- Hong Kong

- /

- Wireless Telecom

- /

- SEHK:8337

What Kind Of Investors Own Most Of Directel Holdings Limited (HKG:8337)?

The big shareholder groups in Directel Holdings Limited (HKG:8337) have power over the company. Generally speaking, as a company grows, institutions will increase their ownership. Conversely, insiders often decrease their ownership over time. I quite like to see at least a little bit of insider ownership. As Charlie Munger said 'Show me the incentive and I will show you the outcome.

Directel Holdings is a smaller company with a market capitalization of HK$887m, so it may still be flying under the radar of many institutional investors. In the chart below, we can see that institutions don't own shares in the company. Let's take a closer look to see what the different types of shareholders can tell us about Directel Holdings.

See our latest analysis for Directel Holdings

What Does The Lack Of Institutional Ownership Tell Us About Directel Holdings?

We don't tend to see institutional investors holding stock of companies that are very risky, thinly traded, or very small. Though we do sometimes see large companies without institutions on the register, it's not particularly common.

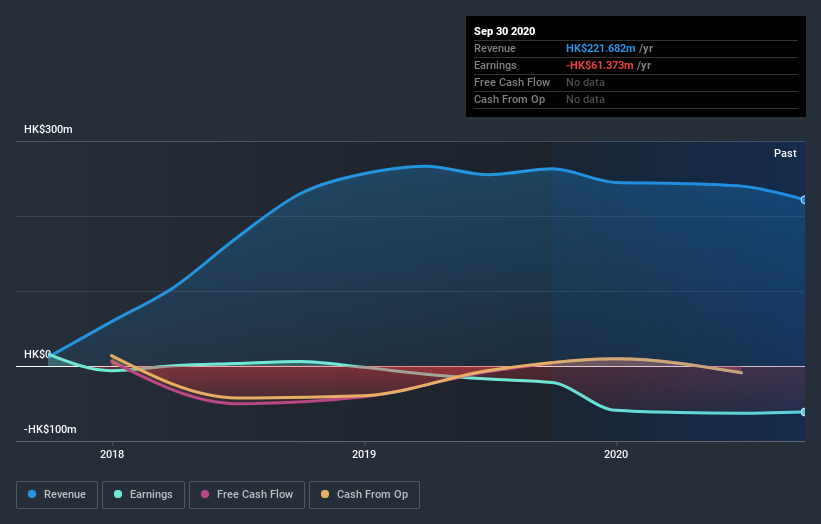

There are multiple explanations for why institutions don't own a stock. The most common is that the company is too small relative to funds under management, so the institution does not bother to look closely at the company. It is also possible that fund managers don't own the stock because they aren't convinced it will perform well. Directel Holdings' earnings and revenue track record (below) may not be compelling to institutional investors -- or they simply might not have looked at the business closely.

Directel Holdings is not owned by hedge funds. Kin Shing Li is currently the company's largest shareholder with 59% of shares outstanding. This implies that they have majority interest control of the future of the company. Meanwhile, the second and third largest shareholders, hold 8.9% and 0.8%, of the shares outstanding, respectively. Kin Wa Wong, who is the third-largest shareholder, also happens to hold the title of Member of the Board of Directors. Furthermore, CEO Kwok Chau Pang is the owner of 0.8% of the company's shares.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. Our information suggests that there isn't any analyst coverage of the stock, so it is probably little known.

Insider Ownership Of Directel Holdings

The definition of company insiders can be subjective and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

It seems that insiders own more than half the Directel Holdings Limited stock. This gives them a lot of power. That means they own HK$619m worth of shares in the HK$887m company. That's quite meaningful. Most would be pleased to see the board is investing alongside them. You may wish todiscover (for free) if they have been buying or selling.

General Public Ownership

With a 30% ownership, the general public have some degree of sway over Directel Holdings. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 2 warning signs for Directel Holdings you should be aware of, and 1 of them doesn't sit too well with us.

Of course this may not be the best stock to buy. So take a peek at this free free list of interesting companies.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

When trading Directel Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:8337

Directel Holdings

An investment holding company, provides mobile telecommunication and telecommunications value-added services in Hong Kong, Mainland China, and Singapore.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)