- Hong Kong

- /

- Telecom Services and Carriers

- /

- SEHK:762

Here's Why China Unicom (Hong Kong) (HKG:762) Has A Meaningful Debt Burden

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, China Unicom (Hong Kong) Limited (HKG:762) does carry debt. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for China Unicom (Hong Kong)

How Much Debt Does China Unicom (Hong Kong) Carry?

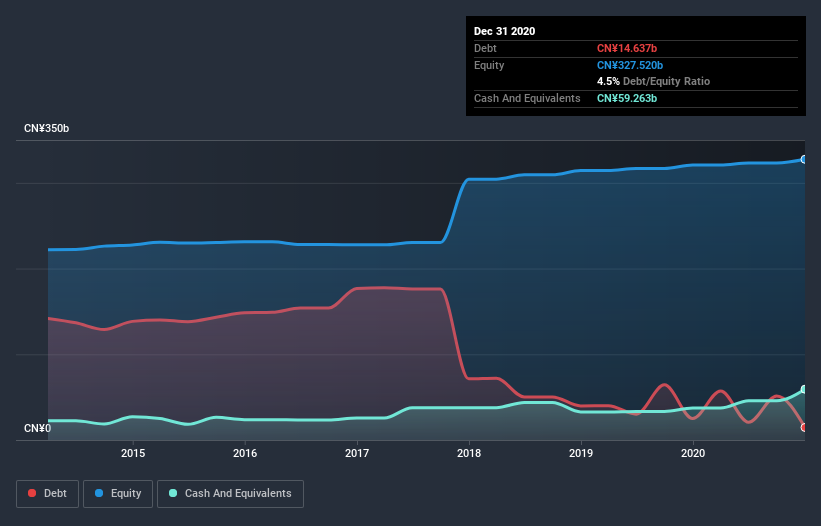

The image below, which you can click on for greater detail, shows that China Unicom (Hong Kong) had debt of CN¥14.6b at the end of December 2020, a reduction from CN¥25.0b over a year. However, it does have CN¥59.3b in cash offsetting this, leading to net cash of CN¥44.6b.

How Strong Is China Unicom (Hong Kong)'s Balance Sheet?

We can see from the most recent balance sheet that China Unicom (Hong Kong) had liabilities of CN¥222.0b falling due within a year, and liabilities of CN¥31.1b due beyond that. Offsetting this, it had CN¥59.3b in cash and CN¥31.5b in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥162.3b.

Given this deficit is actually higher than the company's massive market capitalization of CN¥118.8b, we think shareholders really should watch China Unicom (Hong Kong)'s debt levels, like a parent watching their child ride a bike for the first time. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price. China Unicom (Hong Kong) boasts net cash, so it's fair to say it does not have a heavy debt load, even if it does have very significant liabilities, in total.

But the bad news is that China Unicom (Hong Kong) has seen its EBIT plunge 17% in the last twelve months. We think hat kind of performance, if repeated frequently, could well lead to difficulties for the stock. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if China Unicom (Hong Kong) can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. While China Unicom (Hong Kong) has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last three years, China Unicom (Hong Kong) actually produced more free cash flow than EBIT. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Summing up

Although China Unicom (Hong Kong)'s balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of CN¥44.6b. And it impressed us with free cash flow of CN¥52b, being 341% of its EBIT. So although we see some areas for improvement, we're not too worried about China Unicom (Hong Kong)'s balance sheet. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 1 warning sign for China Unicom (Hong Kong) that you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

When trading China Unicom (Hong Kong) or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:762

China Unicom (Hong Kong)

An investment holding company, provides telecommunications and related value-added services in the People’s Republic of China.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026