Asian Market Insights: Infinity Logistics and Transport Ventures Among 3 Promising Penny Stocks

Reviewed by Simply Wall St

As the global economic landscape shifts, Asian markets are navigating a complex interplay of interest rate adjustments and trade negotiations, with China facing an economic slowdown and Japan considering monetary policy changes. Amid these developments, the allure of penny stocks remains significant for investors seeking growth opportunities in smaller or newer companies. Despite being perceived as a term from past market eras, penny stocks continue to hold potential for those who value affordability and financial strength; this article will explore three such promising options in Asia.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Food Moments (SET:FM) | THB3.86 | THB3.81B | ✅ 4 ⚠️ 0 View Analysis > |

| JBM (Healthcare) (SEHK:2161) | HK$3.00 | HK$2.44B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.52 | HK$940.15M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.41 | HK$2B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.03 | SGD417.45M | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.74 | THB2.84B | ✅ 3 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.31 | SGD13.03B | ✅ 5 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.95 | NZ$135.23M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.86 | THB9.82B | ✅ 3 ⚠️ 3 View Analysis > |

| Lum Chang Holdings (SGX:L19) | SGD0.435 | SGD162.96M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 988 stocks from our Asian Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Infinity Logistics and Transport Ventures (SEHK:1442)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Infinity Logistics and Transport Ventures Limited is an investment holding company offering logistics services across various countries, including Belgium, China, and Malaysia, with a market cap of HK$887.52 million.

Operations: The company's revenue is derived from several segments, including MYR 12.90 million from 4PL Services, MYR 67.96 million from Land Transportation Services, MYR 109.13 million from Logistics Centre and Related Services, MYR 97.67 million from Integrated Freight Forwarding Services, and MYR 167.26 million from Flexitank Solution and Related Services.

Market Cap: HK$887.52M

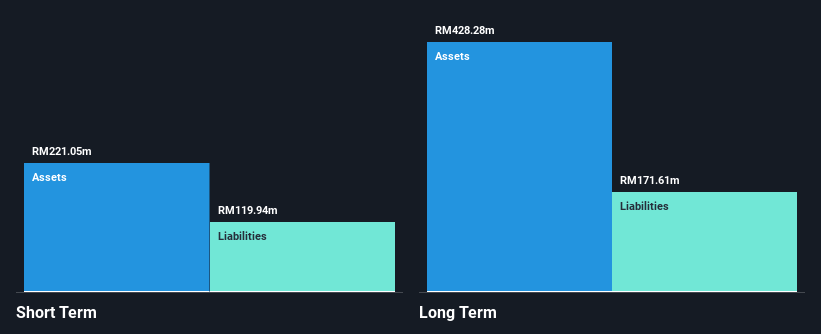

Infinity Logistics and Transport Ventures Limited, with a market cap of HK$887.52 million, demonstrates stability in its financial structure with short-term assets exceeding both short and long-term liabilities. The company has not diluted shareholder value over the past year and maintains a satisfactory net debt to equity ratio of 26.5%. Despite a decline in earnings by 4.3% annually over five years, recent earnings growth of 28.2% signals potential recovery, supported by high-quality earnings and well-covered interest payments on debt (3.4x EBIT coverage). However, recent sales have decreased to MYR 214.66 million from MYR 235.56 million year-on-year as reported for H1 2025.

- Get an in-depth perspective on Infinity Logistics and Transport Ventures' performance by reading our balance sheet health report here.

- Learn about Infinity Logistics and Transport Ventures' historical performance here.

Wanda Hotel Development (SEHK:169)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Wanda Hotel Development Company Limited is an investment holding company involved in property development, investment, leasing, and management across China, the United States, the British Virgin Islands, and internationally with a market cap of HK$3.24 billion.

Operations: The company generates revenue primarily from investment property leasing, amounting to HK$93.04 million.

