J&T Global Express (SEHK:1519): Valuation in Focus After Strong Parcel Growth and Expansion Success

Reviewed by Simply Wall St

J&T Global Express (SEHK:1519) just announced third-quarter operating results that put growth in focus. Total parcel volume climbed 23% from last year, and daily volumes averaged 83.4 million, outpacing market expectations.

See our latest analysis for J&T Global Express.

The upbeat shipment growth has clearly caught investors’ attention, with a striking year-to-date share price return of 77.8% reflecting both the company’s accelerating volumes and renewed confidence in its expansion strategy. Momentum is building as robust results and market share gains spark optimism for longer-term growth.

If J&T’s strong run has you eyeing fresh opportunities, why not broaden your search and discover fast growing stocks with high insider ownership

Yet despite robust growth and an impressive rally, the key question for investors now is whether J&T Global Express shares still offer untapped value, or if the market has already priced in another stage of growth from this point.

Most Popular Narrative: 4.7% Undervalued

J&T Global Express closed at HK$10.42, slightly under the most discussed fair value estimate of HK$10.93. Strong top-line growth and margin improvements are central to the optimism among those following the consensus narrative. This gives investors reason to watch closely for future earnings traction.

The rapid expansion of e-commerce, especially in Southeast Asia and emerging markets like Latin America, continues to drive strong parcel volume growth for J&T (for example, 58% volume growth in Southeast Asia and 22% in new markets in H1 2025), supporting both top-line revenue growth and reinforcing a long-term structural demand tailwind.

Want to know what’s fueling this price target? The fair value hangs on ambitious revenue growth, sweeping margin upgrades, and bold regional bets. The financial projections behind this consensus may surprise you. See the numbers that have the market buzzing.

Result: Fair Value of HK$10.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition in China and the high capital demands of overseas expansion remain critical risks that could quickly alter the outlook ahead.

Find out about the key risks to this J&T Global Express narrative.

Another View: Multiples Tell a Different Story

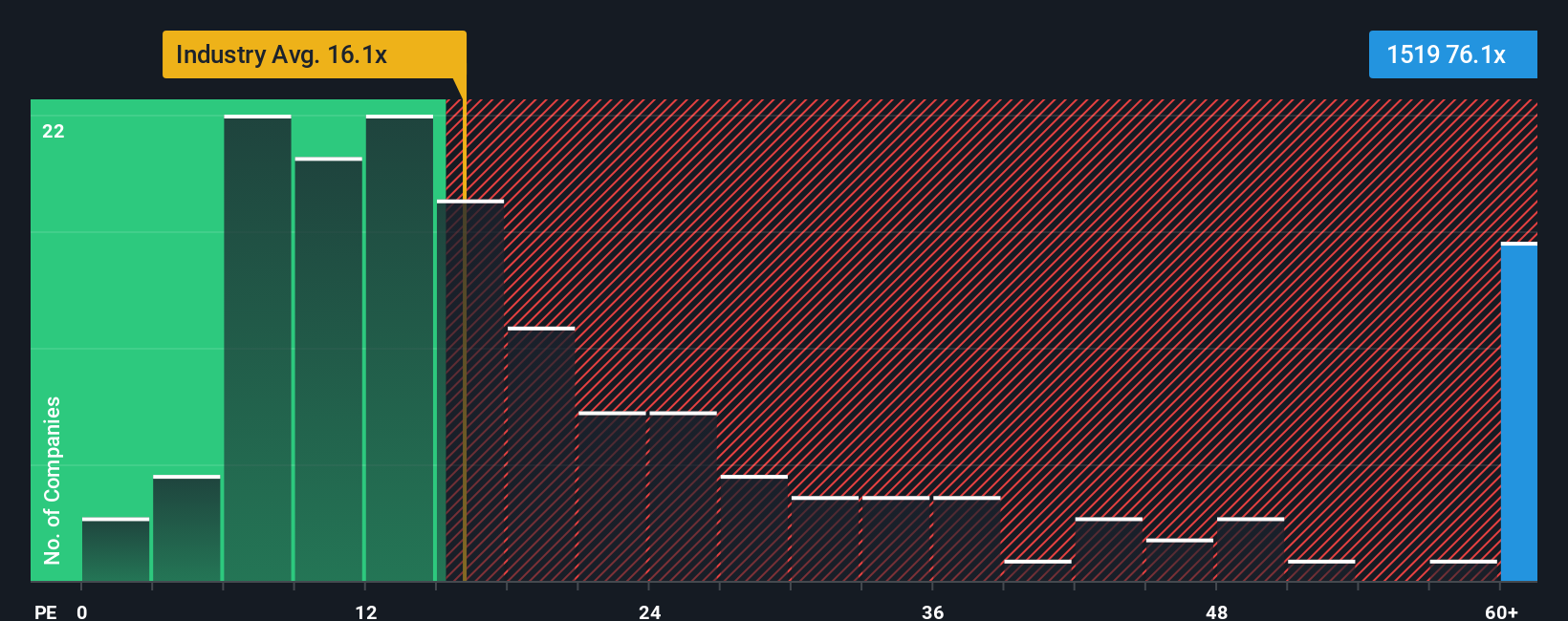

While some see strong growth and fair value based on earnings, the company's price-to-earnings ratio sits at 74.9x, which is much higher than both the Asian logistics industry average of 16.5x and its peer group at 19.9x. The fair ratio, which the market could eventually target, is just 23.3x. This significant premium suggests investors are paying up now for profits that may only materialize years ahead. Is the valuation justified or at risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own J&T Global Express Narrative

If you have a different perspective or want to dive into the numbers yourself, crafting your own narrative takes just a few minutes, so why not Do it your way

A great starting point for your J&T Global Express research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Sharper Investment Ideas?

Don’t miss the smartest opportunities on Simply Wall St. These out-of-the-box screeners can help you spot what’s next and keep you ahead of the curve.

- Capitalize on tech shifts by scanning these 27 AI penny stocks poised to benefit from surging demand for automation, machine learning, and high-growth disruptions.

- Tap into resilient earnings streams by checking out these 17 dividend stocks with yields > 3% if you want stable yields above 3% from well-managed, income-generating companies.

- Seize potential bargains today with these 877 undervalued stocks based on cash flows, carefully selected for promising cash-flow fundamentals that could offer compelling upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1519

J&T Global Express

An investment holding company, offers integrated express delivery services in the People’s Republic of China, Indonesia, the Philippines, Malaysia, Thailand, Vietnam, Saudi Arabia, the United Arab Emirates, Mexico, Brazil, and Egypt.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026