- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:1415

The total return for Cowell e Holdings (HKG:1415) investors has risen faster than earnings growth over the last five years

Buying shares in the best businesses can build meaningful wealth for you and your family. And highest quality companies can see their share prices grow by huge amounts. Just think about the savvy investors who held Cowell e Holdings Inc. (HKG:1415) shares for the last five years, while they gained 614%. And this is just one example of the epic gains achieved by some long term investors. Also pleasing for shareholders was the 30% gain in the last three months. This could be related to the recent financial results, released recently - you can catch up on the most recent data by reading our company report. Anyone who held for that rewarding ride would probably be keen to talk about it.

While this past week has detracted from the company's five-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

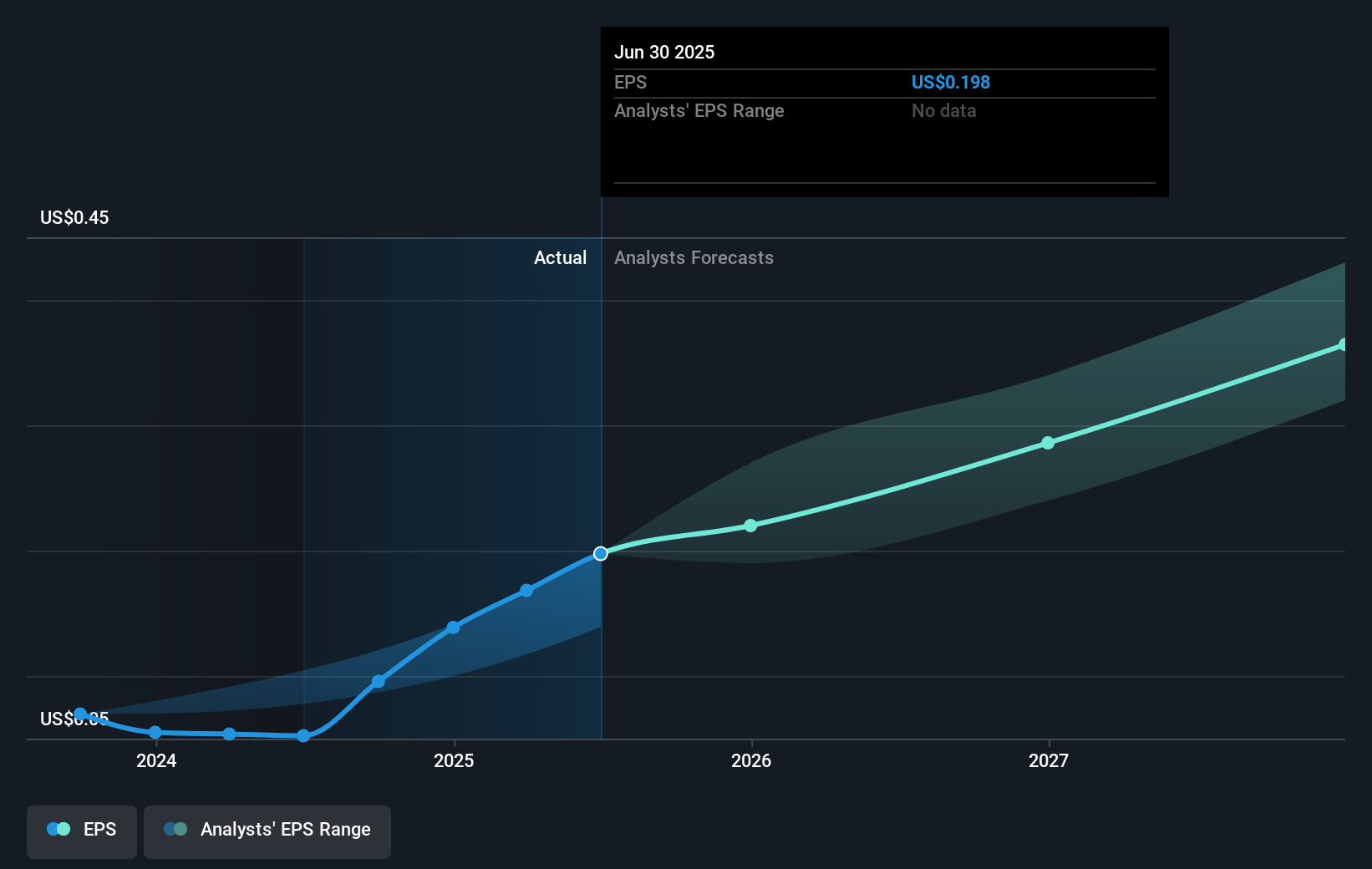

During five years of share price growth, Cowell e Holdings achieved compound earnings per share (EPS) growth of 24% per year. This EPS growth is slower than the share price growth of 48% per year, over the same period. So it's fair to assume the market has a higher opinion of the business than it did five years ago. And that's hardly shocking given the track record of growth.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We know that Cowell e Holdings has improved its bottom line over the last three years, but what does the future have in store? You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Cowell e Holdings' total shareholder return (TSR) and its share price change, which we've covered above. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Its history of dividend payouts mean that Cowell e Holdings' TSR of 774% over the last 5 years is better than the share price return.

A Different Perspective

We're pleased to report that Cowell e Holdings shareholders have received a total shareholder return of 55% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 54% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. Is Cowell e Holdings cheap compared to other companies? These 3 valuation measures might help you decide.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1415

Cowell e Holdings

An investment holding company, engages in the design, development, manufacture and sale of modules and system integration products for smartphones, multimedia tablets and other mobile devices.

Outstanding track record with high growth potential.

Market Insights

Community Narratives