- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:2498

Robosense Technology (SEHK:2498): Assessing Valuation After Recent Share Price Surge

Reviewed by Kshitija Bhandaru

Robosense Technology (SEHK:2498) stock has caught attention lately, driven in part by its strong showing over the past month. Shares are up 14% in that time, which has made many investors curious about what is fueling this momentum.

See our latest analysis for Robosense Technology.

Momentum appears to be building for Robosense Technology, with its strong 30-day share price return drawing fresh interest. This comes against a backdrop of a 1.2% total shareholder return over the past year. Investors seem to be betting that the recent gains reflect growing confidence in Robosense’s growth outlook and emerging opportunities across the tech landscape.

If Robosense’s rally has you searching for the next big mover, it might be time to broaden your search and discover fast growing stocks with high insider ownership

But with such impressive momentum and a recent surge in share price, is Robosense Technology still undervalued, or has the market already caught up with its future growth prospects? This may leave little room for a bargain.

Most Popular Narrative: 9.4% Undervalued

The most widely followed narrative places Robosense Technology's fair value at HK$47.45 compared to the last close of HK$43. This sets up a compelling debate about the company's growth potential and valuation trajectory.

The ongoing global transition toward automation, road safety, and regulatory tightening is supporting sustained demand for advanced LiDAR in automotive ADAS. Even amid short-term sales declines to certain OEMs, as industry regulations strengthen and autonomous and electric vehicle adoption accelerates, Robosense's long-term addressable market and revenue potential remain robust despite recent volatility.

Want to uncover the math behind this bold call? The future outlook leans on projections that would make even growth investors do a double take. The real shocker: robust top-line expansion, margin leaps, and a future profit multiple pointing to a fast-evolving industry winner. Click through to see exactly what ambitious assumptions drive this premium fair value.

Result: Fair Value of $47.45 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a sharp drop in ADAS LiDAR sales and persistently high R&D costs could still challenge Robosense Technology's path to lasting profitability.

Find out about the key risks to this Robosense Technology narrative.

Another View: What Do Market Ratios Say?

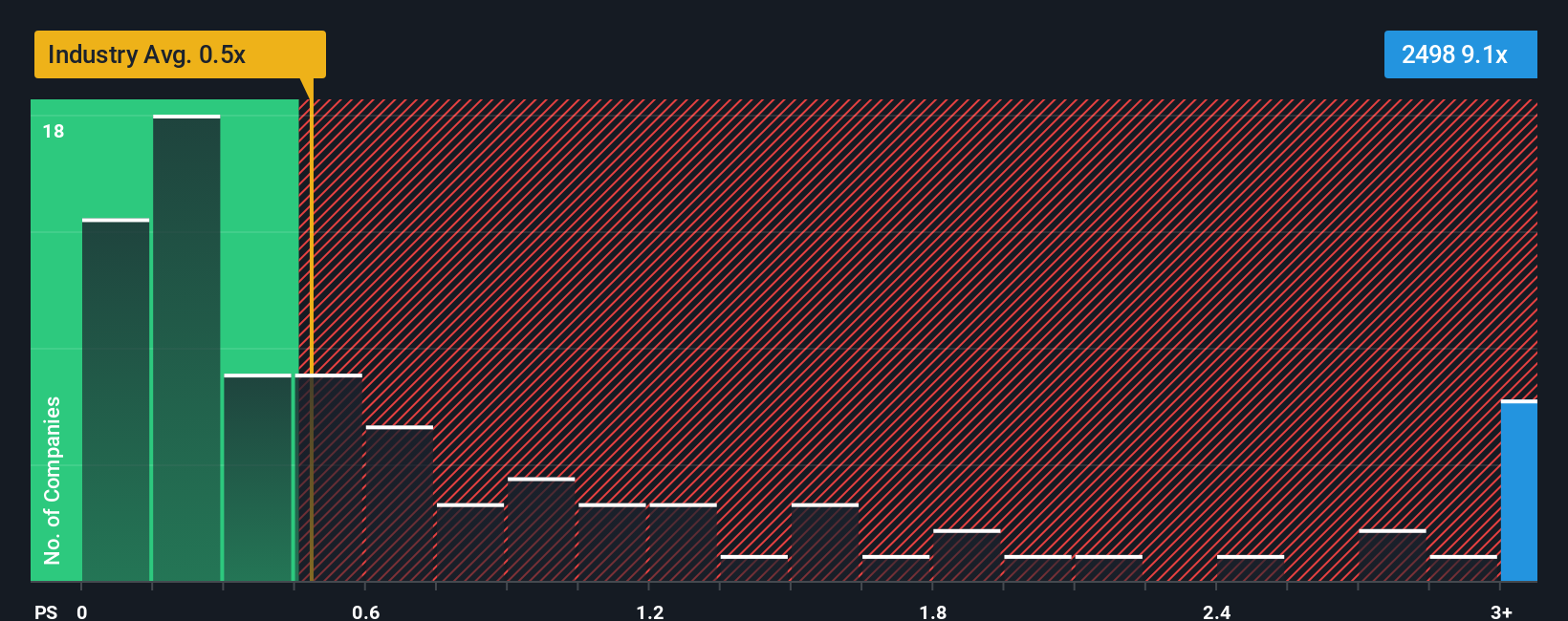

While fair value estimates suggest Robosense Technology is undervalued, a closer look at its price-to-sales ratio offers a different story. Trading at 10.9x sales, it stands well above the 1.1x peer average and the industry’s 0.5x mark. With a fair ratio of just 2x, there is a risk that expectations are running ahead of fundamentals. Could the market be pricing in too much growth, or is this premium justified?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Robosense Technology Narrative

Not convinced by the consensus or eager to dig deeper? You can analyze the numbers and craft a custom Robosense Technology narrative in just a few minutes: Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Robosense Technology.

Looking for More Investment Ideas?

Boost your portfolio with fresh opportunities you might have missed. Smart investors check every corner of the market to avoid letting potential winners slip away.

- Unlock value by reviewing these 904 undervalued stocks based on cash flows, which offers impressive cash flow and growth that could put your returns ahead of the curve.

- Capitalize on innovation and tap into the momentum powering these 24 AI penny stocks, found at the center of global technology trends.

- Collect reliable income with these 19 dividend stocks with yields > 3%, which pays steady yields above 3 percent and is well suited for building long-term wealth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2498

Robosense Technology

An investment holding company, provides LiDAR and perception solutions in the People’s Republic of China and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)