Could The Tongda Group Holdings Limited (HKG:698) Ownership Structure Tell Us Something Useful?

A look at the shareholders of Tongda Group Holdings Limited (HKG:698) can tell us which group is most powerful. Insiders often own a large chunk of younger, smaller, companies while huge companies tend to have institutions as shareholders. I generally like to see some degree of insider ownership, even if only a little. As Nassim Nicholas Taleb said, 'Don’t tell me what you think, tell me what you have in your portfolio.

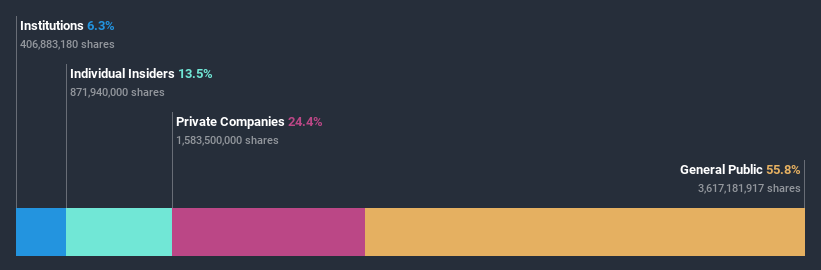

Tongda Group Holdings is not a large company by global standards. It has a market capitalization of HK$3.6b, which means it wouldn't have the attention of many institutional investors. In the chart below, we can see that institutional investors have bought into the company. We can zoom in on the different ownership groups, to learn more about Tongda Group Holdings.

Check out our latest analysis for Tongda Group Holdings

What Does The Institutional Ownership Tell Us About Tongda Group Holdings?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

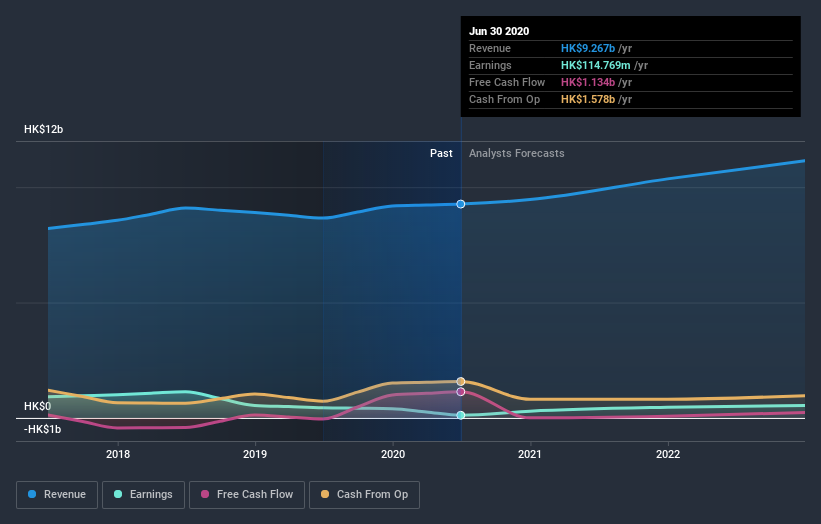

We can see that Tongda Group Holdings does have institutional investors; and they hold a good portion of the company's stock. This suggests some credibility amongst professional investors. But we can't rely on that fact alone since institutions make bad investments sometimes, just like everyone does. If multiple institutions change their view on a stock at the same time, you could see the share price drop fast. It's therefore worth looking at Tongda Group Holdings' earnings history below. Of course, the future is what really matters.

Tongda Group Holdings is not owned by hedge funds. The company's largest shareholder is Landmark Worldwide Holdings Limited, with ownership of 24%. In comparison, the second and third largest shareholders hold about 12% and 2.1% of the stock. Ya Nan Wang, who is the second-largest shareholder, also happens to hold the title of Chief Executive Officer.

On studying our ownership data, we found that 25 of the top shareholders collectively own less than 50% of the share register, implying that no single individual has a majority interest.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. Quite a few analysts cover the stock, so you could look into forecast growth quite easily.

Insider Ownership Of Tongda Group Holdings

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

Our most recent data indicates that insiders own a reasonable proportion of Tongda Group Holdings Limited. Insiders own HK$488m worth of shares in the HK$3.6b company. It is great to see insiders so invested in the business. It might be worth checking if those insiders have been buying recently.

General Public Ownership

The general public, who are mostly retail investors, collectively hold 56% of Tongda Group Holdings shares. This level of ownership gives retail investors the power to sway key policy decisions such as board composition, executive compensation, and the dividend payout ratio.

Private Company Ownership

It seems that Private Companies own 24%, of the Tongda Group Holdings stock. Private companies may be related parties. Sometimes insiders have an interest in a public company through a holding in a private company, rather than in their own capacity as an individual. While it's hard to draw any broad stroke conclusions, it is worth noting as an area for further research.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Tongda Group Holdings better, we need to consider many other factors. Case in point: We've spotted 3 warning signs for Tongda Group Holdings you should be aware of, and 1 of them is significant.

If you are like me, you may want to think about whether this company will grow or shrink. Luckily, you can check this free report showing analyst forecasts for its future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you decide to trade Tongda Group Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Tongda Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:698

Tongda Group Holdings

An investment holding company, provides high-precision structural components for smart mobile communications and consumer electronic products.

Reasonable growth potential with adequate balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)