As global markets experience a rebound, driven by easing core U.S. inflation and strong earnings from major banks, investors are increasingly optimistic about the potential for rate cuts later in the year. In this context, penny stocks—often smaller or less-established companies—continue to offer intriguing opportunities for those willing to explore beyond traditional investments. Despite being a somewhat outdated term, penny stocks can still represent valuable prospects when they possess solid financials and growth potential.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.51B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.40 | MYR1.11B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.68 | HK$42.36B | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.74 | MYR437.82M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.00 | HK$634.79M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.964 | £153.63M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.875 | MYR290.45M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.395 | £177.66M | ★★★★★☆ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.48 | £66.37M | ★★★★☆☆ |

Click here to see the full list of 5,707 stocks from our Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Sino Biopharmaceutical (SEHK:1177)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Sino Biopharmaceutical Limited is a research and development pharmaceutical conglomerate operating in the People's Republic of China, with a market cap of HK$52.37 billion.

Operations: The company generates revenue of CN¥27.45 billion from its Modernised Chinese Medicines and Chemical Medicines segment.

Market Cap: HK$52.37B

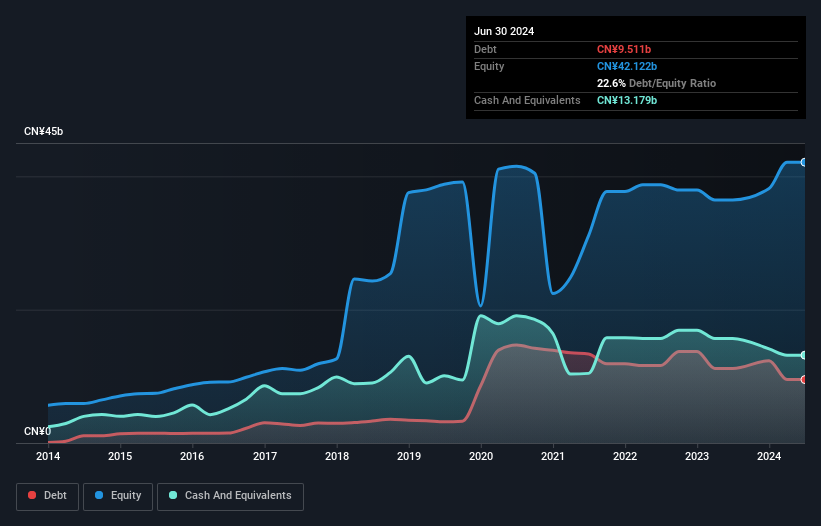

Sino Biopharmaceutical Limited, with a market cap of HK$52.37 billion, is actively enhancing its financial and operational standing through strategic initiatives such as a significant share buyback program aimed at boosting net asset value and earnings per share. The company has demonstrated robust growth in earnings over the past year, significantly outpacing industry averages despite a decline over the last five years. Its debt is well-covered by operating cash flow, and it maintains more cash than total debt, indicating strong financial health. Recent advancements in innovative drug development further bolster its growth potential within the pharmaceutical sector.

- Jump into the full analysis health report here for a deeper understanding of Sino Biopharmaceutical.

- Examine Sino Biopharmaceutical's earnings growth report to understand how analysts expect it to perform.

Frontage Holdings (SEHK:1521)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Frontage Holdings Corporation is a contract research organization offering laboratory and related services to pharmaceutical, biotechnology, and agrochemical companies, with a market cap of HK$3.30 billion.

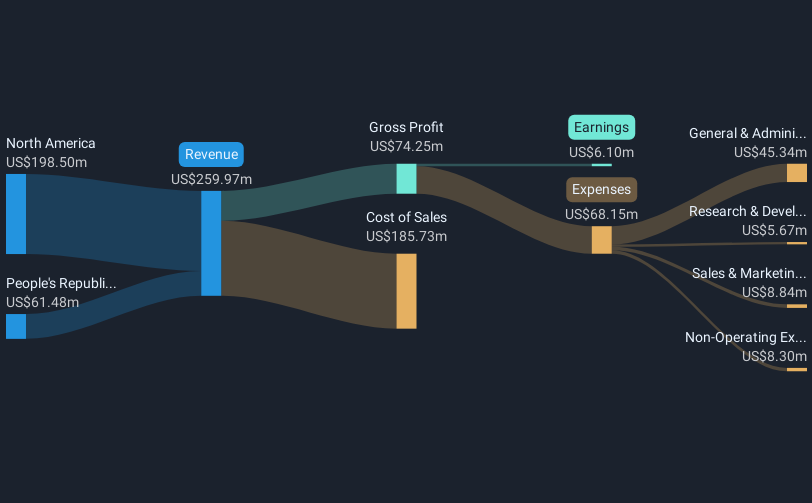

Operations: The company generates revenue primarily from North America, contributing $198.50 million, and the People's Republic of China, with $61.48 million.

Market Cap: HK$3.3B

Frontage Holdings Corporation, with a market cap of HK$3.30 billion, faces challenges typical of its sector, including low return on equity at 1.7% and declining profit margins from 6.7% to 2.3%. Despite this, the company maintains satisfactory debt levels with a net debt to equity ratio of 15.7%, supported by operating cash flow covering debt well at 34.4%. Recent leadership changes aim to drive growth and stability; Drs. Wentao Zhang and John Lin have been appointed Co-CEOs following Dr. Abdul Mutlib's transition to an advisory role, ensuring continuity in strategic direction amidst evolving business dynamics.

