- Hong Kong

- /

- Tech Hardware

- /

- SEHK:1401

Discovering Hidden Gems In Hong Kong With Promising Potential

Reviewed by Simply Wall St

As global markets experience a mix of rebounds and declines, Hong Kong's Hang Seng Index has shown resilience despite broader economic uncertainties. This backdrop provides a fertile ground for identifying small-cap stocks with strong growth potential. In the current market environment, a good stock is often characterized by robust fundamentals, innovative business models, and the ability to navigate economic fluctuations effectively.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| E-Commodities Holdings | 21.33% | 9.04% | 28.46% | ★★★★★★ |

| PW Medtech Group | 0.06% | 22.33% | -17.56% | ★★★★★★ |

| Sundart Holdings | 0.92% | -2.32% | -3.94% | ★★★★★★ |

| China Leon Inspection Holding | 8.55% | 21.36% | 22.77% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| S.A.S. Dragon Holdings | 60.96% | 4.62% | 10.02% | ★★★★★☆ |

| HBM Holdings | 52.89% | 66.59% | 31.70% | ★★★★★☆ |

| Time Interconnect Technology | 212.50% | 27.21% | 15.01% | ★★★★☆☆ |

| Chongqing Machinery & Electric | 27.77% | 8.82% | 11.12% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Sprocomm Intelligence (SEHK:1401)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sprocomm Intelligence Limited is an investment holding company involved in the research, development, design, manufacture, and sale of mobile phones across China, India, Algeria, Bangladesh, and internationally with a market cap of HK$4.15 billion.

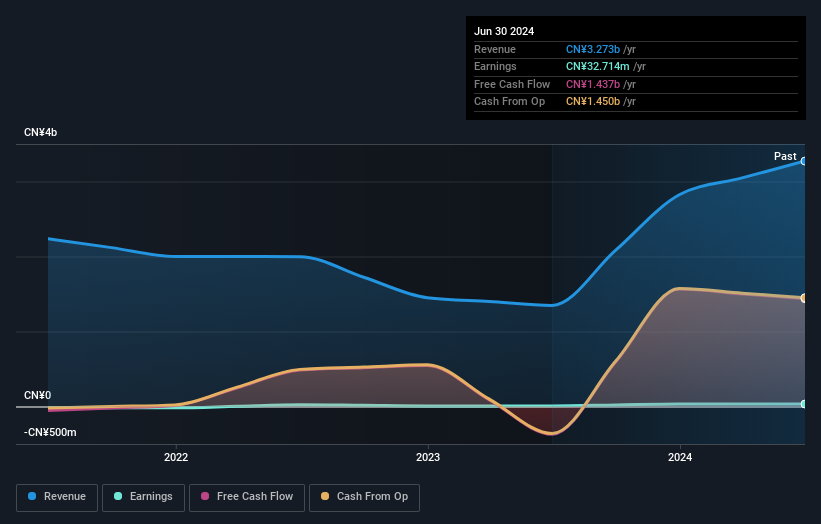

Operations: Sprocomm Intelligence Limited generates revenue primarily from the sale of wireless communications equipment, amounting to CN¥3.27 billion.

Sprocomm Intelligence has shown impressive growth, with earnings increasing by 301.3% over the past year, outpacing the tech industry average of -0.6%. Trading at 88.5% below its estimated fair value, it offers significant upside potential. The company's net debt to equity ratio has improved from 73.8% to 37.6% in five years, indicating better financial health. Recent earnings for H1 2024 reported sales of CN¥1.26 billion and net income of CN¥9.86 million, reflecting steady performance improvements.

- Navigate through the intricacies of Sprocomm Intelligence with our comprehensive health report here.

Understand Sprocomm Intelligence's track record by examining our Past report.

SSY Group (SEHK:2005)

Simply Wall St Value Rating: ★★★★★☆

Overview: SSY Group Limited researches, develops, manufactures, trades in, and sells various pharmaceutical products to hospitals and distributors in the People’s Republic of China and internationally with a market cap of HK$11.38 billion.

Operations: SSY Group Limited generates revenue primarily from Intravenous Infusion Solution and Others (HK$6.30 billion) and Medical Materials (HK$402.49 million).