Market Cap: HK$3.24B

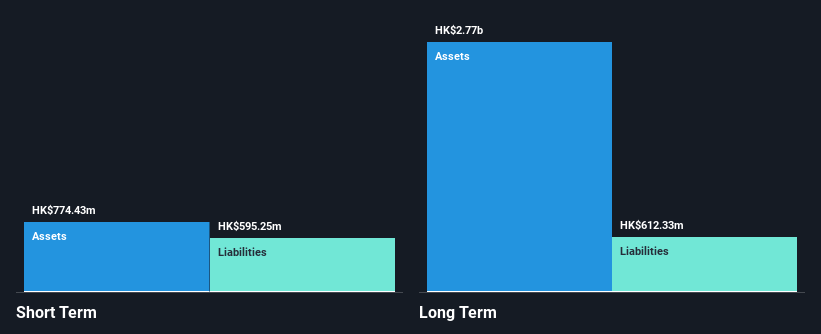

Wanda Hotel Development, with a market cap of HK$3.24 billion, has shown improvement in its financial performance despite being unprofitable. The company reported sales of HK$57.16 million for the first half of 2025, up from HK$47.22 million the previous year, and net income rose to HK$35.64 million from a significant loss last year. Its short-term assets exceed both short and long-term liabilities, providing financial stability without debt concerns. Additionally, its inclusion in the S&P Global BMI Index highlights increased recognition within the investment community while maintaining a positive cash flow trajectory with an ample cash runway exceeding three years.

- Click to explore a detailed breakdown of our findings in Wanda Hotel Development's financial health report.

- Explore historical data to track Wanda Hotel Development's performance over time in our past results report.

Ausnutria Dairy (SEHK:1717)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ausnutria Dairy Corporation Ltd is an investment holding company involved in the research, development, production, marketing, processing, packaging, and distribution of dairy and nutrition products with a market cap of HK$4.62 billion.

Operations: The company generates revenue from two main segments: Nutrition Products, contributing CN¥314.75 million, and Dairy and Related Products, which account for CN¥7.29 billion.

Market Cap: HK$4.62B

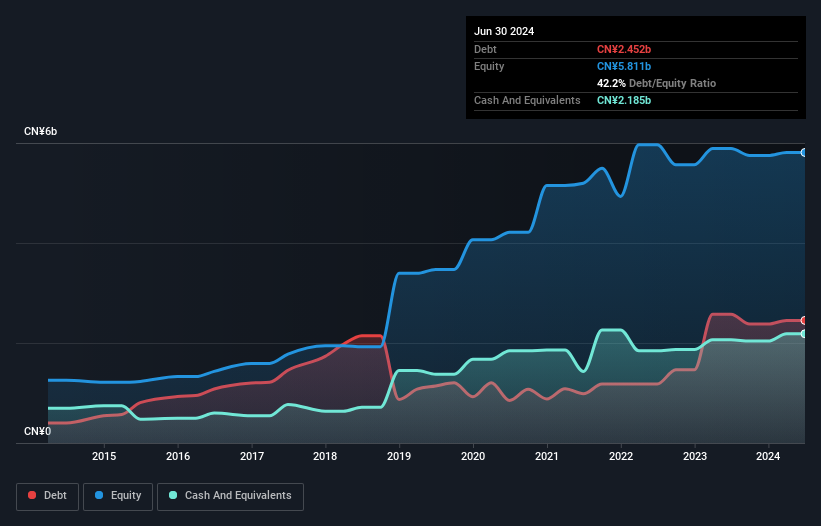

Ausnutria Dairy, with a market cap of HK$4.62 billion, has demonstrated financial resilience despite challenges. For the first half of 2025, sales increased to CN¥3.89 billion from CN¥3.68 billion the previous year, while net income rose to CN¥180.45 million from CN¥145.39 million, reflecting improved profit margins and earnings quality. The company's short-term assets surpass both short and long-term liabilities, ensuring liquidity stability; however, operating cash flow only covers 14.2% of its debt obligations—a potential concern for investors focused on cash flow adequacy in penny stocks within Asia's dynamic market environment.

- Jump into the full analysis health report here for a deeper understanding of Ausnutria Dairy.

- Assess Ausnutria Dairy's future earnings estimates with our detailed growth reports.

Seize The Opportunity

- Get an in-depth perspective on all 988 Asian Penny Stocks by using our screener here.

- Want To Explore Some Alternatives? The latest GPUs need a type of rare earth metal called Neodymium and there are only 30 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1442

Infinity Logistics and Transport Ventures

An investment holding company, provides logistics services in Belgium, China, Indonesia, Malaysia, the Netherlands, Singapore, South Korea, Spain, Thailand, Vietnam, and internationally.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives