- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:6088

High Growth Tech Stocks in Hong Kong for October 2024

Reviewed by Simply Wall St

As global markets navigate geopolitical tensions and economic shifts, Hong Kong's tech sector has shown resilience, with the Hang Seng Index climbing 10.2% amid optimism surrounding Beijing's supportive measures. In this dynamic environment, identifying high-growth tech stocks requires careful consideration of innovation potential and adaptability to market changes, making them attractive prospects for those looking to capitalize on technological advancements in a rapidly evolving landscape.

Top 10 High Growth Tech Companies In Hong Kong

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Wasion Holdings | 22.37% | 25.47% | ★★★★★☆ |

| MedSci Healthcare Holdings | 48.74% | 48.78% | ★★★★★☆ |

| Inspur Digital Enterprise Technology | 25.31% | 39.04% | ★★★★★☆ |

| RemeGen | 26.30% | 52.19% | ★★★★★☆ |

| Innovent Biologics | 21.80% | 59.60% | ★★★★★☆ |

| Akeso | 33.30% | 53.00% | ★★★★★★ |

| Cowell e Holdings | 31.68% | 35.44% | ★★★★★★ |

| Biocytogen Pharmaceuticals (Beijing) | 21.53% | 109.17% | ★★★★★☆ |

| Beijing Airdoc Technology | 37.47% | 93.35% | ★★★★★☆ |

| Sichuan Kelun-Biotech Biopharmaceutical | 24.70% | 8.53% | ★★★★★☆ |

Click here to see the full list of 43 stocks from our SEHK High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Innovent Biologics (SEHK:1801)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Innovent Biologics, Inc. is a biopharmaceutical company focused on developing and commercializing monoclonal antibodies and other drug assets for oncology, ophthalmology, autoimmune, cardiovascular, and metabolic diseases in China with a market cap of HK$79.68 billion.

Operations: The company generates revenue primarily from its biotechnology segment, amounting to CN¥7.46 billion. It focuses on developing and commercializing drug assets in various therapeutic areas within China.

Innovent Biologics, Inc. has demonstrated a robust commitment to innovation, particularly through its strategic collaborations and R&D initiatives. Recently, the company secured exclusive commercialization rights for limertinib in China, anticipating significant revenue from this lung cancer treatment given its promising clinical outcomes. Financially, Innovent reported a sharp 59.6% forecasted annual earnings growth and an impressive expected revenue increase of 21.8% per year—outpacing the broader Hong Kong market significantly. These figures underscore its potential in transforming patient care with advanced therapies while scaling its market presence aggressively.

BYD Electronic (International) (SEHK:285)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BYD Electronic (International) Company Limited is an investment holding company that focuses on the design, manufacture, assembly, and sale of mobile handset components and modules in China and internationally, with a market capitalization of approximately HK$69.85 billion.

Operations: The company generates revenue primarily from the manufacture, assembly, and sale of mobile handset components and modules, amounting to CN¥152.36 billion. The focus is on both domestic and international markets within this sector.

BYD Electronic has demonstrated a notable capacity to adapt and thrive in the competitive tech landscape of Hong Kong. With a 12% annual revenue growth rate, it outpaces the broader market's 7.4%, reflecting its robust market positioning and strategic initiatives. The company also reported significant earnings growth, with profits expected to rise by nearly 24.9% annually, showcasing efficient operations and strong financial health. Recent presentations at the Macquarie Asia TMT Conference highlighted these achievements alongside their half-year sales jump from CNY 56.18 billion to CNY 78.58 billion, affirming their upward trajectory in tech innovation and market penetration. Their commitment to R&D is evident as they continue investing in new technologies, ensuring long-term competitiveness within Hong Kong's tech sector—a crucial move given the rapid technological advancements globally. This strategic focus not only enhances BYD Electronic's product offerings but also solidifies its reputation as a forward-thinking player amidst fierce competition. Looking ahead, these investments in innovation are likely to keep them at the forefront of technological advancements, promising exciting prospects for future growth and industry leadership.

- Click here to discover the nuances of BYD Electronic (International) with our detailed analytical health report.

Understand BYD Electronic (International)'s track record by examining our Past report.

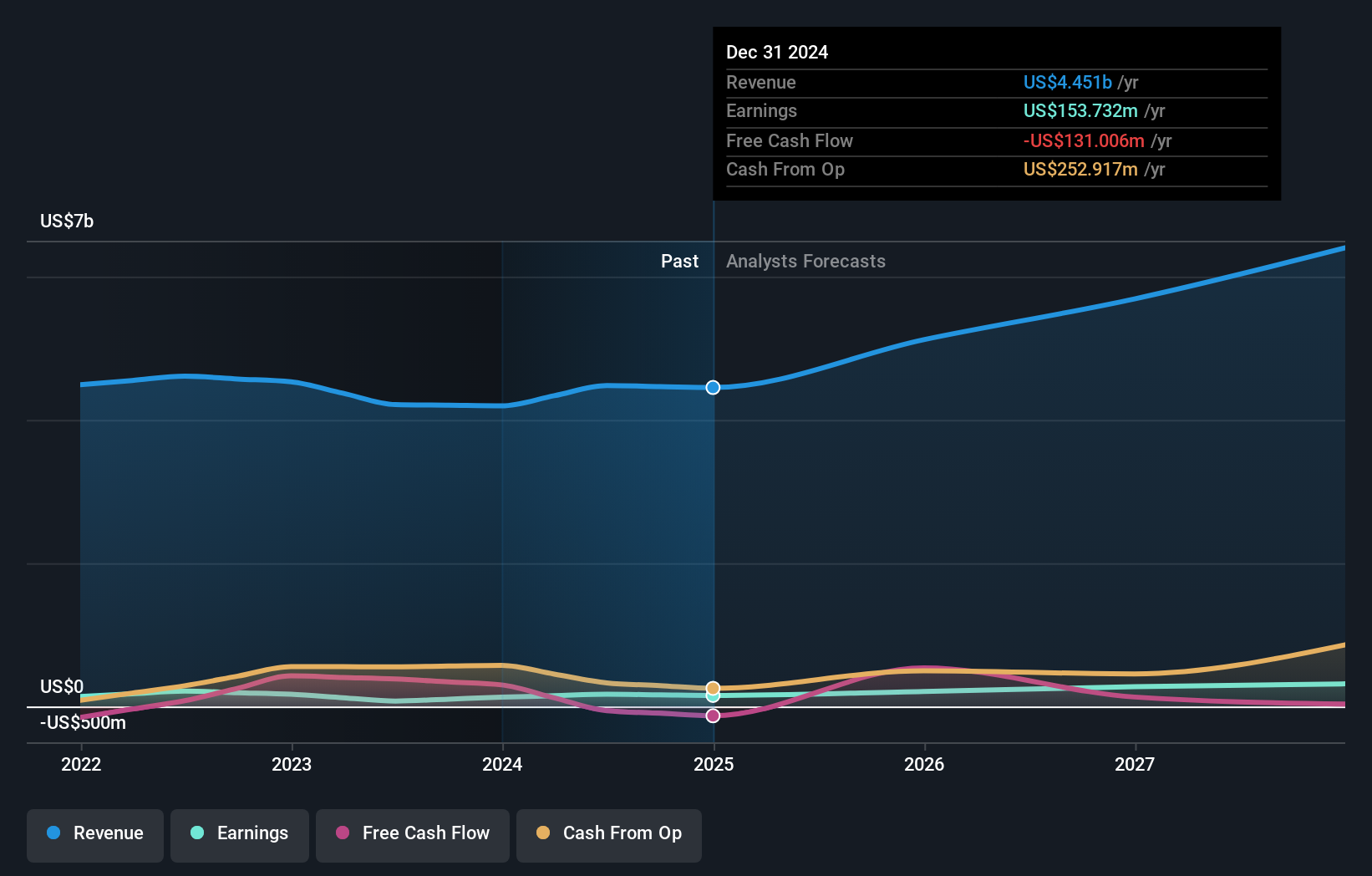

FIT Hon Teng (SEHK:6088)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: FIT Hon Teng Limited manufactures and sells mobile and wireless devices and connectors in Taiwan and internationally, with a market capitalization of HK$20.90 billion.

Operations: The company's primary revenue streams are from consumer products and intermediate products, generating $690.95 million and $3.94 billion respectively.

FIT Hon Teng has demonstrated a robust recovery, with its recent half-year earnings revealing a swing from a net loss to a profit of USD 32.52 million, alongside an increase in sales to USD 2.07 billion from USD 1.78 billion year-over-year. This performance underscores its resilience and adaptability in the tech sector, particularly impressive given the company's strategic emphasis on R&D investments which have significantly contributed to this turnaround. With revenue projected to grow at an annual rate of 18.4%, outpacing Hong Kong's market growth rate of 7.4%, and earnings expected to surge by 32.2% annually, FIT Hon Teng is positioning itself as a dynamic entity within high-growth technology spheres despite some challenges like lower forecasted return on equity at just 10.9%. These figures not only highlight its current financial health but also suggest promising future prospects as it continues to innovate and expand its market reach.

- Delve into the full analysis health report here for a deeper understanding of FIT Hon Teng.

Assess FIT Hon Teng's past performance with our detailed historical performance reports.

Make It Happen

- Navigate through the entire inventory of 43 SEHK High Growth Tech and AI Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6088

FIT Hon Teng

Manufactures and sells mobile and wireless devices and connectors in Taiwan and internationally.

Excellent balance sheet with reasonable growth potential.