- Finland

- /

- General Merchandise and Department Stores

- /

- HLSE:LINDEX

Promising Penny Stocks To Watch In January 2025

Reviewed by Simply Wall St

As global markets experience a rebound, driven by cooling inflation and robust bank earnings in the U.S., investors are eyeing opportunities across various sectors. Penny stocks, though an outdated term, remain a relevant investment area for those interested in smaller or newer companies that may offer growth potential. These stocks can present significant value when backed by strong financials and stability, making them intriguing options for investors seeking under-the-radar opportunities with long-term promise.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.405 | MYR1.13B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.69 | HK$42.48B | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.72 | MYR425.99M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.99 | HK$628.44M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.946 | £153.63M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.405 | £177.66M | ★★★★★☆ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £4.62 | £66.37M | ★★★★☆☆ |

Click here to see the full list of 5,711 stocks from our Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Lindex Group Oyj (HLSE:LINDEX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Lindex Group Oyj operates in the retail sector both in Finland and internationally, with a market cap of €435.57 million.

Operations: The company generates revenue from its Lindex segment, contributing €627.9 million, and its Stockmann segment, adding €313 million.

Market Cap: €435.57M

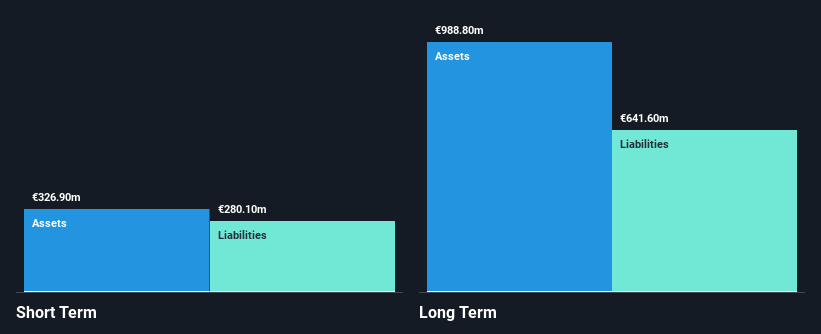

Lindex Group Oyj, with a market cap of €435.57 million, operates in the retail sector and has recently undertaken significant strategic initiatives. The company opened a €110 million highly automated omnichannel distribution center in Sweden to enhance efficiency and sustainability, which is expected to yield annual savings of €10 million from 2026. Despite facing legal challenges and reporting a net loss of €6.5 million for the first nine months of 2024, Lindex's short-term assets exceed its short-term liabilities by €34.2 million. However, long-term liabilities remain uncovered by short-term assets, indicating potential financial pressure ahead.

- Click here to discover the nuances of Lindex Group Oyj with our detailed analytical financial health report.

- Review our growth performance report to gain insights into Lindex Group Oyj's future.

China Sunshine Paper Holdings (SEHK:2002)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: China Sunshine Paper Holdings Company Limited, along with its subsidiaries, is engaged in the production and sale of paper products both within the People's Republic of China and internationally, with a market cap of HK$2.13 billion.

Operations: The company's revenue is derived from several segments, including CN¥1.33 billion from Electricity and Steam, CN¥615.63 million from Core Board paper products, CN¥1.81 billion from Corrugated Paper, CN¥1.57 billion from White Top Linerboard, CN¥1.71 billion from Specialised Paper Products, and CN¥1.97 billion from Coated-White TOP Linerboard.

