What Infinity Logistics and Transport Ventures Limited's (HKG:1442) P/E Is Not Telling You

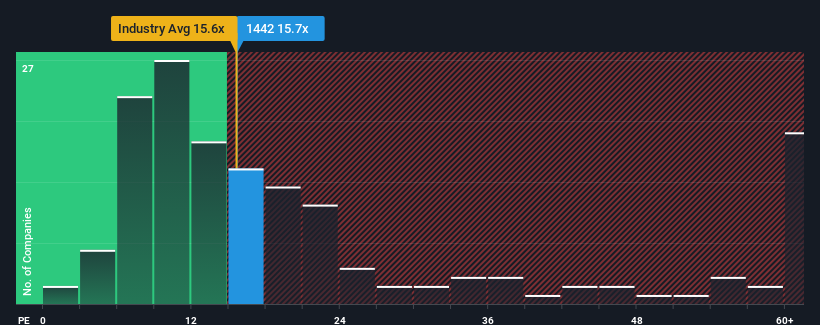

When close to half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") below 10x, you may consider Infinity Logistics and Transport Ventures Limited (HKG:1442) as a stock to potentially avoid with its 15.7x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Recent times have been quite advantageous for Infinity Logistics and Transport Ventures as its earnings have been rising very briskly. It seems that many are expecting the strong earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for Infinity Logistics and Transport Ventures

Is There Enough Growth For Infinity Logistics and Transport Ventures?

There's an inherent assumption that a company should outperform the market for P/E ratios like Infinity Logistics and Transport Ventures' to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 60% last year. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 32% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 20% shows it's an unpleasant look.

With this information, we find it concerning that Infinity Logistics and Transport Ventures is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Key Takeaway

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Infinity Logistics and Transport Ventures currently trades on a much higher than expected P/E since its recent earnings have been in decline over the medium-term. Right now we are increasingly uncomfortable with the high P/E as this earnings performance is highly unlikely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Infinity Logistics and Transport Ventures that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

If you're looking to trade Infinity Logistics and Transport Ventures, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1442

Infinity Logistics and Transport Ventures

An investment holding company, engages in the provision of logistics services in China, Indonesia, Malaysia, the Netherlands, Singapore, South Korea, Thailand, Vietnam, and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives