- Hong Kong

- /

- Communications

- /

- SEHK:8487

It's Unlikely That The CEO Of ISP Global Limited (HKG:8487) Will See A Huge Pay Rise This Year

In the past three years, the share price of ISP Global Limited (HKG:8487) has struggled to grow and now shareholders are sitting on a loss. In addition, the company's per-share earnings growth is not looking good, despite growing revenues. In light of this performance, shareholders will have a chance to question the board in the upcoming AGM on 05 November 2021, where they can impact on future company performance by voting on resolutions, including executive compensation. We think shareholders may be cautious of approving a pay rise for the CEO at the moment, based on our analysis below.

See our latest analysis for ISP Global

Comparing ISP Global Limited's CEO Compensation With the industry

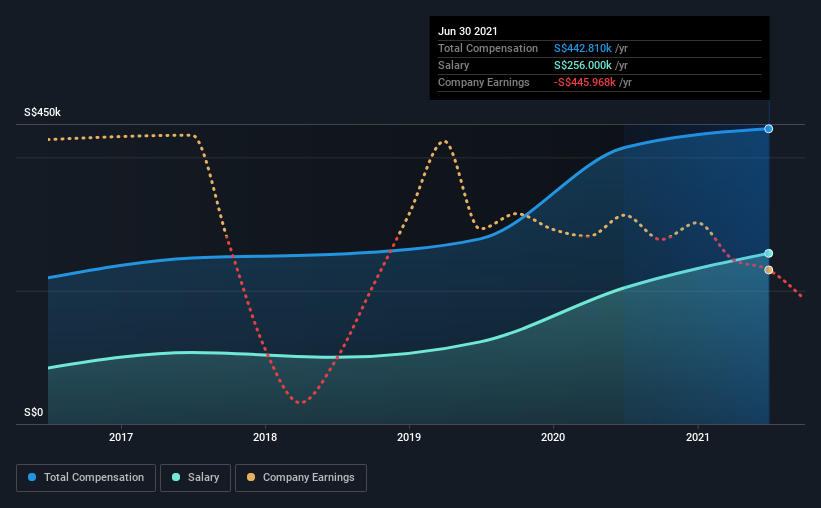

According to our data, ISP Global Limited has a market capitalization of HK$537m, and paid its CEO total annual compensation worth S$443k over the year to June 2021. That's just a smallish increase of 6.8% on last year. We note that the salary of S$256.0k makes up a sizeable portion of the total compensation received by the CEO.

In comparison with other companies in the industry with market capitalizations under HK$1.6b, the reported median total CEO compensation was S$346k. This suggests that ISP Global remunerates its CEO largely in line with the industry average.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | S$256k | S$204k | 58% |

| Other | S$187k | S$210k | 42% |

| Total Compensation | S$443k | S$415k | 100% |

Speaking on an industry level, nearly 79% of total compensation represents salary, while the remainder of 21% is other remuneration. ISP Global pays a modest slice of remuneration through salary, as compared to the broader industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at ISP Global Limited's Growth Numbers

Over the last three years, ISP Global Limited has shrunk its earnings per share by 63% per year. Its revenue is up 146% over the last year.

The decrease in EPS could be a concern for some investors. But in contrast the revenue growth is strong, suggesting future potential for EPS growth. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has ISP Global Limited Been A Good Investment?

With a total shareholder return of -74% over three years, ISP Global Limited shareholders would by and large be disappointed. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

The loss to shareholders over the past three years is certainly concerning and possibly has something to do with the fact that the company's earnings haven't grown. The upcoming AGM will provide shareholders the opportunity to revisit the company’s remuneration policies and evaluate if the board’s judgement and decision-making is aligned with that of the company’s shareholders.

CEO compensation can have a massive impact on performance, but it's just one element. We did our research and spotted 3 warning signs for ISP Global that investors should look into moving forward.

Switching gears from ISP Global, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:8487

ISP Global

An investment holding company, operates as a sound and communication services solution provider in Singapore, the People’s Republic of China, and Malaysia.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Moving from "Science Fiction" to "Science Fact" – A Bullish Valuation Case

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026