As global markets continue to navigate a complex economic landscape, U.S. stock indexes have been climbing toward record highs, with the Nasdaq Composite leading the charge and growth stocks outperforming value shares. In this environment of heightened inflation expectations and volatile Treasury yields, identifying high-growth tech stocks requires an understanding of their potential to thrive amidst both economic uncertainty and technological innovation.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 25.36% | 25.10% | ★★★★★★ |

| CD Projekt | 27.11% | 39.37% | ★★★★★★ |

| Pharma Mar | 23.77% | 45.40% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Travere Therapeutics | 30.33% | 61.73% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.80% | 58.78% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Mental Health TechnologiesLtd | 21.91% | 92.81% | ★★★★★★ |

| Ascendis Pharma | 33.05% | 58.72% | ★★★★★★ |

Click here to see the full list of 1209 stocks from our High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

BOE Varitronix (SEHK:710)

Simply Wall St Growth Rating: ★★★★☆☆

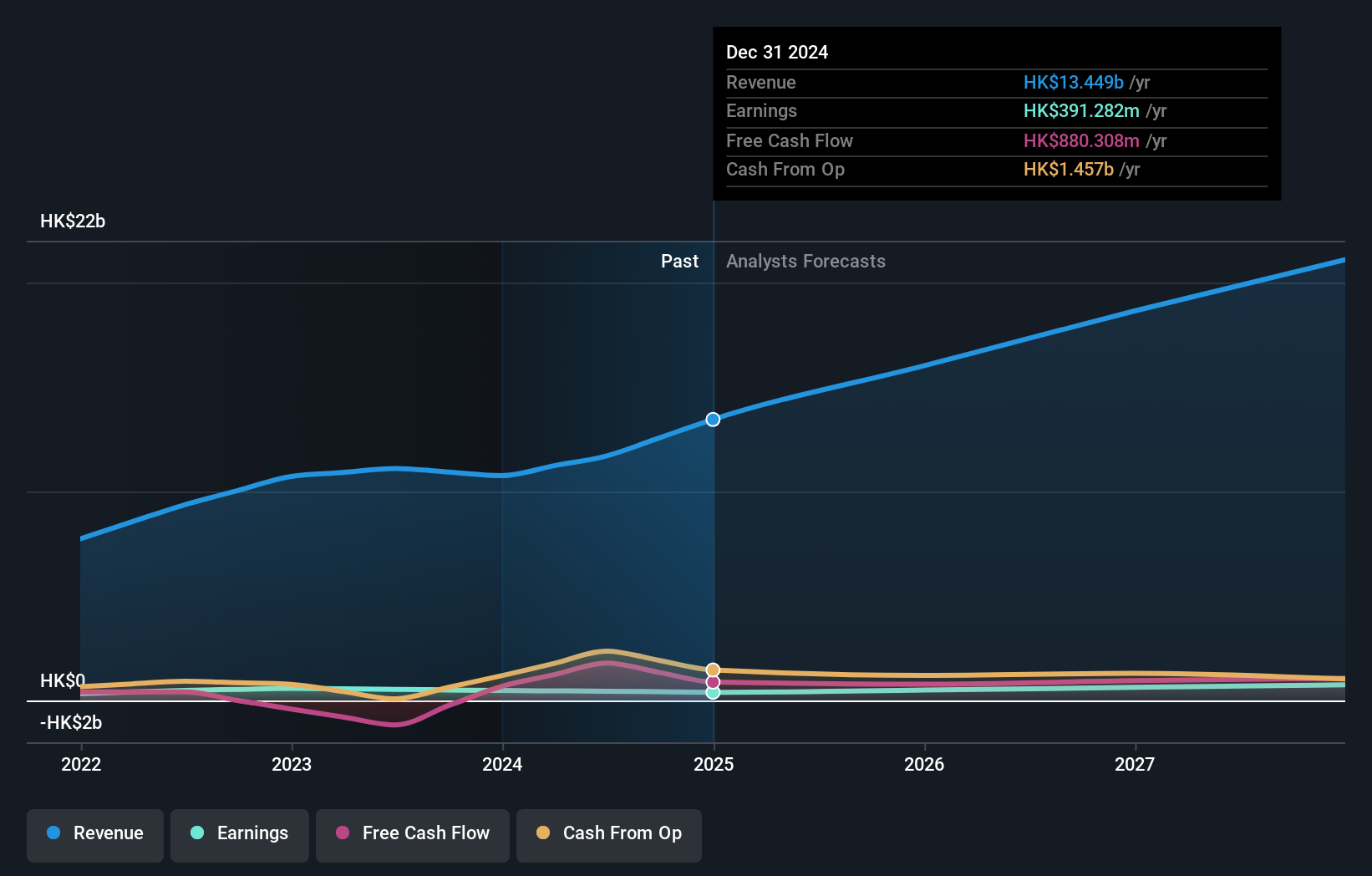

Overview: BOE Varitronix Limited is an investment holding company that specializes in designing, manufacturing, and selling liquid crystal displays and related products across various international markets, with a market cap of approximately HK$5.96 billion.

