- Hong Kong

- /

- Electrical

- /

- SEHK:40

Shareholders Will Probably Hold Off On Increasing Gold Peak Industries (Holdings) Limited's (HKG:40) CEO Compensation For The Time Being

In the past three years, shareholders of Gold Peak Industries (Holdings) Limited (HKG:40) have seen a loss on their investment. However, what is unusual is that EPS growth has been positive, suggesting that the share price has diverged from fundamentals. The AGM coming up on the 02 September 2021 could be an opportunity for shareholders to bring these concerns to the board's attention. They could also try to influence management and firm direction through voting on resolutions such as executive remuneration and other company matters. Here's our take on why we think shareholders may want to be cautious of approving a raise for the CEO at the moment.

View our latest analysis for Gold Peak Industries (Holdings)

How Does Total Compensation For Victor Lo Compare With Other Companies In The Industry?

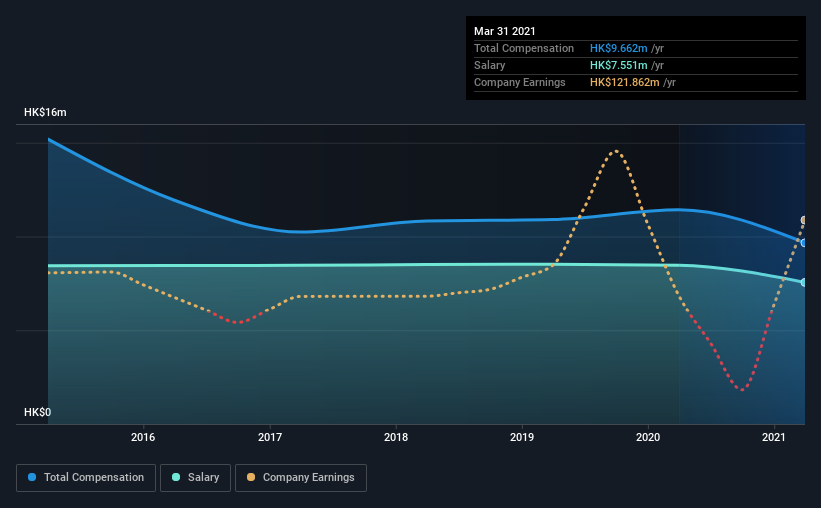

Our data indicates that Gold Peak Industries (Holdings) Limited has a market capitalization of HK$502m, and total annual CEO compensation was reported as HK$9.7m for the year to March 2021. That's a notable decrease of 15% on last year. Notably, the salary which is HK$7.55m, represents most of the total compensation being paid.

In comparison with other companies in the industry with market capitalizations under HK$1.6b, the reported median total CEO compensation was HK$2.2m. Hence, we can conclude that Victor Lo is remunerated higher than the industry median. What's more, Victor Lo holds HK$128m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | HK$7.6m | HK$8.5m | 78% |

| Other | HK$2.1m | HK$3.0m | 22% |

| Total Compensation | HK$9.7m | HK$11m | 100% |

Speaking on an industry level, nearly 81% of total compensation represents salary, while the remainder of 19% is other remuneration. Although there is a difference in how total compensation is set, Gold Peak Industries (Holdings) more or less reflects the market in terms of setting the salary. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Gold Peak Industries (Holdings) Limited's Growth

Gold Peak Industries (Holdings) Limited has seen its earnings per share (EPS) increase by 82% a year over the past three years. In the last year, its revenue is up 11%.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's a real positive to see this sort of revenue growth in a single year. That suggests a healthy and growing business. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Gold Peak Industries (Holdings) Limited Been A Good Investment?

Since shareholders would have lost about 13% over three years, some Gold Peak Industries (Holdings) Limited investors would surely be feeling negative emotions. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

Shareholders have not seen their shares grow in value, rather they have seen their shares decline. The stock's movement is disjointed with the company's earnings growth, which ideally should move in the same direction. If there are some unknown variables that are influencing the stock's price, surely shareholders would have some concerns. These concerns should be addressed at the upcoming AGM, where shareholders can question the board and evaluate if their judgement and decision making is still in line with their expectations.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We identified 2 warning signs for Gold Peak Industries (Holdings) (1 makes us a bit uncomfortable!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:40

Gold Peak Technology Group

An investment holding company, engages in the development, manufacture, marketing, and trading of batteries, rechargeable batteries, audio, electronics, and acoustics products.

Fair value with acceptable track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)