- Hong Kong

- /

- Tech Hardware

- /

- SEHK:992

Lenovo Group (SEHK:992) Strengthens Market Position with Cisco and Red Hat Alliances for AI Solutions

Reviewed by Simply Wall St

Lenovo Group (SEHK:992) is leveraging strategic alliances, such as its collaboration with Cisco, to enhance its market position by offering innovative solutions like TruScale Meeting Room as a Service, which aligns with its vision of empowering organizations through AI. Despite its financial health, highlighted by a high forecasted return on equity and reliable dividends, Lenovo faces challenges with slow revenue growth and negative earnings, necessitating a focus on addressing inefficiencies. Readers should expect a discussion on how Lenovo's strategic partnerships and product innovations, like the ThinkSmart Core Gen 2, could drive future growth amidst these challenges.

Dive into the specifics of Lenovo Group here with our thorough analysis report.

Core Advantages Driving Sustained Success for Lenovo Group

Lenovo's strategic alliances, such as the collaboration with Cisco, enhance its market position by offering innovative solutions like TruScale Meeting Room as a Service. These partnerships streamline IT operations and boost productivity, aligning with Lenovo's vision of empowering organizations through AI. The company's financial health is strong, with a forecasted high return on equity of 24.1% and reliable dividend payments over the past decade. This stability is further supported by a seasoned management team, which drives strategic goals and innovation. Lenovo's valuation, with a Price-To-Earnings Ratio of 15.2x, positions it favorably against the Asian Tech industry average of 21.6x, indicating a SWS fair ratio.

To dive deeper into how Lenovo Group's valuation metrics are shaping its market position, check out our detailed analysis of Lenovo Group's Valuation.Vulnerabilities Impacting Lenovo Group

Lenovo faces challenges with slow revenue growth, projected at 7.9% annually, and negative earnings growth of -15.1% last year. The current net profit margin of 1.8% is lower than the previous year's 2.2%, reflecting financial pressures. Additionally, the current return on equity of 19.3% is considered low. These figures suggest inefficiencies that need addressing to maintain competitive advantage.

Areas for Expansion and Innovation for Lenovo Group

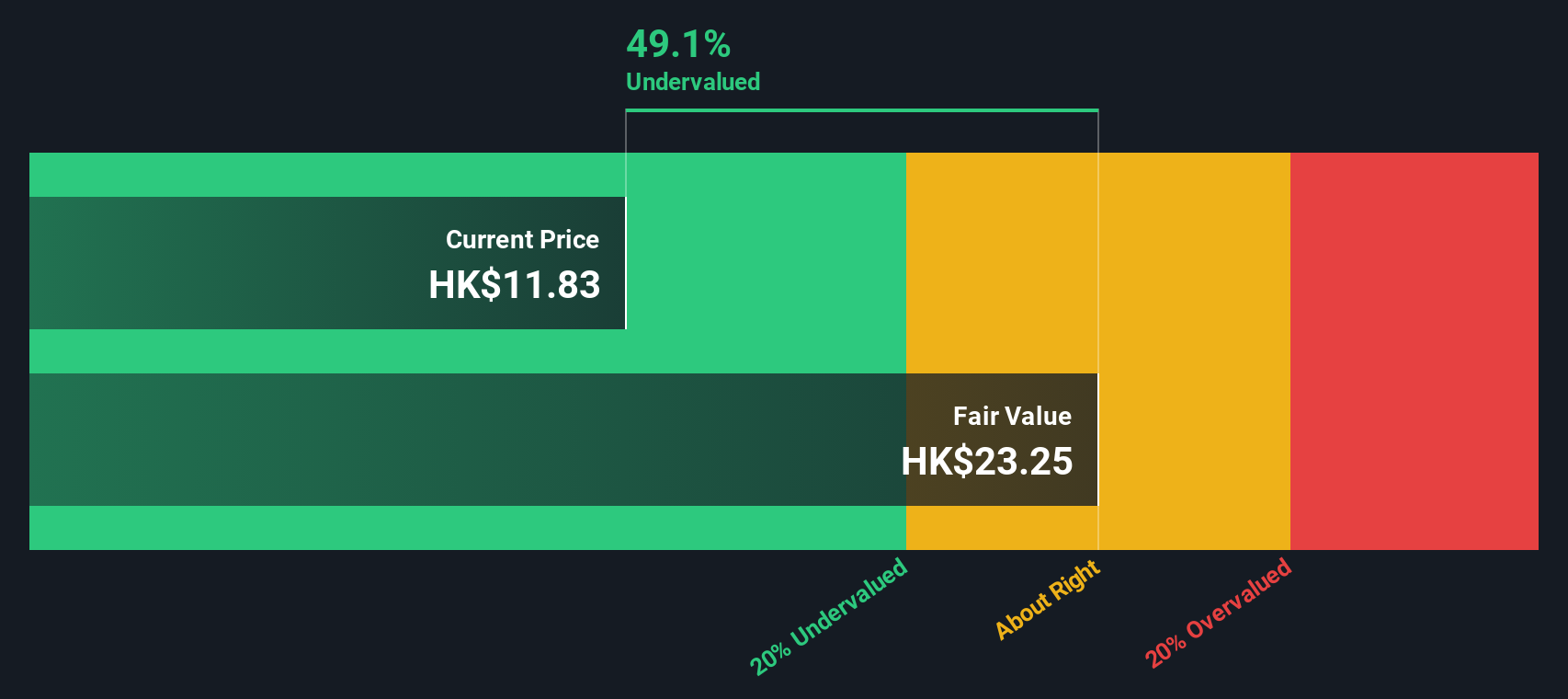

Lenovo's strategic alliances, such as the partnership with Red Hat for AI solutions, provide significant growth opportunities. The analyst price target, over 20% higher than the current share price, indicates potential for stock price increase. Product-related announcements, like the Lenovo ThinkSmart Core Gen 2, highlight the company's commitment to innovation, positioning it to capitalize on emerging market trends.

See what the latest analyst reports say about Lenovo Group's future prospects and potential market movements.Key Risks and Challenges That Could Impact Lenovo Group's Success

External factors such as shareholder dilution, with a 2.3% increase in total shares outstanding, pose risks to market share. Competitive pressures from the tech industry, compounded by negative earnings growth, threaten Lenovo's market position. Economic uncertainties could impact consumer spending, necessitating proactive risk management strategies to ensure continued success.

To gain deeper insights into Lenovo Group's historical performance, explore our detailed analysis of past performance. Explore the current health of Lenovo Group and how it reflects on its financial stability and growth potential.Conclusion

Lenovo's strategic alliances, such as those with Cisco and Red Hat, are pivotal in enhancing its market position and fostering innovation, which aligns with its vision of empowering organizations through AI. However, the company faces challenges, including slow revenue growth and declining profit margins, which suggest areas that require efficiency improvements to maintain its competitive edge. Lenovo's stock is trading below its estimated fair value of HK$24.49, indicating potential for stock price appreciation. To capitalize on its growth opportunities and mitigate risks such as shareholder dilution and competitive pressures, Lenovo must continue to innovate and manage economic uncertainties proactively, ensuring sustained success and improved financial performance.

Next Steps

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About SEHK:992

Lenovo Group

An investment holding company, develops, manufactures, and markets technology products and services.

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives