- Hong Kong

- /

- Marine and Shipping

- /

- SEHK:1919

COSCO SHIPPING Holdings Co., Ltd.'s (HKG:1919) 29% Price Boost Is Out Of Tune With Earnings

Despite an already strong run, COSCO SHIPPING Holdings Co., Ltd. (HKG:1919) shares have been powering on, with a gain of 29% in the last thirty days. The last 30 days bring the annual gain to a very sharp 89%.

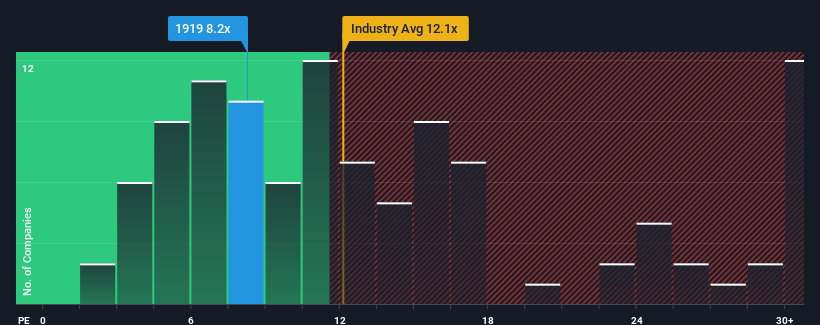

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about COSCO SHIPPING Holdings' P/E ratio of 8.2x, since the median price-to-earnings (or "P/E") ratio in Hong Kong is also close to 10x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

COSCO SHIPPING Holdings could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for COSCO SHIPPING Holdings

Does Growth Match The P/E?

In order to justify its P/E ratio, COSCO SHIPPING Holdings would need to produce growth that's similar to the market.

Retrospectively, the last year delivered a frustrating 74% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 10% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to slump, contracting by 8.3% per annum during the coming three years according to the ten analysts following the company. That's not great when the rest of the market is expected to grow by 16% each year.

With this information, we find it concerning that COSCO SHIPPING Holdings is trading at a fairly similar P/E to the market. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining earnings are likely to weigh on the share price eventually.

The Bottom Line On COSCO SHIPPING Holdings' P/E

Its shares have lifted substantially and now COSCO SHIPPING Holdings' P/E is also back up to the market median. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that COSCO SHIPPING Holdings currently trades on a higher than expected P/E for a company whose earnings are forecast to decline. Right now we are uncomfortable with the P/E as the predicted future earnings are unlikely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for COSCO SHIPPING Holdings (1 shouldn't be ignored) you should be aware of.

If these risks are making you reconsider your opinion on COSCO SHIPPING Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1919

COSCO SHIPPING Holdings

An investment holding company, engages in the container shipping and terminal operations in the United States, Europe, the Asia Pacific, Mainland China, and internationally.

Flawless balance sheet and undervalued.