- China

- /

- Specialty Stores

- /

- SZSE:002656

Logory Logistics Technology And 2 Other Asian Penny Stocks To Watch

Reviewed by Simply Wall St

Amid a backdrop of easing monetary policies and fluctuating trade tensions, Asian markets continue to navigate a complex landscape. For investors willing to explore beyond established giants, penny stocks offer intriguing possibilities. While the term "penny stock" may seem outdated, it still captures the essence of investing in smaller or newer companies that can provide significant value when backed by strong financial health. In this article, we examine three Asian penny stocks that present compelling opportunities with promising balance sheets and potential for growth.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| JBM (Healthcare) (SEHK:2161) | HK$2.93 | HK$2.39B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.52 | HK$940.15M | ✅ 4 ⚠️ 1 View Analysis > |

| Asia Medical and Agricultural Laboratory and Research Center (SET:AMARC) | THB2.96 | THB1.24B | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.58 | HK$2.14B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.15 | SGD466.08M | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.74 | THB2.84B | ✅ 3 ⚠️ 3 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.098 | SGD51.3M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.27 | SGD12.87B | ✅ 5 ⚠️ 1 View Analysis > |

| Anton Oilfield Services Group (SEHK:3337) | HK$1.10 | HK$2.97B | ✅ 4 ⚠️ 1 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.32 | THB8.73B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 948 stocks from our Asian Penny Stocks screener.

We'll examine a selection from our screener results.

Logory Logistics Technology (SEHK:2482)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Logory Logistics Technology Co., Ltd. offers road freight transportation services and solutions to various stakeholders in the logistics industry in China, with a market cap of HK$1.25 billion.

Operations: The company generates CN¥7.31 billion in revenue from its digital freight businesses and related services.

Market Cap: HK$1.25B

Logory Logistics Technology's recent performance highlights its potential within the penny stock segment, with earnings growing significantly by 161.7% over the past year, surpassing industry averages. Although trading at a substantial discount to its estimated fair value, it maintains a stable financial position with more cash than total debt and well-covered interest payments. Despite high share price volatility recently, the company has managed to improve net profit margins and reduce debt levels over five years. Recent earnings reports show modest sales decline but an increase in net income, reflecting resilient operational efficiency amidst market challenges.

- Dive into the specifics of Logory Logistics Technology here with our thorough balance sheet health report.

- Learn about Logory Logistics Technology's historical performance here.

Guangxi Fenglin Wood Industry GroupLtd (SHSE:601996)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Guangxi Fenglin Wood Industry Group Co., Ltd operates in the production and sale of wood-based panels and engages in afforestation activities in China, with a market cap of CN¥2.77 billion.

Operations: Guangxi Fenglin Wood Industry Group Co., Ltd does not report distinct revenue segments.

Market Cap: CN¥2.77B

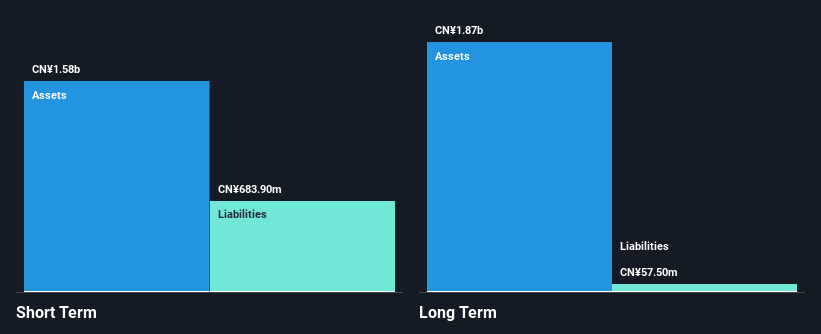

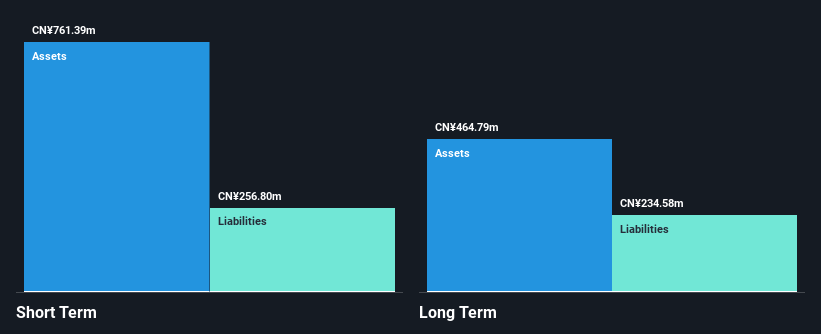

Guangxi Fenglin Wood Industry Group Ltd's financial standing presents a mixed picture for penny stock investors. The company has more cash than total debt, indicating a solid liquidity position, and its short-term assets significantly surpass both short- and long-term liabilities. However, it remains unprofitable with a negative return on equity of -6.77%, and losses have increased at an annual rate of 55.6% over the past five years. Recent earnings reveal declining revenue from CN¥966.63 million to CN¥782.97 million year-over-year, resulting in a net loss of CN¥46.6 million compared to the previous year's profit.

- Get an in-depth perspective on Guangxi Fenglin Wood Industry GroupLtd's performance by reading our balance sheet health report here.

