- Hong Kong

- /

- Marine and Shipping

- /

- SEHK:2343

Pacific Basin Shipping (SEHK:2343): Valuation in Focus After Board Changes Address US Regulatory Risks

Reviewed by Simply Wall St

Pacific Basin Shipping (SEHK:2343) has drawn renewed attention after announcing executive changes intended to address US regulatory risks. The board appointed Kristian Helt as executive Director, while Alexander Howarth Yat Kay Cheung resigned as Non-executive Director.

See our latest analysis for Pacific Basin Shipping.

Investor sentiment has been lively this year, with Pacific Basin Shipping’s share price climbing over 54% year-to-date and notching a 13.6% gain in the last 90 days, although it slipped following the board’s reshuffle. With a five-year total shareholder return above 230%, recent momentum suggests investors are reevaluating growth potential and regulatory risks in light of board changes and the upcoming Q3 call.

If executive shake-ups have you thinking broader, now could be the perfect time to discover fast growing stocks with high insider ownership.

Given the boardroom shifts and strong recent returns, the key question for investors now is whether Pacific Basin Shipping remains undervalued, or if the market has already factored in the company’s future growth prospects and regulatory developments.

Most Popular Narrative: 2.4% Undervalued

Pacific Basin Shipping’s last close price of HK$2.50 sits just below the most widely followed narrative’s fair value estimate of HK$2.56. This suggests the stock may be trading at a slight discount right now as analysts weigh recent performance and shifting market dynamics.

"Strong operational efficiency, strategic fleet renewal, and favorable market dynamics position Pacific Basin for sustained revenue growth, earnings resilience, and compliance with evolving environmental standards."

What is driving this valuation uptick? Explore the pivotal future earnings upgrades and a profit outlook that relies on increased efficiency and significant changes in the shipping sector. If you want the precise figures and key assumptions behind this target, the full narrative offers all the details that could shift expectations for Pacific Basin.

Result: Fair Value of $2.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued robust demand for minor bulk and sustained operational outperformance could offset current oversupply fears. This may also challenge the consensus valuation outlook.

Find out about the key risks to this Pacific Basin Shipping narrative.

Another View: Market Multiples Signal a Premium

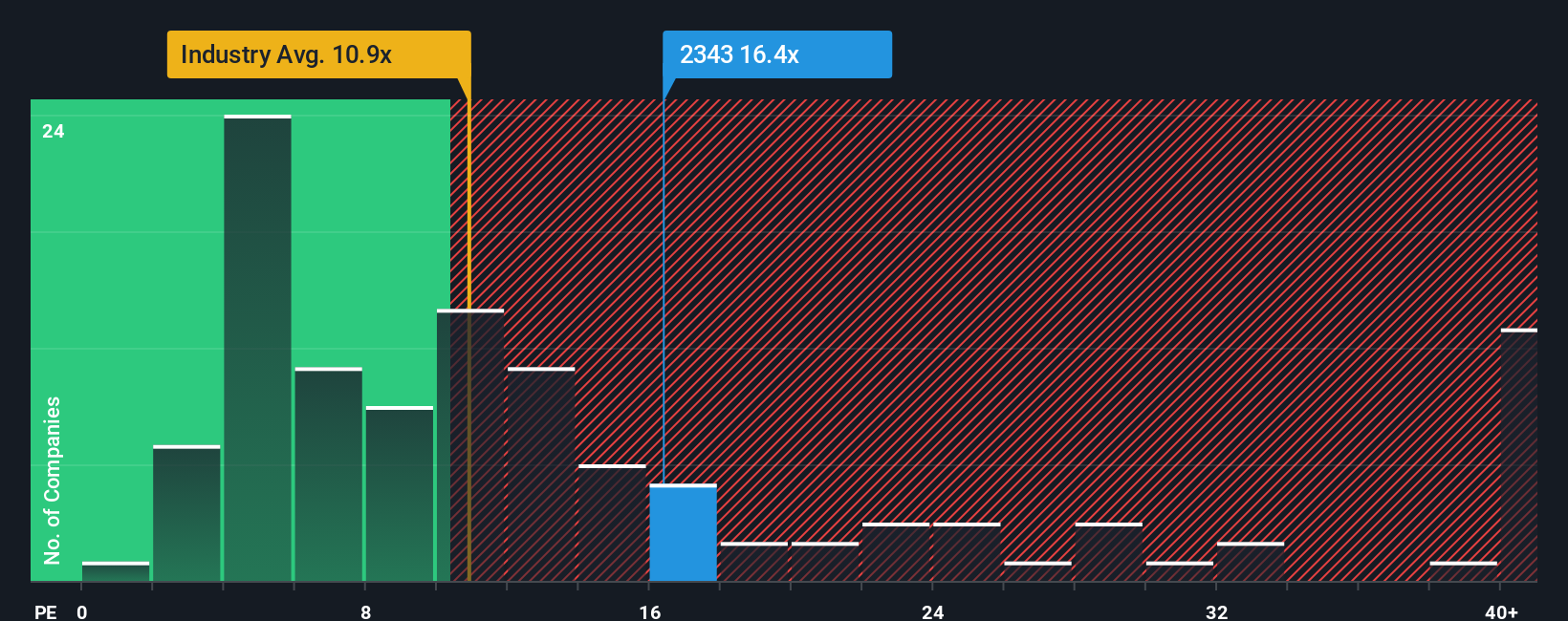

Looking at market multiples, Pacific Basin Shipping’s price-to-earnings ratio stands at 16.5 times, significantly higher than the Asian shipping industry average of 10.7 and its peer average of 5.8. This premium suggests investors see higher growth or resilience, but it could also mean greater valuation risk if those expectations are not met. With the fair ratio at 14.3, the current market could eventually shift toward that level. Will Pacific Basin’s fundamentals keep up?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Pacific Basin Shipping Narrative

If you see the story differently or want to dive deeper into the numbers, you can build your own Pacific Basin Shipping narrative. This process often takes just minutes. Do it your way

A great starting point for your Pacific Basin Shipping research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Smart moves now can set you up for tomorrow’s opportunities. Beat the crowd and stay ahead by acting on new market trends before they hit the headlines.

- Tap into tomorrow’s profit potential by checking out these 873 undervalued stocks based on cash flows that could be trading for less than their true worth right now.

- Capitalize on the AI boom by exploring these 24 AI penny stocks harnessing artificial intelligence for significant growth potential in the future.

- Unlock reliable cash flow with these 17 dividend stocks with yields > 3% offering attractive yields and steady returns in changing markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2343

Pacific Basin Shipping

An investment holding company, engages in the provision of dry bulk shipping services in Hong Kong and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)