- Unlock comprehensive insights into our analysis of Frontage Holdings stock in this financial health report.

- Gain insights into Frontage Holdings' future direction by reviewing our growth report.

Tian An China Investments (SEHK:28)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tian An China Investments Company Limited is an investment holding company that focuses on investing in, developing, and managing properties across the People's Republic of China, Hong Kong, the United Kingdom, and Australia with a market cap of HK$6.47 billion.

Operations: The company's revenue is primarily derived from property development (HK$1.10 billion) and property investment (HK$581.17 million).

Market Cap: HK$6.47B

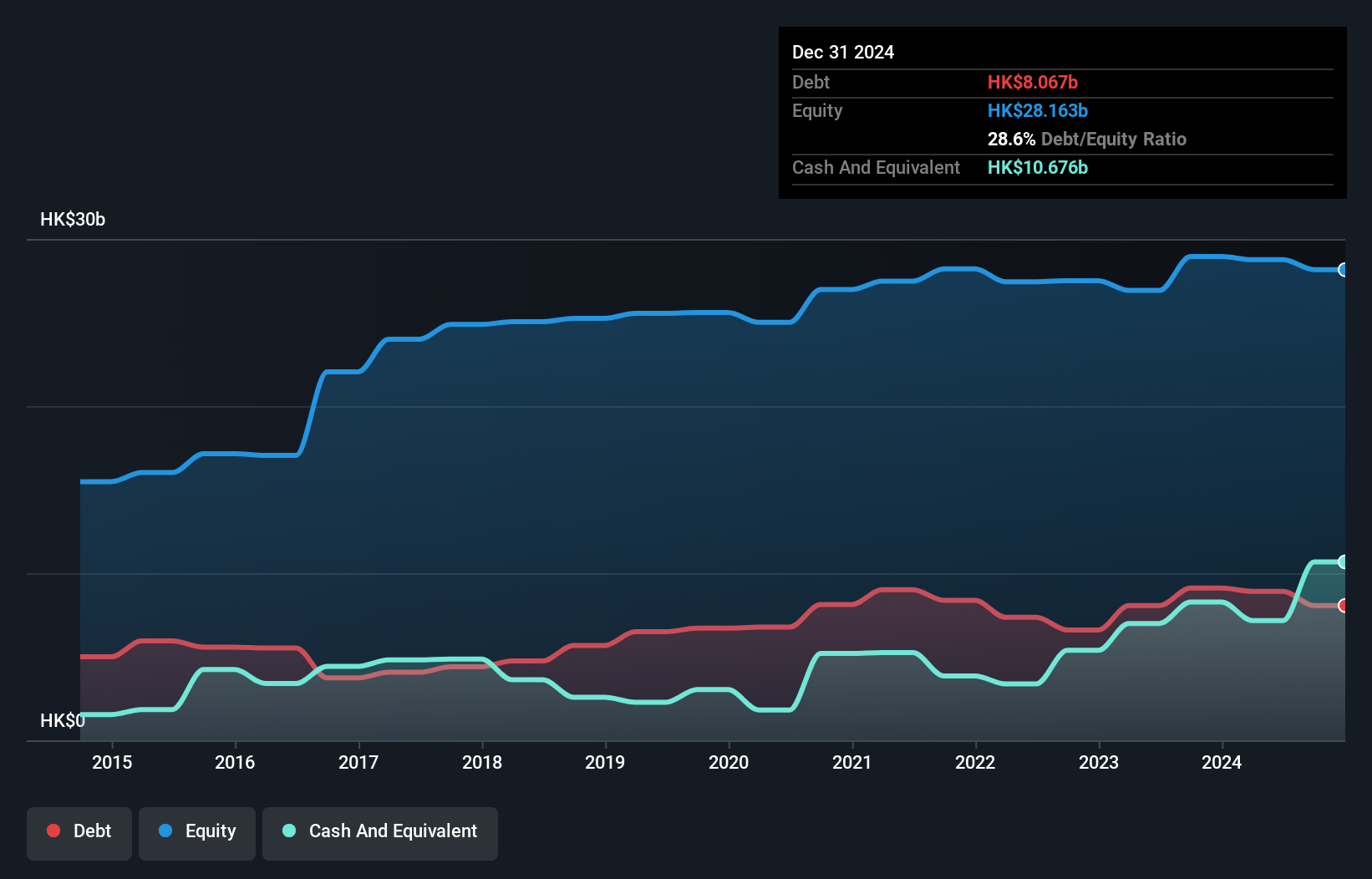

Tian An China Investments, with a market cap of HK$6.47 billion, navigates the real estate sector with seasoned management and board teams. Despite negative earnings growth last year, the company maintains stable weekly volatility and satisfactory net debt to equity ratio at 6.1%. It offers a reliable dividend yield of 4.54% and has short-term assets exceeding both short-term (HK$17.1B) and long-term liabilities (HK$8.4B). Recent corporate governance enhancements include appointing Ms. Lau Tung Ni as Company Secretary, emphasizing strategic succession planning for sustained operational integrity amidst evolving market conditions.

- Click to explore a detailed breakdown of our findings in Tian An China Investments' financial health report.

- Learn about Tian An China Investments' historical performance here.

Turning Ideas Into Actions

- Click this link to deep-dive into the 5,707 companies within our Penny Stocks screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1177

Sino Biopharmaceutical

An investment holding company, operates as a research and development pharmaceutical conglomerate in the People’s Republic of China.

Excellent balance sheet with proven track record.