- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:6088

January 2025's Promising Penny Stocks To Consider

Reviewed by Simply Wall St

Global markets have shown resilience, with U.S. stocks advancing due to easing core inflation and strong bank earnings, while European indices rose on hopes of continued interest rate cuts. In such a climate, identifying promising investments requires a focus on financial strength and potential for growth. Penny stocks, despite being an older term, remain relevant as they often represent smaller or newer companies that can offer unique opportunities when backed by solid financials.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.51B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.40 | MYR1.11B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.68 | HK$42.36B | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.74 | MYR437.82M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.00 | HK$634.79M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.964 | £153.63M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.875 | MYR290.45M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.395 | £177.66M | ★★★★★☆ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.48 | £66.37M | ★★★★☆☆ |

Click here to see the full list of 5,707 stocks from our Penny Stocks screener.

Let's review some notable picks from our screened stocks.

China Zheshang Bank (SEHK:2016)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: China Zheshang Bank Co., Ltd. offers a range of commercial banking products and services in Mainland China, with a market cap of HK$78.55 billion.

Operations: The bank generates CN¥38.47 billion in revenue from its operations in Mainland China.

Market Cap: HK$78.55B

China Zheshang Bank, with a market cap of HK$78.55 billion, is trading at 73.1% below its estimated fair value, presenting a potentially attractive entry point for investors interested in penny stocks. The bank's earnings have grown by 9.2% over the past year, outpacing the industry average of 2.1%, and are forecast to grow by 10.2% annually. It maintains high-quality earnings with an appropriate level of non-performing loans at 1.5%. While its return on equity is low at 7.9%, it benefits from primarily low-risk funding sources and has not diluted shareholders recently.

- Dive into the specifics of China Zheshang Bank here with our thorough balance sheet health report.

- Learn about China Zheshang Bank's future growth trajectory here.

FIT Hon Teng (SEHK:6088)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: FIT Hon Teng Limited manufactures and sells mobile and wireless devices and connectors in Taiwan and internationally, with a market cap of HK$24.80 billion.

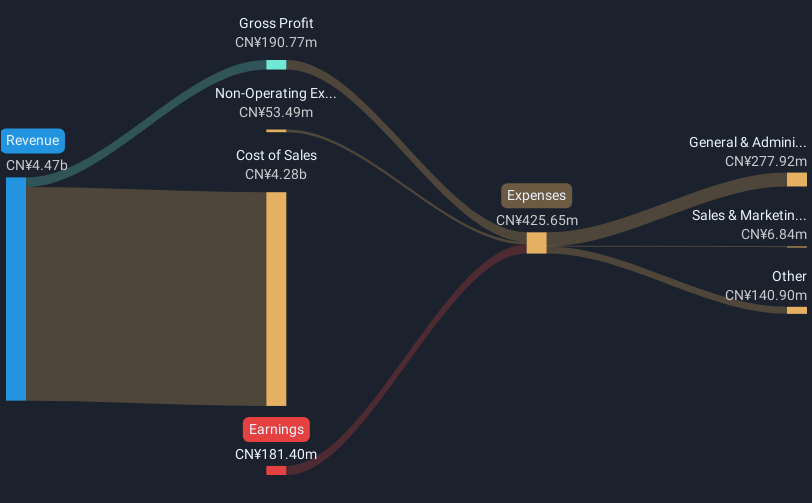

Operations: The company's revenue is primarily derived from its Intermediate Products segment, which generated $3.94 billion, followed by the Consumer Products segment with $690.95 million.

