- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:6088

3 Leading Stocks Estimated To Be Up To 49.3% Below Their Intrinsic Value

Reviewed by Simply Wall St

In the current global market landscape, cooling inflation in the U.S. and robust bank earnings have driven major stock indexes higher, with value stocks outperforming growth shares significantly. Amid these developments, identifying undervalued stocks becomes crucial as they offer potential opportunities for investors looking to capitalize on discrepancies between market prices and intrinsic values.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Atlantic Union Bankshares (NYSE:AUB) | US$37.87 | US$75.61 | 49.9% |

| Dongsung FineTec (KOSDAQ:A033500) | ₩18390.00 | ₩36679.19 | 49.9% |

| Thai Coconut (SET:COCOCO) | THB10.80 | THB21.59 | 50% |

| Gaming Realms (AIM:GMR) | £0.36 | £0.72 | 49.9% |

| Sudarshan Chemical Industries (BSE:506655) | ₹1114.70 | ₹2219.89 | 49.8% |

| Equity Bancshares (NYSE:EQBK) | US$43.13 | US$86.02 | 49.9% |

| LifeMD (NasdaqGM:LFMD) | US$4.90 | US$9.77 | 49.8% |

| Shinko Electric Industries (TSE:6967) | ¥5879.00 | ¥11701.39 | 49.8% |

| Hd Hyundai MipoLtd (KOSE:A010620) | ₩129300.00 | ₩257307.05 | 49.7% |

| Vista Group International (NZSE:VGL) | NZ$3.11 | NZ$6.18 | 49.7% |

Let's review some notable picks from our screened stocks.

