Public Company Limited is involved in the distribution of skincare, cosmetics, food supplements, pharmaceutical, and medical products across Thailand, Indonesia, Cambodia, Laos, and internationally with a market cap of THB2.64 billion.

Operations: The company generates revenue of THB1.10 billion from its Personal Products segment.

Market Cap: THB2.64B

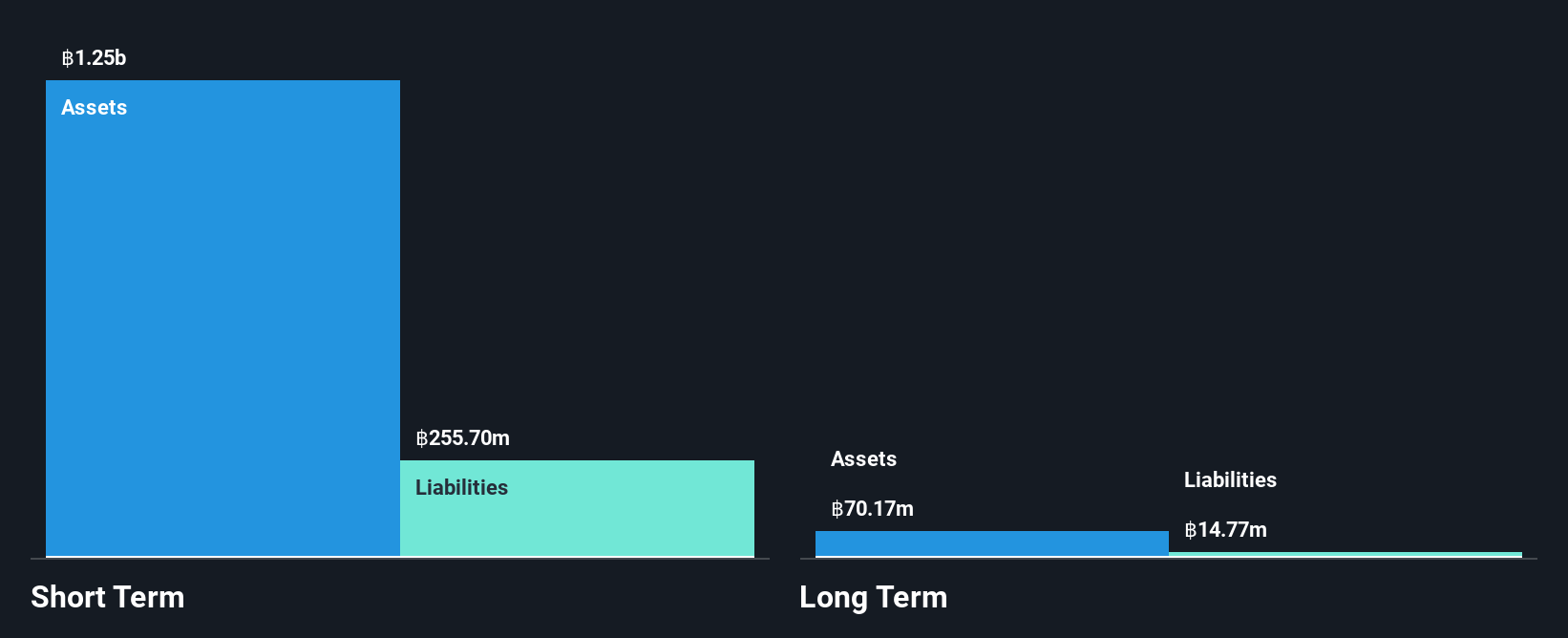

Rojukiss International, with a market cap of THB2.64 billion, has demonstrated financial stability by maintaining no debt and having short-term assets of THB1.2 billion that exceed its liabilities. The company's recent earnings report shows a net income increase to THB125.33 million for the nine months ending September 2024, reflecting improved profit margins and an earnings growth rate surpassing industry averages. However, despite trading below estimated fair value and showing high-quality past earnings, its return on equity remains low at 16.4%, and dividends are not well covered by free cash flows. Recent executive changes may impact future strategic direction.

- Click here and access our complete financial health analysis report to understand the dynamics of Rojukiss International.

- Examine Rojukiss International's earnings growth report to understand how analysts expect it to perform.

Key Takeaways

- Unlock more gems! Our Penny Stocks screener has unearthed 5,817 more companies for you to explore.Click here to unveil our expertly curated list of 5,820 Penny Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2482

Logory Logistics Technology

Provides digital freight transportation services and solutions to logistics companies, cargo owners, other shippers, and truck drivers in China.

Adequate balance sheet with questionable track record.

Market Insights

Community Narratives