- Evaluate Guangxi Fenglin Wood Industry GroupLtd's historical performance by accessing our past performance report.

Modern Avenue Group (SZSE:002656)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Modern Avenue Group Co., Ltd. operates retail outlets worldwide and has a market cap of CN¥1.78 billion.

Operations: The company generates revenue from two segments: CN¥218.19 million from China and CN¥121.59 million from overseas markets.

Market Cap: CN¥1.78B

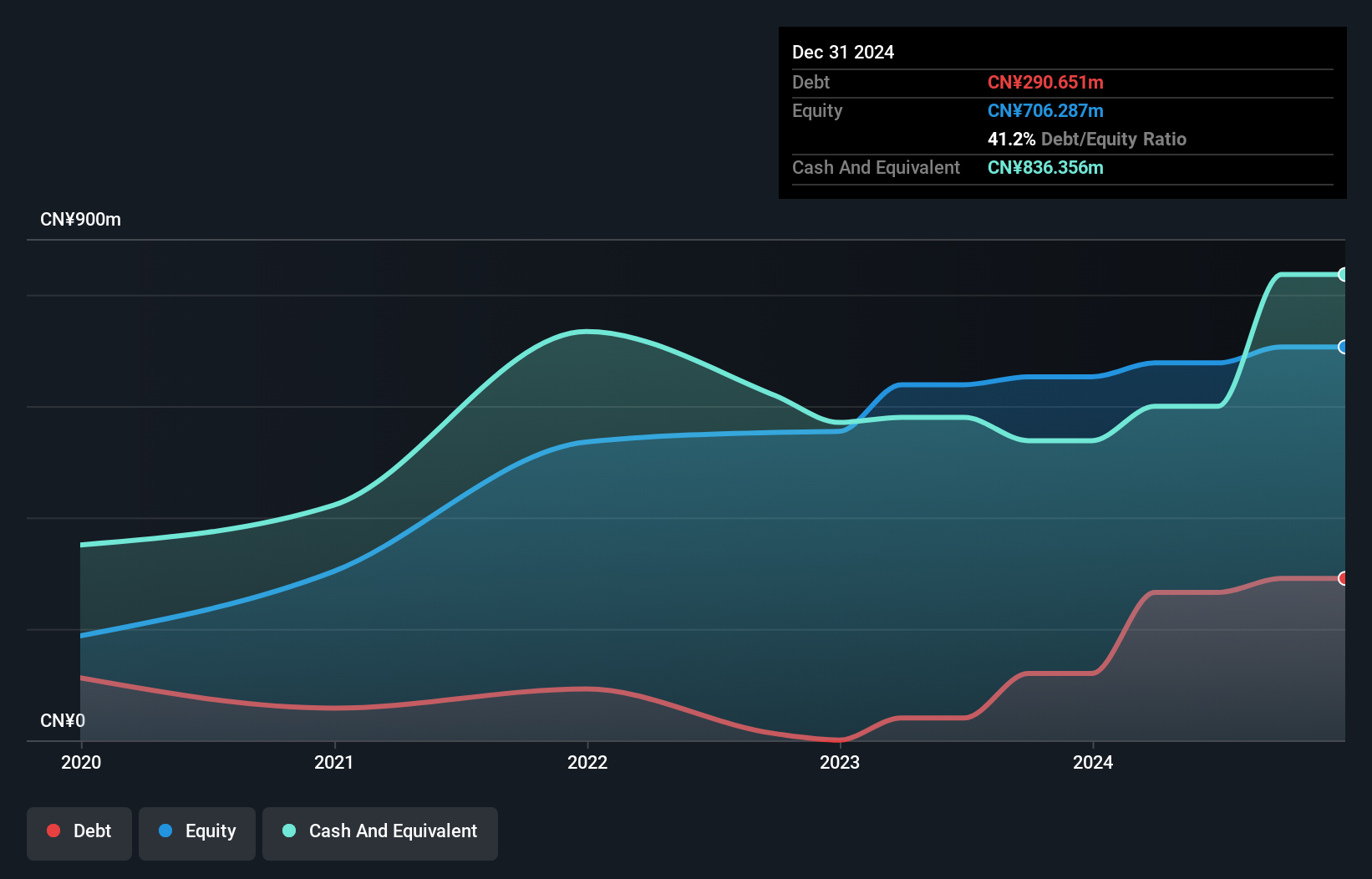

Modern Avenue Group Co., Ltd. demonstrates certain strengths and challenges as a penny stock. The company reported CN¥234.95 million in revenue for H1 2025, showing growth from the previous year, although it remains unprofitable with a net loss of CN¥20.77 million. Its short-term assets of CN¥535.6 million comfortably cover both its short- and long-term liabilities, indicating robust liquidity. Despite having more cash than debt and a stable cash runway exceeding three years, the company's negative return on equity highlights ongoing profitability issues, though it has significantly reduced losses by 66.8% annually over five years.

- Click to explore a detailed breakdown of our findings in Modern Avenue Group's financial health report.

- Examine Modern Avenue Group's past performance report to understand how it has performed in prior years.

Make It Happen

- Click through to start exploring the rest of the 945 Asian Penny Stocks now.

- Ready For A Different Approach? The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002656

Mediocre balance sheet and overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)