- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:8311

Could The Perfect Optronics Limited (HKG:8311) Ownership Structure Tell Us Something Useful?

Every investor in Perfect Optronics Limited (HKG:8311) should be aware of the most powerful shareholder groups. Insiders often own a large chunk of younger, smaller, companies while huge companies tend to have institutions as shareholders. Warren Buffett said that he likes "a business with enduring competitive advantages that is run by able and owner-oriented people." So it's nice to see some insider ownership, because it may suggest that management is owner-oriented.

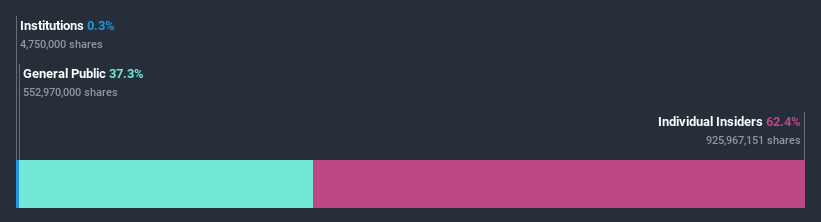

With a market capitalization of HK$801m, Perfect Optronics is a small cap stock, so it might not be well known by many institutional investors. Taking a look at our data on the ownership groups (below), it seems that institutions don't own many shares in the company. Let's take a closer look to see what the different types of shareholders can tell us about Perfect Optronics.

View our latest analysis for Perfect Optronics

What Does The Lack Of Institutional Ownership Tell Us About Perfect Optronics?

We don't tend to see institutional investors holding stock of companies that are very risky, thinly traded, or very small. Though we do sometimes see large companies without institutions on the register, it's not particularly common.

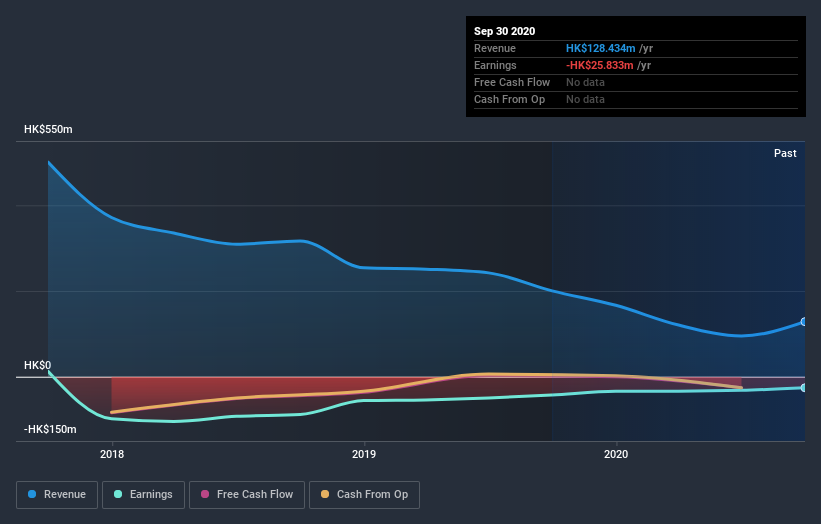

There are multiple explanations for why institutions don't own a stock. The most common is that the company is too small relative to funds under management, so the institution does not bother to look closely at the company. On the other hand, it's always possible that professional investors are avoiding a company because they don't think it's the best place for their money. Perfect Optronics' earnings and revenue track record (below) may not be compelling to institutional investors -- or they simply might not have looked at the business closely.

Hedge funds don't have many shares in Perfect Optronics. Looking at our data, we can see that the largest shareholder is the CEO Wai Tak Cheng with 62% of shares outstanding. This implies that they possess majority interests and have significant control over the company. Investors usually consider it a good sign when the company leadership has such a significant stake, as this is widely perceived to increase the chance that the management will act in the best interests of the company. For context, the second largest shareholder holds about 0.3% of the shares outstanding, followed by an ownership of 0.02% by the third-largest shareholder. Interestingly, the third-largest shareholder, Man Wai Kan is also a Chairman of the Board, again, indicating strong insider ownership amongst the company's top shareholders.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. As far I can tell there isn't analyst coverage of the company, so it is probably flying under the radar.

Insider Ownership Of Perfect Optronics

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

Our information suggests that insiders own more than half of Perfect Optronics Limited. This gives them effective control of the company. So they have a HK$500m stake in this HK$801m business. It is good to see this level of investment. You can check here to see if those insiders have been buying recently.

General Public Ownership

The general public, with a 37% stake in the company, will not easily be ignored. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Perfect Optronics better, we need to consider many other factors. Be aware that Perfect Optronics is showing 2 warning signs in our investment analysis , and 1 of those is concerning...

Of course this may not be the best stock to buy. Therefore, you may wish to see our free collection of interesting prospects boasting favorable financials.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

When trading Perfect Optronics or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:8311

Perfect Optronics

An investment holding company, engages in development, trading, and sale of display and optics products and related electronic components in Hong Kong, Mainland China, and Taiwan.

Mediocre balance sheet with low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion