- Hong Kong

- /

- Telecom Services and Carriers

- /

- SEHK:728

China Telecom And 2 Other Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets navigate a period of economic uncertainty, with major indices experiencing mixed performances and central banks adjusting interest rates, investors are keenly observing opportunities to stabilize their portfolios. In such an environment, dividend stocks like China Telecom can offer a reliable income stream and potential for portfolio enhancement by providing consistent returns amidst market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 7.12% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.58% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.00% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.35% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.96% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.36% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.83% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.67% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.42% | ★★★★★★ |

Click here to see the full list of 1829 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

China Telecom (SEHK:728)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Telecom Corporation Limited, along with its subsidiaries, offers wireline and mobile telecommunications services mainly in the People's Republic of China and has a market cap of HK$646.14 billion.

Operations: China Telecom Corporation Limited generates revenue from its core offerings in wireline and mobile telecommunications services, primarily within the People's Republic of China.

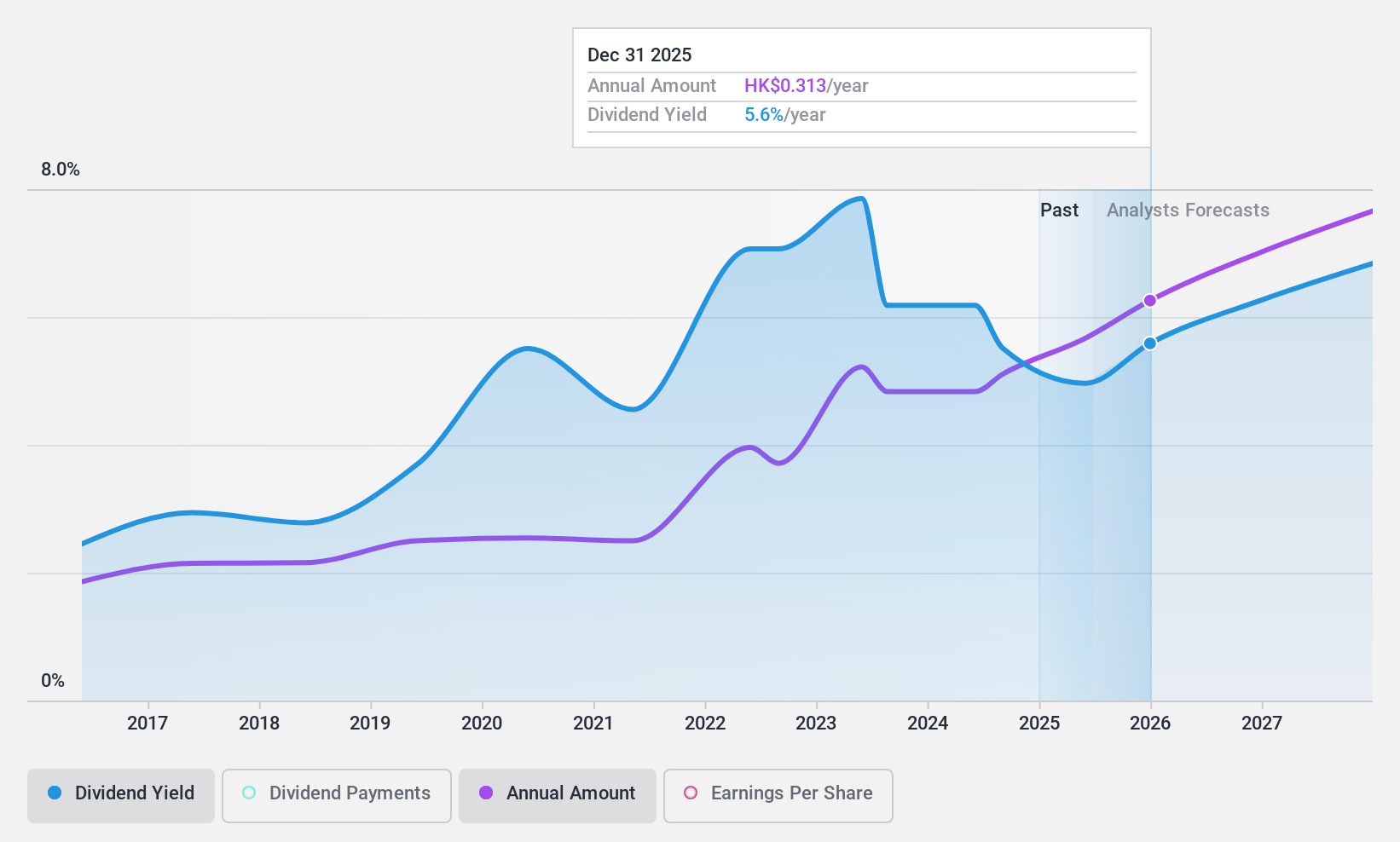

Dividend Yield: 5.7%

China Telecom's dividend payments have been volatile over the past decade, though they have increased overall. Despite this instability, the dividends are well-covered by earnings with a payout ratio of 25.5% and cash flows at 66.6%. The stock trades at a significant discount to its estimated fair value, suggesting potential for capital appreciation. Recent earnings show growth in net income and sales, indicating underlying business strength which may support future dividend stability.