Operations: The company primarily generates revenue from the design, manufacture, and sale of liquid crystal displays and related products, amounting to approximately HK$11.71 billion. Operating across multiple regions including China, Europe, the United States, and Korea, it serves a diverse international market.

BOE Varitronix, a subsidiary of BOE Technology Group, is making significant strides in the automotive display sector, showcasing its prowess at CES 2025 with over 60 cutting-edge technologies. The company's HERO initiative for smart vehicles and partnerships like that with Stoneridge highlight its innovative approach to integrating healthiness, entertainment, relaxation, and office functionalities into automotive experiences. Notably, its R&D expenditure has been robust, supporting developments such as the UB Cell Smart Display which surpasses OLED quality and introduces adaptive environmental settings. This focus on high-quality displays and smart cockpit solutions positions BOE Varitronix favorably in an industry evolving towards more interactive and integrated vehicle environments.

- Dive into the specifics of BOE Varitronix here with our thorough health report.

Gain insights into BOE Varitronix's past trends and performance with our Past report.

Computer Modelling Group (TSX:CMG)

Simply Wall St Growth Rating: ★★★★☆☆

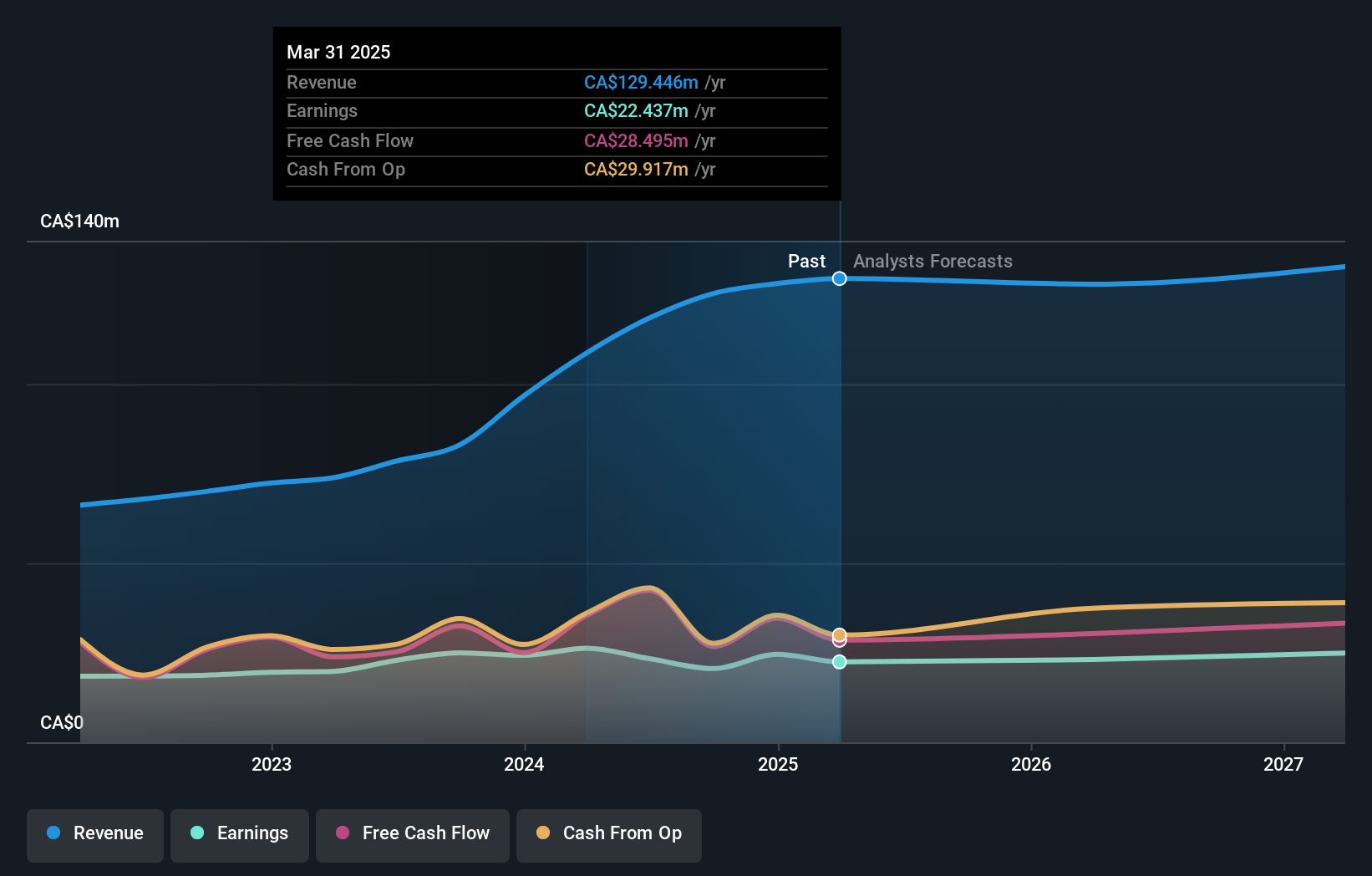

Overview: Computer Modelling Group Ltd. is a software and consulting technology company that develops and licenses reservoir simulation and seismic interpretation software, with a market cap of CA$704.83 million.