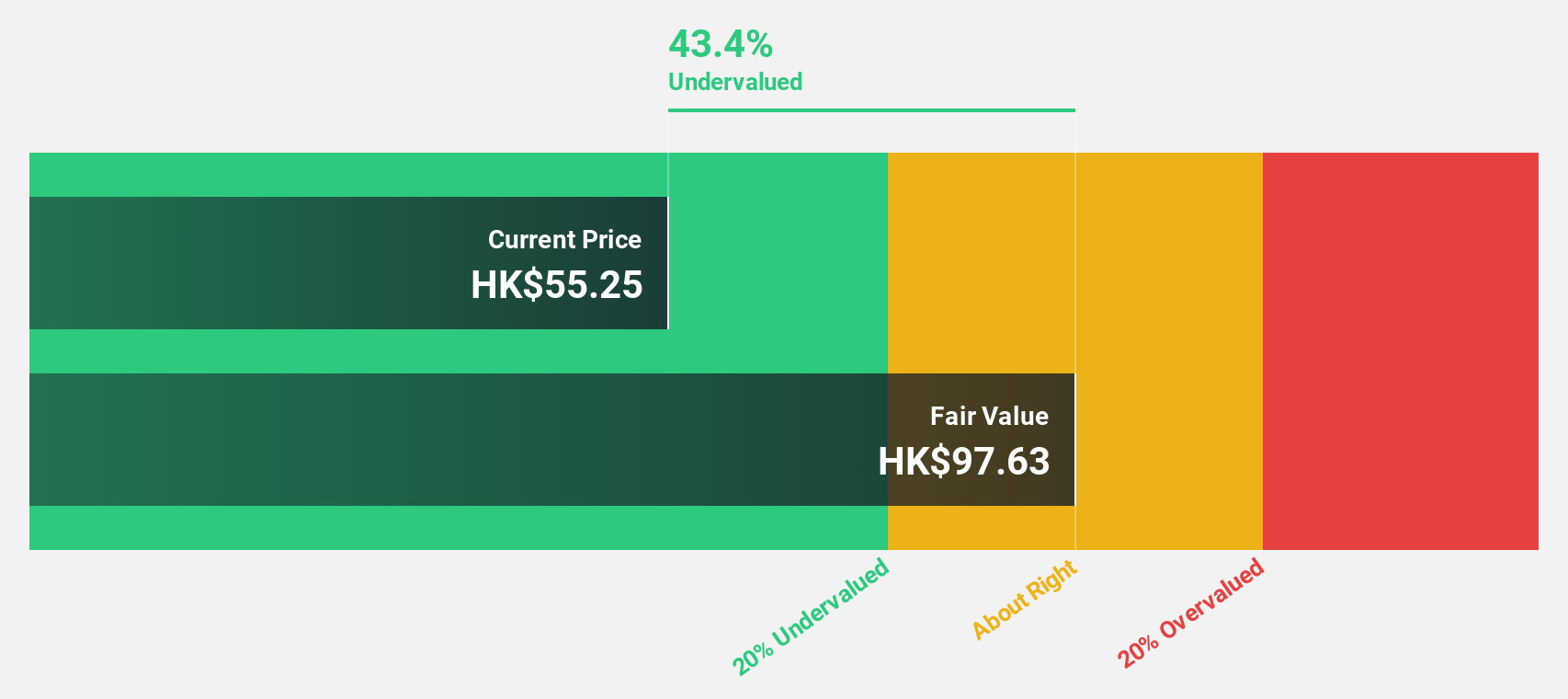

Genscript Biotech (SEHK:1548)

Overview: Genscript Biotech Corporation is an investment holding company that manufactures and sells life science research products and services globally, with a market cap of HK$21.27 billion.

Operations: The company's revenue is derived from several segments: Cell Therapy ($456 million), Biologics Development Services ($84.76 million), Life Science Services and Products ($432.28 million), and Industrial Synthetic Biology Products ($50.98 million).

Estimated Discount To Fair Value: 48.6%

Genscript Biotech is trading at HK$9.91, significantly below its estimated fair value of HK$19.29, indicating potential undervaluation based on cash flows. The company is projected to achieve substantial revenue growth of 40.3% annually, outpacing the Hong Kong market's average growth rate and becoming profitable within three years. However, its forecasted Return on Equity remains modest at 9.5%. Recent executive changes aim to enhance global marketing strategies in life sciences.

- Our earnings growth report unveils the potential for significant increases in Genscript Biotech's future results.

- Navigate through the intricacies of Genscript Biotech with our comprehensive financial health report here.