Market Cap: HK$2.13B

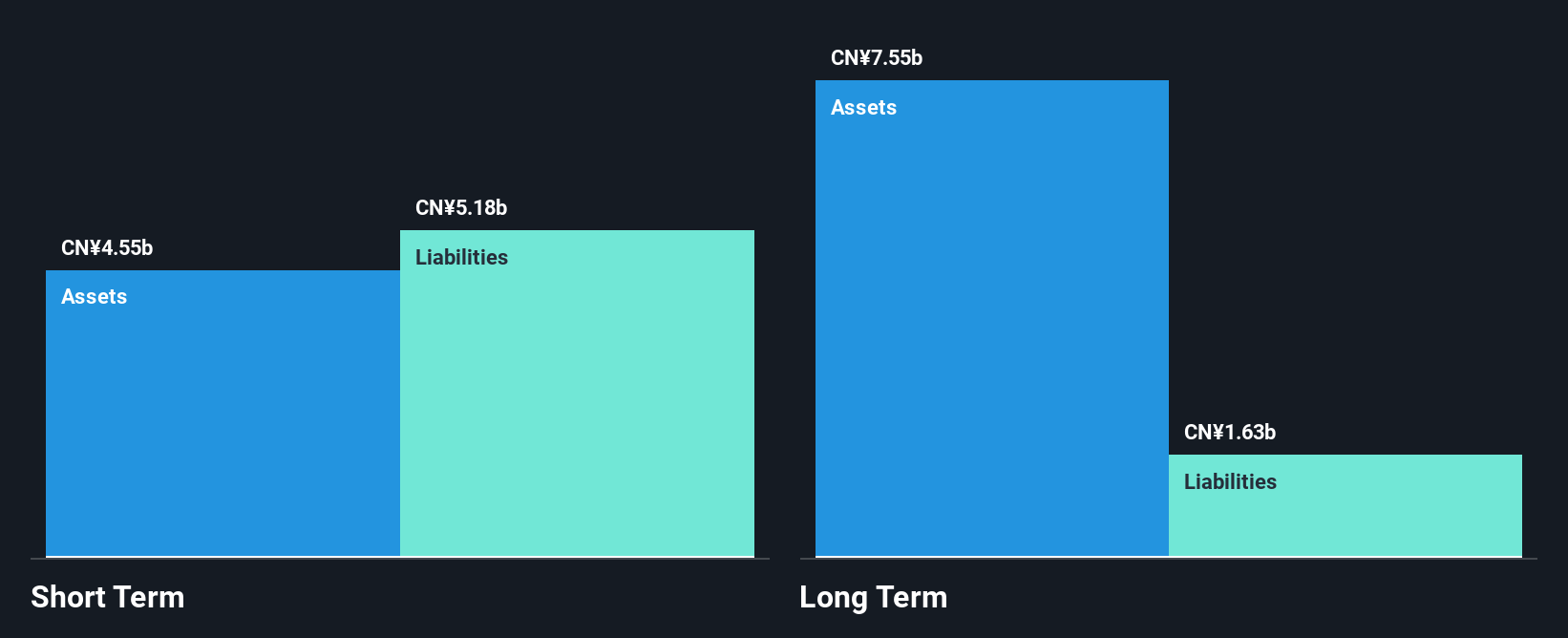

China Sunshine Paper Holdings, with a market cap of HK$2.13 billion, has shown significant earnings growth over the past year at 65.5%, outpacing the packaging industry average. Despite this, its net debt to equity ratio remains high at 62.8%, and short-term assets (CN¥4.7 billion) fall short of covering short-term liabilities (CN¥5.3 billion). However, long-term liabilities are well-covered by these assets, suggesting some financial stability. The company’s interest payments are well-managed with EBIT covering them 4.6 times over, and its operating cash flow effectively covers debt obligations at 20.8%.

- Take a closer look at China Sunshine Paper Holdings' potential here in our financial health report.

- Gain insights into China Sunshine Paper Holdings' past trends and performance with our report on the company's historical track record.

VSTECS Holdings (SEHK:856)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: VSTECS Holdings Limited is an investment holding company that develops IT product channels and provides technical solution integration services in North Asia and South East Asia, with a market cap of HK$6.94 billion.

Operations: The company's revenue is derived from three main segments: Cloud Computing (HK$3.44 billion), Enterprise Systems (HK$44.82 billion), and Consumer Electronics (HK$31.69 billion).