Operations: The company generates revenue primarily through its Reservoir & Production Solutions segment, which accounts for CA$90.44 million, and Seismic Solutions segment, contributing CA$37.62 million.

With a robust growth trajectory, Computer Modelling Group Ltd. (CMG) has demonstrated significant financial performance improvements, with third-quarter sales rising to CAD 35.77 million from CAD 33.01 million year-over-year and net income nearly doubling to CAD 9.61 million. This upward trend is supported by an annual revenue growth rate of 9.4%, outpacing the Canadian market's average of 5.4%. Despite facing challenges in matching the software industry's earnings growth rate, CMG's projected annual earnings increase of 20.3% exceeds the national forecast of 14.7%. The firm continues to reward shareholders, affirming a dividend payout amidst these gains, underscoring its commitment to shareholder returns while navigating competitive market dynamics effectively.

- Get an in-depth perspective on Computer Modelling Group's performance by reading our health report here.

Evaluate Computer Modelling Group's historical performance by accessing our past performance report.

Lotes (TWSE:3533)

Simply Wall St Growth Rating: ★★★★★☆

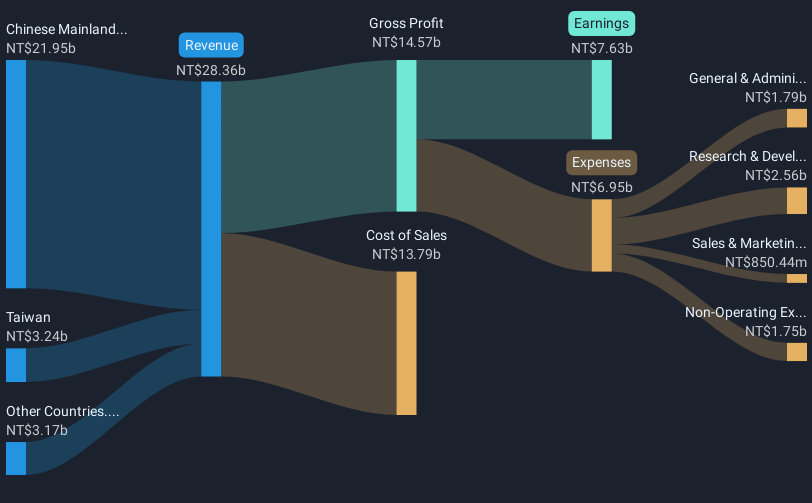

Overview: Lotes Co., Ltd is a company that designs, manufactures, and sells electronic interconnect and hardware components across Taiwan, Mainland China, and internationally with a market cap of NT$200.87 billion.

Operations: Lotes generates revenue primarily from its electronic components and parts segment, which reported NT$28.36 billion. The company's operations span Taiwan, Mainland China, and international markets.

Lotes stands out in the tech sector with its impressive earnings growth of 31.8% over the past year, surpassing the electronic industry's average of 7.8%. This performance is bolstered by a robust forecast that expects revenue to increase by 16.3% annually, significantly ahead of Taiwan's market average growth rate of 11.2%. The company’s commitment to innovation is evident from its R&D expenditures, which are strategically aligned to fuel future advancements and maintain competitive edge in rapidly evolving tech landscapes. Additionally, Lotes has demonstrated prudent financial management with a Return on Equity projected at an impressive 27.4% in three years, highlighting its efficiency in generating profits from shareholders' equity amidst a highly volatile share price environment.

- Click here and access our complete health analysis report to understand the dynamics of Lotes.

Assess Lotes' past performance with our detailed historical performance reports.

Taking Advantage

- Embark on your investment journey to our 1209 High Growth Tech and AI Stocks selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CMG

Computer Modelling Group

A software and consulting technology company, engages in the development and licensing of reservoir simulation and seismic interpretation software and related services.

Excellent balance sheet and fair value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

<html><head></head><body><div dir="auto">This is true here, but always true in the case of Alpha leaders. Often is takes a turn or two to get it right, like Gates to Nardella,  or Anton to Pinchar. This is when succession planning has failed or never happened. </div><div><br></div> </body></html>