- Hong Kong

- /

- Communications

- /

- SEHK:1523

Should You Be Adding Plover Bay Technologies (HKG:1523) To Your Watchlist Today?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like Plover Bay Technologies (HKG:1523), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Plover Bay Technologies with the means to add long-term value to shareholders.

Check out our latest analysis for Plover Bay Technologies

How Quickly Is Plover Bay Technologies Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That makes EPS growth an attractive quality for any company. Shareholders will be happy to know that Plover Bay Technologies' EPS has grown 27% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

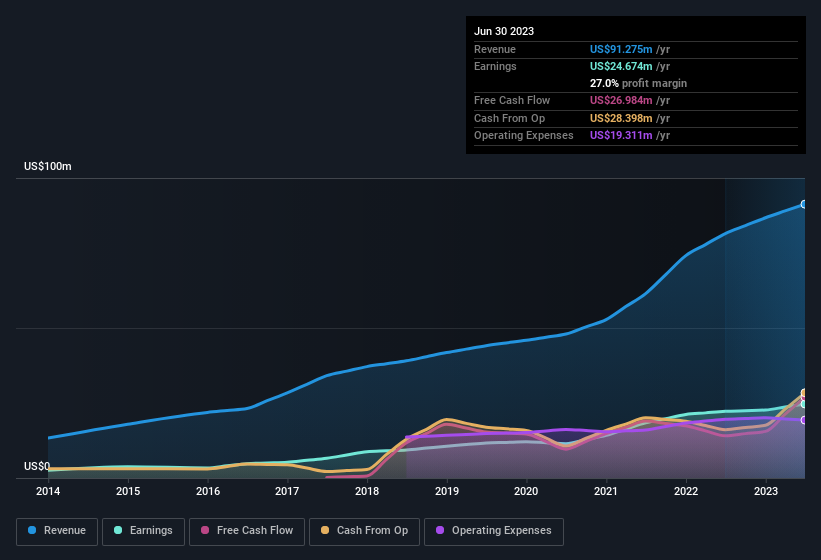

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. EBIT margins for Plover Bay Technologies remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 12% to US$91m. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Since Plover Bay Technologies is no giant, with a market capitalisation of HK$2.3b, you should definitely check its cash and debt before getting too excited about its prospects.

Are Plover Bay Technologies Insiders Aligned With All Shareholders?

Seeing insiders owning a large portion of the shares on issue is often a good sign. Their incentives will be aligned with the investors and there's less of a probability in a sudden sell-off that would impact the share price. So as you can imagine, the fact that Plover Bay Technologies insiders own a significant number of shares certainly is appealing. Indeed, with a collective holding of 70%, company insiders are in control and have plenty of capital behind the venture. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. US$1.6b That means they have plenty of their own capital riding on the performance of the business!

While it's always good to see some strong conviction in the company from insiders through heavy investment, it's also important for shareholders to ask if management compensation policies are reasonable. Well, based on the CEO pay, you'd argue that they are indeed. For companies with market capitalisations between US$100m and US$400m, like Plover Bay Technologies, the median CEO pay is around US$322k.

The CEO of Plover Bay Technologies was paid just US$218k in total compensation for the year ending December 2022. This total may indicate that the CEO is sacrificing take home pay for performance-based benefits, ensuring that their motivations are synonymous with strong company results. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is Plover Bay Technologies Worth Keeping An Eye On?

If you believe that share price follows earnings per share you should definitely be delving further into Plover Bay Technologies' strong EPS growth. If you need more convincing beyond that EPS growth rate, don't forget about the reasonable remuneration and the high insider ownership. Everyone has their own preferences when it comes to investing but it definitely makes Plover Bay Technologies look rather interesting indeed. It's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Plover Bay Technologies , and understanding this should be part of your investment process.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of Hong Kong companies which have demonstrated growth backed by recent insider purchases.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1523

Plover Bay Technologies

An investment holding company, designs, develops, and markets software defined wide area network routers.

Undervalued with solid track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)