Market Cap: HK$6.94B

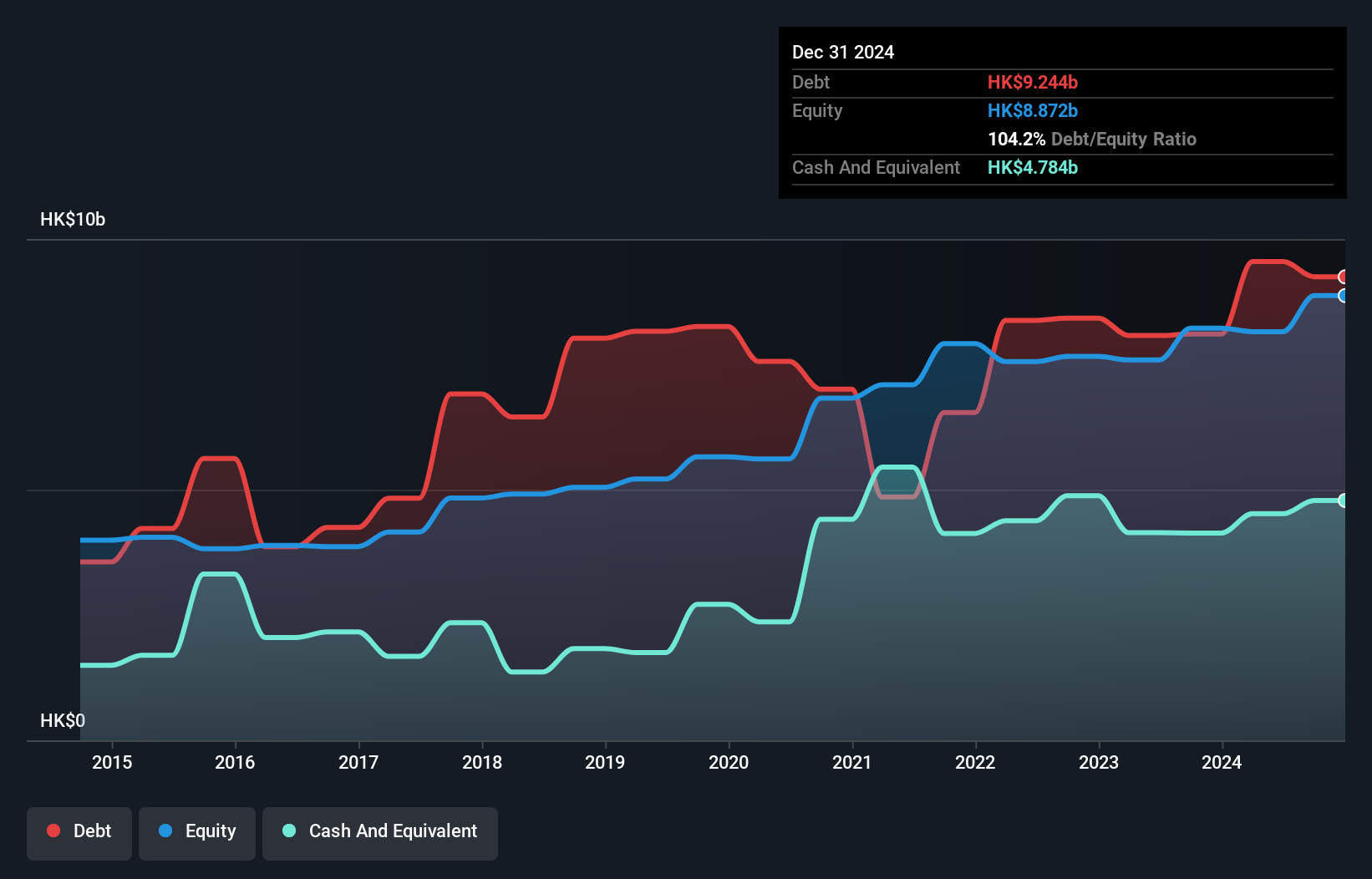

VSTECS Holdings, with a market cap of HK$6.94 billion, derives significant revenue from its Enterprise Systems (HK$44.82 billion) and Consumer Electronics (HK$31.69 billion) segments, indicating robust business operations in North Asia and South East Asia. The company has shown modest earnings growth of 0.3% annually over the past five years but maintains a stable financial position with short-term assets exceeding both short- and long-term liabilities. Recent board changes bring experienced leadership with Mr. Yu Dingheng's appointment, potentially enhancing governance amidst an unstable dividend track record and high net debt to equity ratio of 61.7%.

- Navigate through the intricacies of VSTECS Holdings with our comprehensive balance sheet health report here.

- Learn about VSTECS Holdings' future growth trajectory here.

Taking Advantage

- Navigate through the entire inventory of 5,711 Penny Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:LINDEX

Lindex Group Oyj

Engages in the retailing business in Finland and internationally.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives