- Hong Kong

- /

- Tech Hardware

- /

- SEHK:2385

Revenues Tell The Story For Readboy Education Holding Company Limited (HKG:2385)

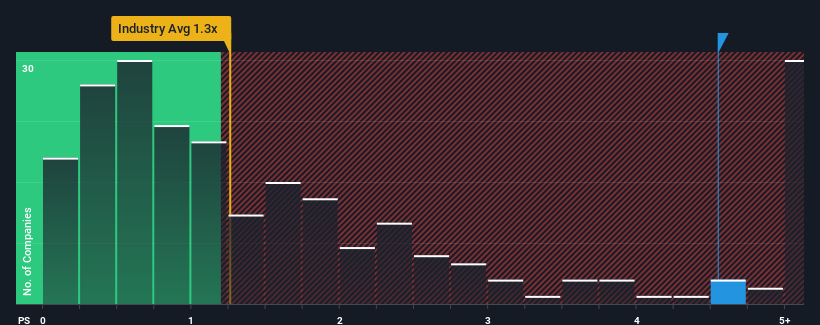

When you see that almost half of the companies in the Tech industry in Hong Kong have price-to-sales ratios (or "P/S") below 0.5x, Readboy Education Holding Company Limited (HKG:2385) looks to be giving off strong sell signals with its 4.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Readboy Education Holding

What Does Readboy Education Holding's Recent Performance Look Like?

Readboy Education Holding has been struggling lately as its revenue has declined faster than most other companies. Perhaps the market is predicting a change in fortunes for the company and is expecting them to blow past the rest of the industry, elevating the P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Readboy Education Holding.Is There Enough Revenue Growth Forecasted For Readboy Education Holding?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Readboy Education Holding's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 26% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 9.7% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 94% during the coming year according to the lone analyst following the company. That's shaping up to be materially higher than the 2.3% growth forecast for the broader industry.

In light of this, it's understandable that Readboy Education Holding's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look into Readboy Education Holding shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

It is also worth noting that we have found 2 warning signs for Readboy Education Holding (1 is a bit unpleasant!) that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2385

Readboy Education Holding

Engages in the design, development, manufacture, and sale of smart learning devices to primary and secondary school students in the People's Republic of China.

Flawless balance sheet with minimal risk.

Similar Companies

Market Insights

Community Narratives