China Silver Technology Holdings Limited's (HKG:515) CEO Compensation Looks Acceptable To Us And Here's Why

Key Insights

- China Silver Technology Holdings' Annual General Meeting to take place on 26th of June

- Salary of HK$360.0k is part of CEO Ming Xu's total remuneration

- Total compensation is 78% below industry average

- Over the past three years, China Silver Technology Holdings' EPS grew by 36% and over the past three years, the total loss to shareholders 66%

Shareholders may be wondering what CEO Ming Xu plans to do to improve the less than great performance at China Silver Technology Holdings Limited (HKG:515) recently. One way they can exercise their influence on management is through voting on resolutions, such as executive remuneration at the next AGM, coming up on 26th of June. Setting appropriate executive remuneration to align with the interests of shareholders may also be a way to influence the company performance in the long run. We have prepared some analysis below to show that CEO compensation looks to be reasonable.

View our latest analysis for China Silver Technology Holdings

Comparing China Silver Technology Holdings Limited's CEO Compensation With The Industry

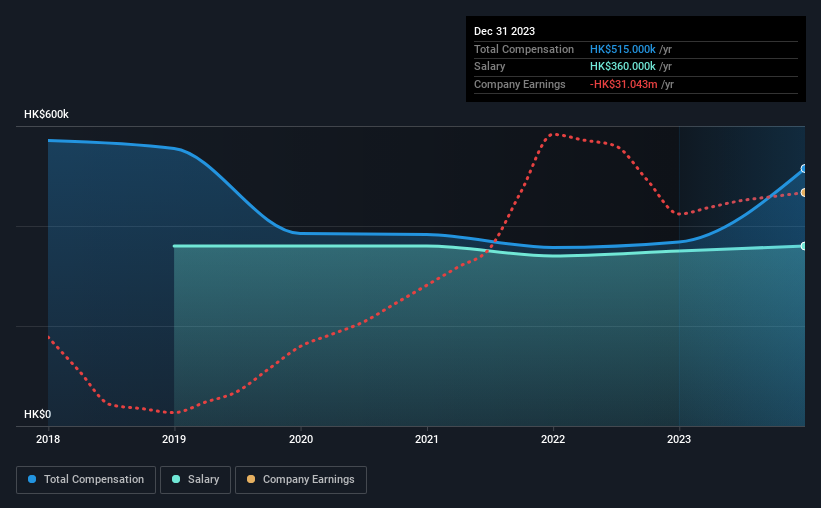

According to our data, China Silver Technology Holdings Limited has a market capitalization of HK$81m, and paid its CEO total annual compensation worth HK$515k over the year to December 2023. We note that's an increase of 40% above last year. We note that the salary portion, which stands at HK$360.0k constitutes the majority of total compensation received by the CEO.

In comparison with other companies in the Hong Kong Electronic industry with market capitalizations under HK$1.6b, the reported median total CEO compensation was HK$2.4m. Accordingly, China Silver Technology Holdings pays its CEO under the industry median.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | HK$360k | HK$350k | 70% |

| Other | HK$155k | HK$18k | 30% |

| Total Compensation | HK$515k | HK$368k | 100% |

Speaking on an industry level, nearly 79% of total compensation represents salary, while the remainder of 21% is other remuneration. It's interesting to note that China Silver Technology Holdings allocates a smaller portion of compensation to salary in comparison to the broader industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

China Silver Technology Holdings Limited's Growth

China Silver Technology Holdings Limited has seen its earnings per share (EPS) increase by 36% a year over the past three years. The trailing twelve months of revenue was pretty much the same as the prior period.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's also good to see modest revenue growth, suggesting the underlying business is healthy. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has China Silver Technology Holdings Limited Been A Good Investment?

Few China Silver Technology Holdings Limited shareholders would feel satisfied with the return of -66% over three years. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

The loss to shareholders over the past three years is certainly concerning. This diverges with the robust growth in EPS, suggesting that there is a large discrepancy between share price and fundamentals. A key focus for the board and management will be how to align the share price with fundamentals. The upcoming AGM will provide shareholders the opportunity to raise their concerns and evaluate if the board’s judgement and decision-making is aligned with their expectations.

CEO compensation can have a massive impact on performance, but it's just one element. We've identified 2 warning signs for China Silver Technology Holdings that investors should be aware of in a dynamic business environment.

Switching gears from China Silver Technology Holdings, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:515

China Silver Technology Holdings

Manufactures and trades in light emitting diode (LED) lighting products and printed circuit boards (PCBs) in the People’s Republic of China, Hong Kong, other Asian countries, Hungary, Turkey, Germany, and rest of Europe.

Moderate risk and overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026