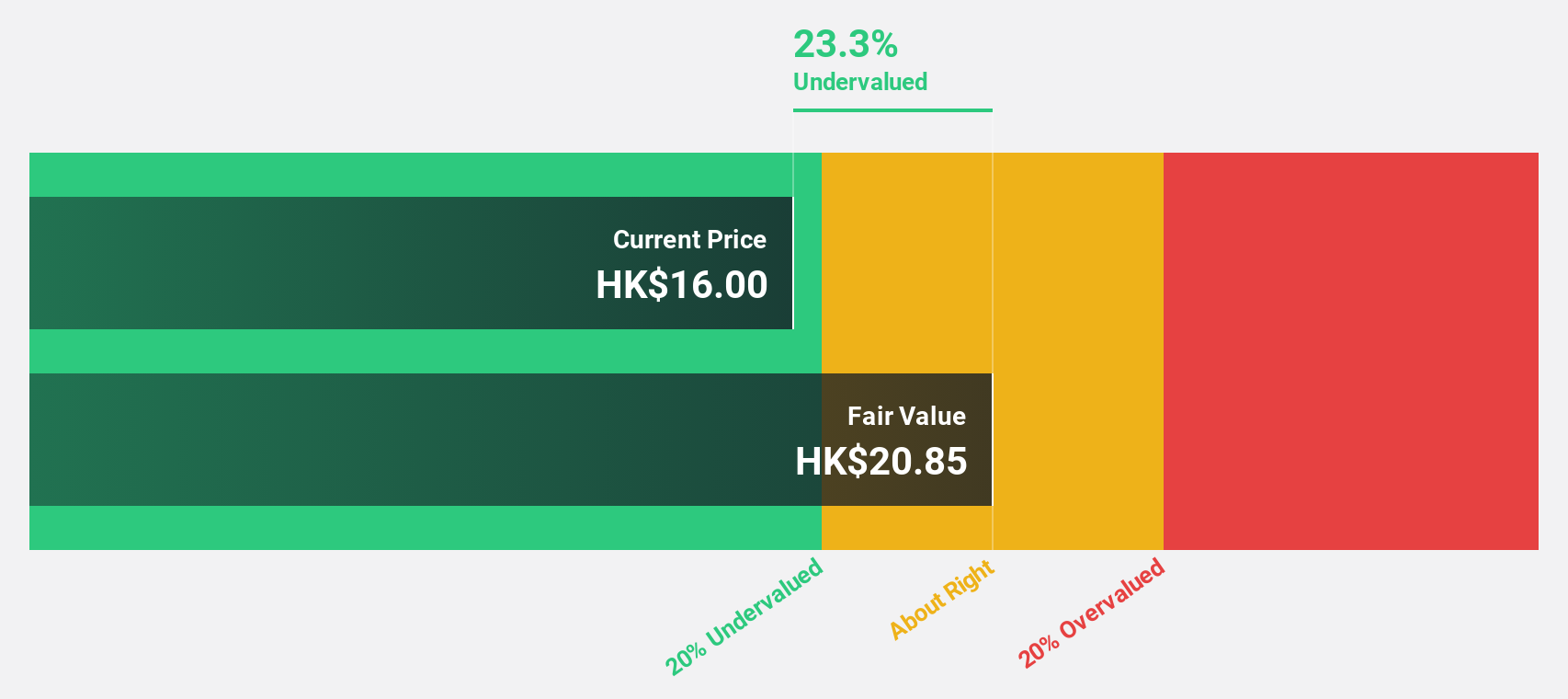

ASMPT (SEHK:522)

Overview: ASMPT Limited is an investment holding company involved in the design, manufacture, and marketing of machines, tools, and materials for the semiconductor and electronics assembly industries globally, with a market cap of approximately HK$31.92 billion.

Operations: The company generates revenue from its Semiconductor Solutions segment, amounting to HK$6.42 billion, and its Surface Mount Technology (SMT) Solutions segment, which totals HK$6.81 billion.

Estimated Discount To Fair Value: 49.3%

ASMPT is trading at HK$76.65, significantly below its estimated fair value of HK$151.04, highlighting potential undervaluation based on cash flows. Despite a decline in profit margins from 5.8% to 3.1%, earnings are forecasted to grow significantly at 46.1% annually over the next three years, surpassing the Hong Kong market's growth rate. However, recent guidance indicates a revenue decline for Q4 2024 due to seasonal factors, which may impact short-term performance.

- In light of our recent growth report, it seems possible that ASMPT's financial performance will exceed current levels.

- Get an in-depth perspective on ASMPT's balance sheet by reading our health report here.

