- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:3638

Hunlicar Group (HKG:3638) Knows How To Allocate Capital Effectively

What trends should we look for it we want to identify stocks that can multiply in value over the long term? Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. With that in mind, the ROCE of Hunlicar Group (HKG:3638) looks great, so lets see what the trend can tell us.

Our free stock report includes 1 warning sign investors should be aware of before investing in Hunlicar Group. Read for free now.Understanding Return On Capital Employed (ROCE)

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. Analysts use this formula to calculate it for Hunlicar Group:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.24 = HK$67m ÷ (HK$492m - HK$208m) (Based on the trailing twelve months to September 2024).

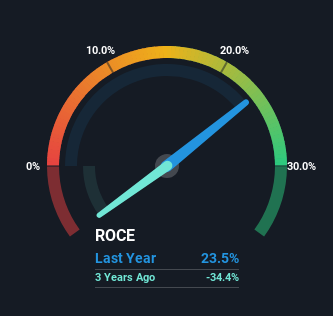

Thus, Hunlicar Group has an ROCE of 24%. In absolute terms that's a great return and it's even better than the Electronic industry average of 6.8%.

View our latest analysis for Hunlicar Group

Historical performance is a great place to start when researching a stock so above you can see the gauge for Hunlicar Group's ROCE against it's prior returns. If you want to delve into the historical earnings , check out these free graphs detailing revenue and cash flow performance of Hunlicar Group.

The Trend Of ROCE

Like most people, we're pleased that Hunlicar Group is now generating some pretax earnings. Historically the company was generating losses but as we can see from the latest figures referenced above, they're now earning 24% on their capital employed. At first glance, it seems the business is getting more proficient at generating returns, because over the same period, the amount of capital employed has reduced by 53%. The reduction could indicate that the company is selling some assets, and considering returns are up, they appear to be selling the right ones.

Another thing to note, Hunlicar Group has a high ratio of current liabilities to total assets of 42%. This effectively means that suppliers (or short-term creditors) are funding a large portion of the business, so just be aware that this can introduce some elements of risk. While it's not necessarily a bad thing, it can be beneficial if this ratio is lower.

The Bottom Line On Hunlicar Group's ROCE

From what we've seen above, Hunlicar Group has managed to increase it's returns on capital all the while reducing it's capital base. And since the stock has dived 79% over the last five years, there may be other factors affecting the company's prospects. Still, it's worth doing some further research to see if the trends will continue into the future.

If you'd like to know about the risks facing Hunlicar Group, we've discovered 1 warning sign that you should be aware of.

High returns are a key ingredient to strong performance, so check out our free list ofstocks earning high returns on equity with solid balance sheets.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hunlicar Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3638

Hunlicar Group

An investment holding company, engages in the computer and electronic products trading business in Hong Kong and the People's Republic of China.

Flawless balance sheet with minimal risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)