Market Cap: HK$24.8B

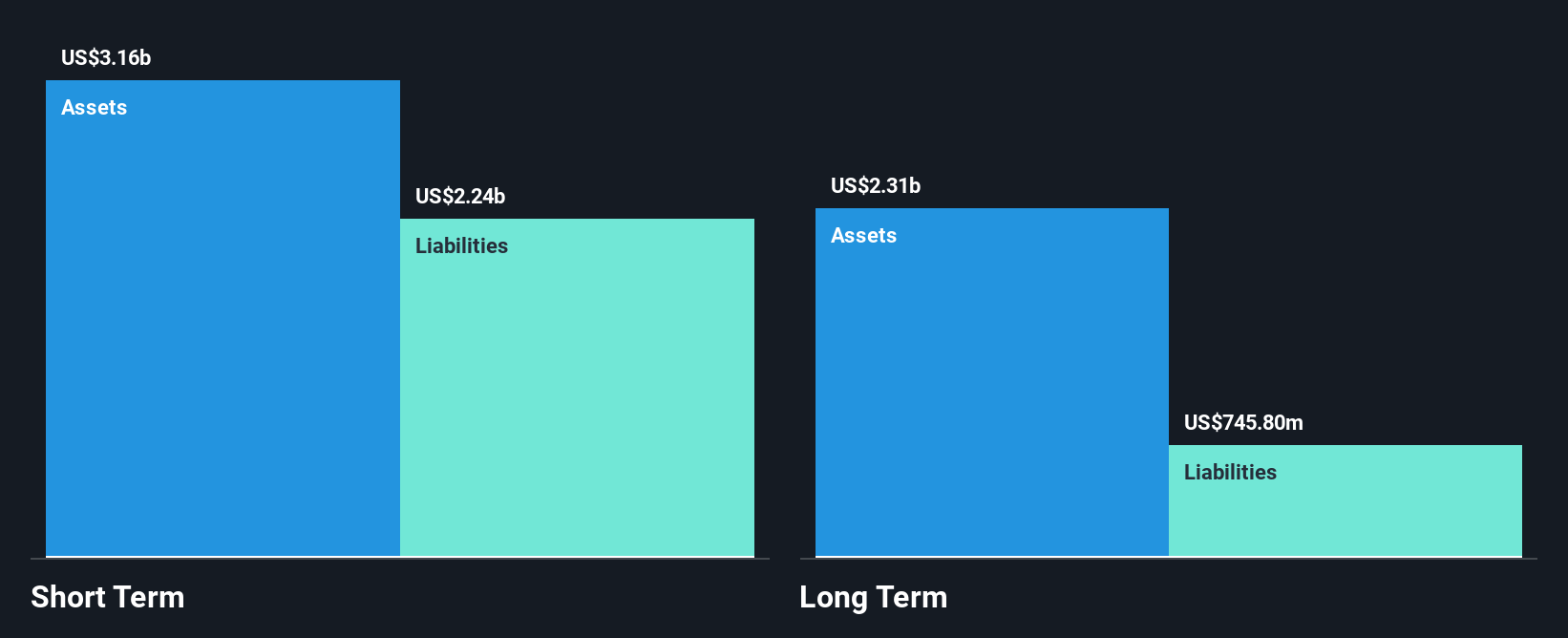

FIT Hon Teng Limited, with a market cap of HK$24.80 billion, trades 18% below its estimated fair value, indicating potential undervaluation. The company has demonstrated robust earnings growth of 125.6% over the past year and is forecasted to grow by 30.8% annually. Its financial health is supported by short-term assets exceeding liabilities and satisfactory net debt to equity at 12.1%. However, the share price has been highly volatile recently, and return on equity remains low at 7.2%. Despite these challenges, FIT Hon Teng maintains high-quality earnings without significant shareholder dilution in the past year.

- Take a closer look at FIT Hon Teng's potential here in our financial health report.

- Review our growth performance report to gain insights into FIT Hon Teng's future.

Pengxin International MiningLtd (SHSE:600490)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Pengxin International Mining Co., Ltd operates in the non-ferrous metal industry worldwide and has a market cap of CN¥7.32 billion.

Operations: Revenue Segments: No revenue segments reported.

Market Cap: CN¥7.32B

Pengxin International Mining Co., Ltd, with a market cap of CN¥7.32 billion, faces financial challenges as it reported a net loss of CN¥117.04 million for the nine months ending September 2024, an increase from the previous year's loss. Despite having short-term assets exceeding both its short and long-term liabilities, the company remains unprofitable with negative operating cash flow and return on equity at -4.81%. On a positive note, Pengxin's debt-to-equity ratio has improved significantly over five years, reducing from 27.2% to 12.1%, and it holds more cash than its total debt without significant shareholder dilution recently.

- Click to explore a detailed breakdown of our findings in Pengxin International MiningLtd's financial health report.

- Gain insights into Pengxin International MiningLtd's past trends and performance with our report on the company's historical track record.

Where To Now?

- Click through to start exploring the rest of the 5,704 Penny Stocks now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6088

FIT Hon Teng

Manufactures and sells mobile and wireless devices and connectors in Taiwan and internationally.

Excellent balance sheet with reasonable growth potential.