- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:2018

Does The Market Have A Low Tolerance For AAC Technologies Holdings Inc.'s (HKG:2018) Mixed Fundamentals?

With its stock down 12% over the past week, it is easy to disregard AAC Technologies Holdings (HKG:2018). It seems that the market might have completely ignored the positive aspects of the company's fundamentals and decided to weigh-in more on the negative aspects. Stock prices are usually driven by a company’s financial performance over the long term, and therefore we decided to pay more attention to the company's financial performance. Specifically, we decided to study AAC Technologies Holdings' ROE in this article.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

How Is ROE Calculated?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for AAC Technologies Holdings is:

8.9% = CN¥2.1b ÷ CN¥24b (Based on the trailing twelve months to June 2025).

The 'return' is the profit over the last twelve months. So, this means that for every HK$1 of its shareholder's investments, the company generates a profit of HK$0.09.

Check out our latest analysis for AAC Technologies Holdings

What Has ROE Got To Do With Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

AAC Technologies Holdings' Earnings Growth And 8.9% ROE

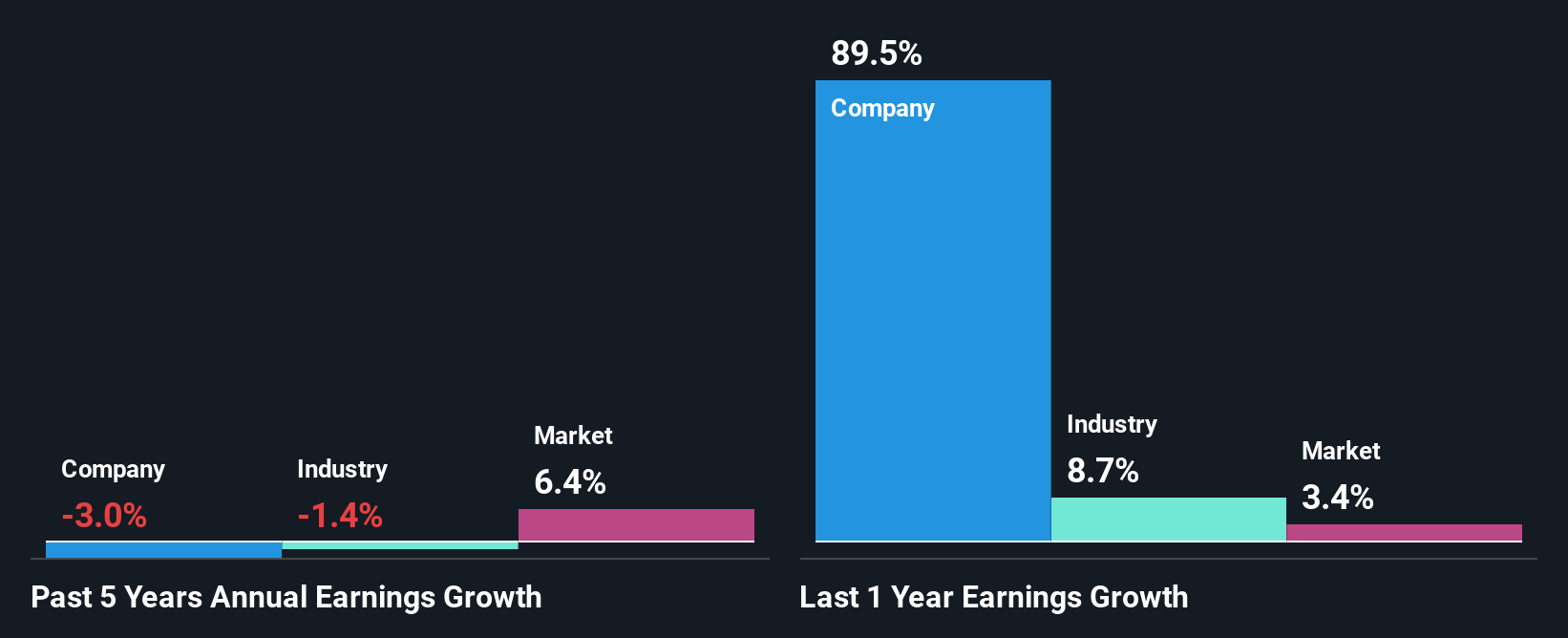

At first glance, AAC Technologies Holdings' ROE doesn't look very promising. Yet, a closer study shows that the company's ROE is similar to the industry average of 8.2%. But then again, AAC Technologies Holdings' five year net income shrunk at a rate of 3.0%. Bear in mind, the company does have a slightly low ROE. Therefore, the decline in earnings could also be the result of this.

As a next step, we compared AAC Technologies Holdings' performance with the industry and found thatAAC Technologies Holdings' performance is depressing even when compared with the industry, which has shrunk its earnings at a rate of 1.4% in the same period, which is a slower than the company.

Earnings growth is an important metric to consider when valuing a stock. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. This then helps them determine if the stock is placed for a bright or bleak future. What is 2018 worth today? The intrinsic value infographic in our free research report helps visualize whether 2018 is currently mispriced by the market.

Is AAC Technologies Holdings Using Its Retained Earnings Effectively?

AAC Technologies Holdings' low three-year median payout ratio of 15% (implying that it retains the remaining 85% of its profits) comes as a surprise when you pair it with the shrinking earnings. The low payout should mean that the company is retaining most of its earnings and consequently, should see some growth. So there could be some other explanations in that regard. For example, the company's business may be deteriorating.

Additionally, AAC Technologies Holdings has paid dividends over a period of at least ten years, which means that the company's management is determined to pay dividends even if it means little to no earnings growth. Upon studying the latest analysts' consensus data, we found that the company is expected to keep paying out approximately 13% of its profits over the next three years. Still, forecasts suggest that AAC Technologies Holdings' future ROE will rise to 11% even though the the company's payout ratio is not expected to change by much.

Summary

On the whole, we feel that the performance shown by AAC Technologies Holdings can be open to many interpretations. Even though it appears to be retaining most of its profits, given the low ROE, investors may not be benefitting from all that reinvestment after all. The low earnings growth suggests our theory correct. With that said, we studied the latest analyst forecasts and found that while the company has shrunk its earnings in the past, analysts expect its earnings to grow in the future. To know more about the company's future earnings growth forecasts take a look at this free report on analyst forecasts for the company to find out more.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2018

AAC Technologies Holdings

An investment holding company, provides sensory experience solutions in Greater China, the United States, Europe, Other Asian countries, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)