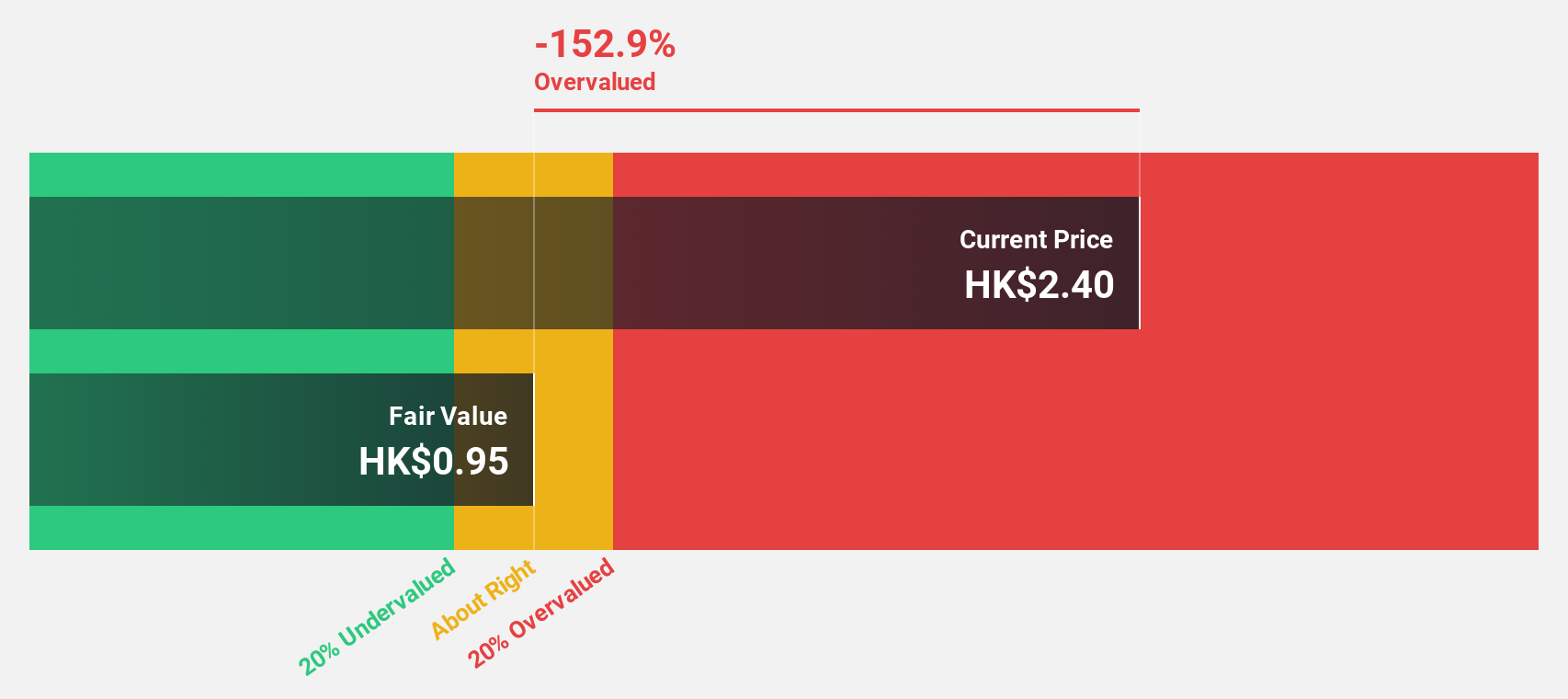

FIT Hon Teng (SEHK:6088)

Overview: FIT Hon Teng Limited manufactures and sells mobile and wireless devices and connectors in Taiwan and internationally, with a market cap of HK$24.80 billion.

Operations: The company's revenue segments include Consumer Products generating $690.95 million and Intermediate Products contributing $3.94 billion.

Estimated Discount To Fair Value: 18%

FIT Hon Teng is trading at HK$3.5, below its estimated fair value of HK$4.27, suggesting potential undervaluation based on cash flows. Earnings grew by 125.6% last year and are expected to rise 30.8% annually, surpassing the Hong Kong market's growth rate. Revenue is forecasted to grow at 17.5% per year but remains below the significant threshold of 20%. The stock's high volatility may concern risk-averse investors despite its valuation appeal.

- Our growth report here indicates FIT Hon Teng may be poised for an improving outlook.

- Dive into the specifics of FIT Hon Teng here with our thorough financial health report.

Make It Happen

- Unlock our comprehensive list of 875 Undervalued Stocks Based On Cash Flows by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6088

FIT Hon Teng

Manufactures and sells mobile and wireless devices and connectors in Taiwan and internationally.

Excellent balance sheet with reasonable growth potential.