- Take a closer look at China Telecom's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of China Telecom shares in the market.

G-Tekt (TSE:5970)

Simply Wall St Dividend Rating: ★★★★★★

Overview: G-Tekt Corporation manufactures and sells auto body components and transmission parts in Japan and internationally, with a market cap of ¥70.42 billion.

Operations: G-Tekt Corporation's revenue primarily comes from its manufacturing and sales of auto body components and transmission parts both domestically in Japan and on an international scale.

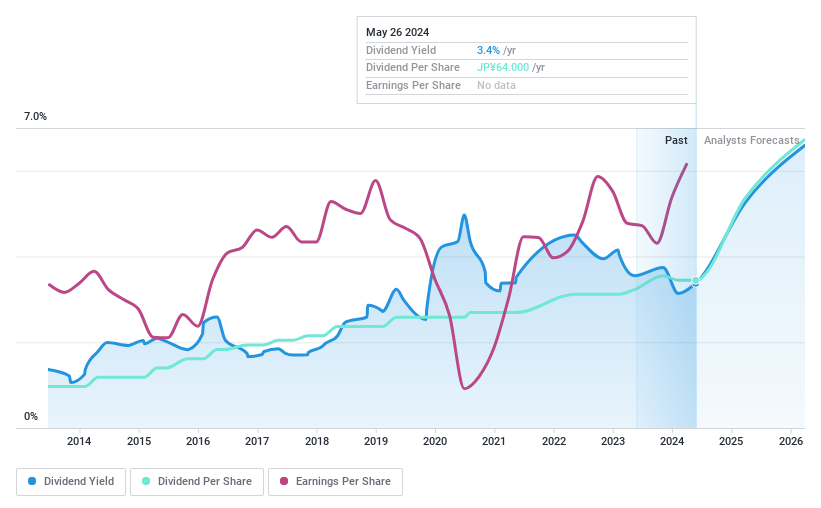

Dividend Yield: 4.5%

G-Tekt offers a compelling dividend profile with stable and reliable payouts over the past decade, supported by a low payout ratio of 13.5% from earnings and 58.5% from cash flows. The dividend yield of 4.53% is among the top in Japan, reflecting its attractiveness to income-focused investors. Trading at a price-to-earnings ratio of 6.3x, below the Japanese market average, it presents good relative value alongside forecasted annual earnings growth of 6.71%.

- Unlock comprehensive insights into our analysis of G-Tekt stock in this dividend report.

- Our expertly prepared valuation report G-Tekt implies its share price may be lower than expected.

Isuzu Motors (TSE:7202)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Isuzu Motors Limited is a global manufacturer and seller of commercial vehicles, light commercial vehicles, and diesel engines and components, with a market cap of ¥1.58 trillion.

Operations: Isuzu Motors Limited generates revenue from its global operations in commercial vehicles, light commercial vehicles, and diesel engines and components.

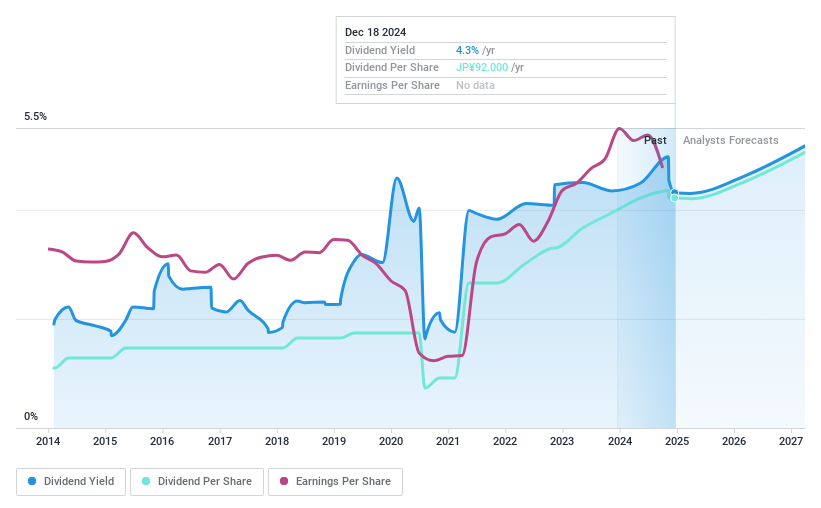

Dividend Yield: 4.2%

Isuzu Motors' dividend yield of 4.24% is among the top 25% in Japan, supported by a low payout ratio of 45.5%, indicating strong earnings coverage. The company has consistently increased dividends over the past decade, with recent hikes to ¥46 per share. Despite revised lower earnings guidance due to challenging overseas markets, its dividends remain well-covered by cash flows (55% payout), and its P/E ratio of 10.1x suggests good value relative to the market average.

- Delve into the full analysis dividend report here for a deeper understanding of Isuzu Motors.

- The analysis detailed in our Isuzu Motors valuation report hints at an inflated share price compared to its estimated value.

Turning Ideas Into Actions

- Discover the full array of 1829 Top Dividend Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:728

China Telecom

Provides wireline and mobile telecommunications services primarily in the People’s Republic of China.

Excellent balance sheet, good value and pays a dividend.