- Hong Kong

- /

- Tech Hardware

- /

- SEHK:1810

Xiaomi Corporation's (HKG:1810) Business Is Yet to Catch Up With Its Share Price

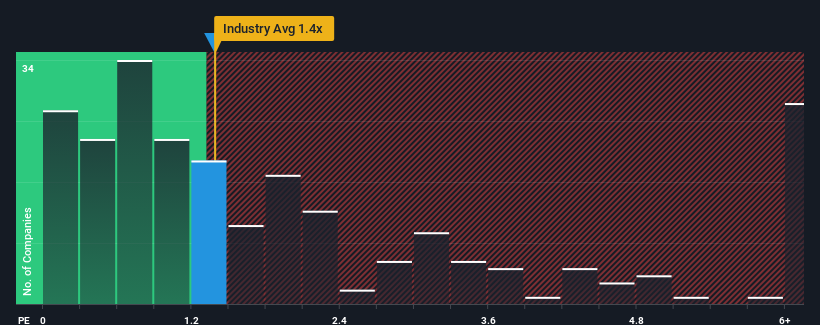

When you see that almost half of the companies in the Tech industry in Hong Kong have price-to-sales ratios (or "P/S") below 0.6x, Xiaomi Corporation (HKG:1810) looks to be giving off some sell signals with its 1.4x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Xiaomi

What Does Xiaomi's Recent Performance Look Like?

Recent times have been more advantageous for Xiaomi as its revenue hasn't fallen as much as the rest of the industry. The P/S ratio is probably high because investors think this comparatively better revenue performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price, especially if revenue continues to dissolve.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Xiaomi.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Xiaomi's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 12%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 14% overall rise in revenue. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 9.9% each year during the coming three years according to the analysts following the company. That's shaping up to be similar to the 8.4% per year growth forecast for the broader industry.

With this in consideration, we find it intriguing that Xiaomi's P/S is higher than its industry peers. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Bottom Line On Xiaomi's P/S

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that Xiaomi currently trades on a higher than expected P/S. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Xiaomi that you should be aware of.

If these risks are making you reconsider your opinion on Xiaomi, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1810

Xiaomi

An investment holding company, provides hardware and software services in Mainland China and internationally.

Flawless balance sheet with reasonable growth potential.