While shareholders of Truly International Holdings (HKG:732) are in the black over 1 year, those who bought a week ago aren't so fortunate

Truly International Holdings Limited (HKG:732) shareholders might be concerned after seeing the share price drop 10% in the last week. While that might be a setback, it doesn't negate the nice returns received over the last twelve months. Looking at the full year, the company has easily bested an index fund by gaining 58%.

Although Truly International Holdings has shed HK$409m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

View our latest analysis for Truly International Holdings

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last year Truly International Holdings grew its earnings per share, moving from a loss to a profit.

When a company is just on the edge of profitability it can be well worth considering other metrics in order to more precisely gauge growth (and therefore understand share price movements).

We haven't seen Truly International Holdings increase dividend payments yet, so the yield probably hasn't helped drive the share higher. It seems far more likely that the 7.4% boost to the revenue over the last year, is making the difference. Revenue growth often does precede earnings growth, so some investors might be willing to forgo profits today because they have their eyes fixed firmly on the future.

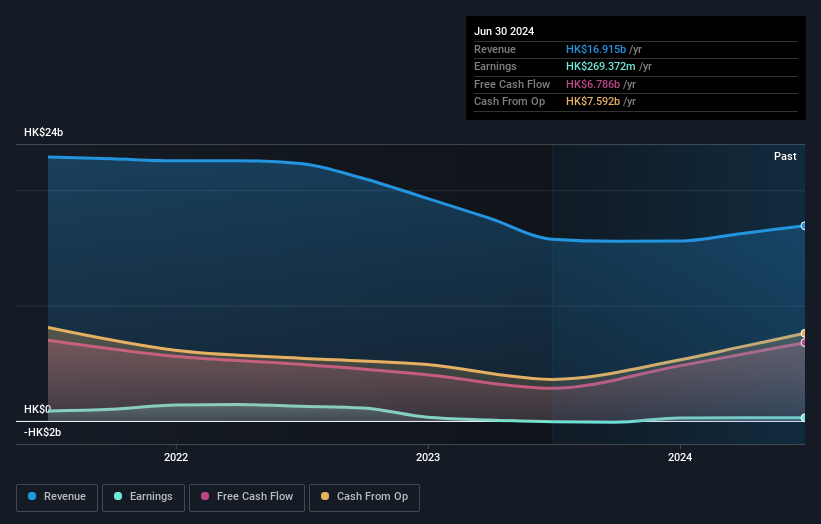

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for Truly International Holdings the TSR over the last 1 year was 75%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

We're pleased to report that Truly International Holdings shareholders have received a total shareholder return of 75% over one year. That's including the dividend. That's better than the annualised return of 9% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand Truly International Holdings better, we need to consider many other factors. Take risks, for example - Truly International Holdings has 4 warning signs (and 2 which don't sit too well with us) we think you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: most of them are flying under the radar).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Truly International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:732

Truly International Holdings

An investment holding company, manufactures, sells, and trades in liquid crystal display (LCD) products and electronic consumer products.

Slight and fair value.

Similar Companies

Market Insights

Community Narratives