- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:8113

Most Shareholders Will Probably Find That The Compensation For Hi-Level Technology Holdings Limited's (HKG:8113) CEO Is Reasonable

Shareholders may be wondering what CEO Benson Chang plans to do to improve the less than great performance at Hi-Level Technology Holdings Limited (HKG:8113) recently. They will get a chance to exercise their voting power to influence the future direction of the company in the next AGM on 18 May 2021. It has been shown that setting appropriate executive remuneration incentivises the management to act in the interests of shareholders. We have prepared some analysis below to show that CEO compensation looks to be reasonable.

See our latest analysis for Hi-Level Technology Holdings

Comparing Hi-Level Technology Holdings Limited's CEO Compensation With the industry

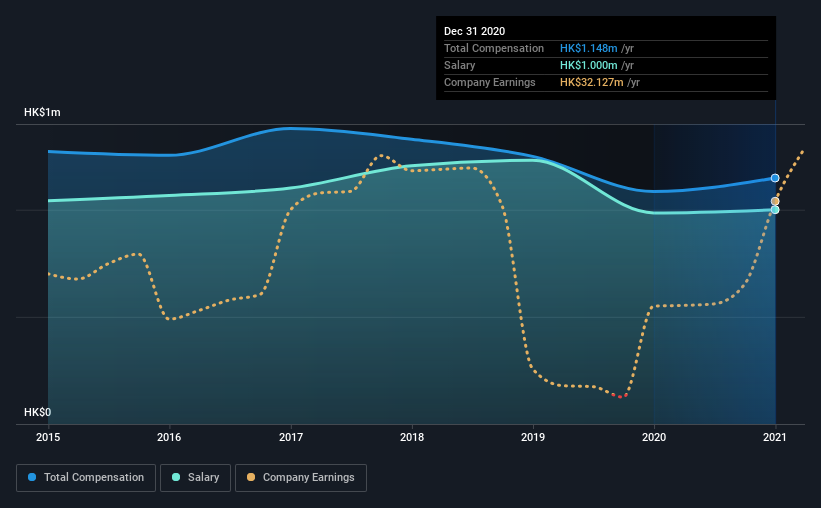

According to our data, Hi-Level Technology Holdings Limited has a market capitalization of HK$300m, and paid its CEO total annual compensation worth HK$1.1m over the year to December 2020. That's a modest increase of 5.8% on the prior year. In particular, the salary of HK$1.00m, makes up a huge portion of the total compensation being paid to the CEO.

In comparison with other companies in the industry with market capitalizations under HK$1.6b, the reported median total CEO compensation was HK$1.9m. That is to say, Benson Chang is paid under the industry median. Moreover, Benson Chang also holds HK$35m worth of Hi-Level Technology Holdings stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | HK$1.0m | HK$985k | 87% |

| Other | HK$148k | HK$100k | 13% |

| Total Compensation | HK$1.1m | HK$1.1m | 100% |

Speaking on an industry level, nearly 76% of total compensation represents salary, while the remainder of 24% is other remuneration. Hi-Level Technology Holdings pays out 87% of remuneration in the form of a salary, significantly higher than the industry average. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Hi-Level Technology Holdings Limited's Growth

Hi-Level Technology Holdings Limited has seen its earnings per share (EPS) increase by 1.5% a year over the past three years. In the last year, its revenue is up 41%.

We like the look of the strong year-on-year improvement in revenue. Combined with modest EPS growth, we get a good impression of the company. We wouldn't say this is necessarily top notch growth, but it is certainly promising. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Hi-Level Technology Holdings Limited Been A Good Investment?

Since shareholders would have lost about 23% over three years, some Hi-Level Technology Holdings Limited investors would surely be feeling negative emotions. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

The loss to shareholders over the past three years is certainly concerning. The lacklustre earnings growth perhaps may have something to do with the downward trend in the share price. In the upcoming AGM, shareholders should take this opportunity to raise these concerns with the board and revisit their investment thesis with regards to the company.

CEO pay is simply one of the many factors that need to be considered while examining business performance. In our study, we found 4 warning signs for Hi-Level Technology Holdings you should be aware of, and 1 of them is potentially serious.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:8113

V & V Technology Holdings

Sells electronic components in the People’s Republic of China, Hong Kong, Taiwan, and internationally.

Low risk and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)