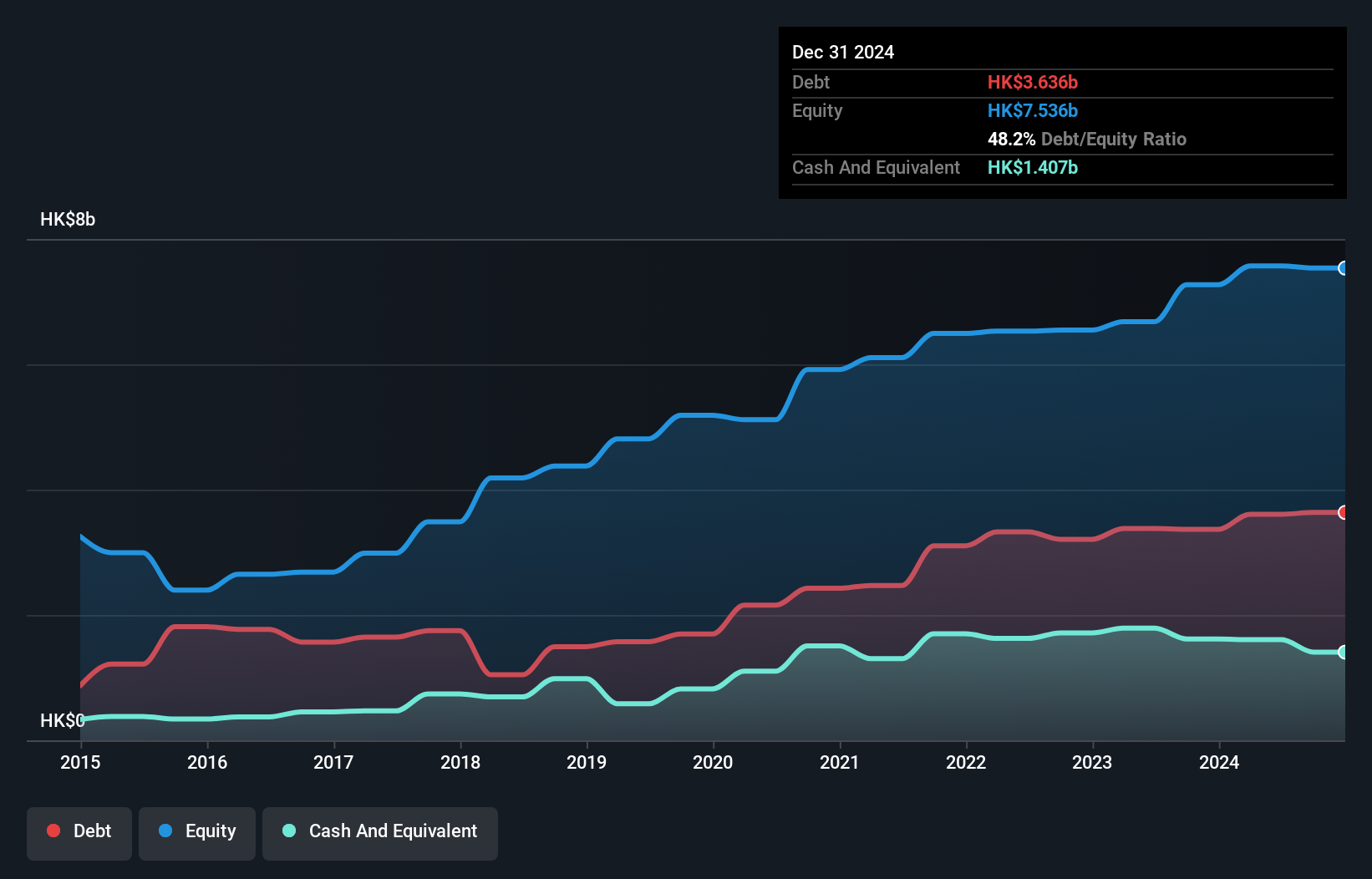

SSY Group, a notable player in the pharmaceutical sector, has shown promising growth with earnings increasing by 14.6% over the past year, outpacing industry growth of 1.2%. The company trades at 60.9% below its estimated fair value and has a satisfactory net debt to equity ratio of 26.4%. Recent approvals for key drugs like Nefopam Hydrochloride Injection and Nicorandil Tablets highlight its expanding product portfolio, while share repurchases authorized up to 297 million shares could enhance shareholder value.

- Delve into the full analysis health report here for a deeper understanding of SSY Group.

Explore historical data to track SSY Group's performance over time in our Past section.

Wasion Holdings (SEHK:3393)

Simply Wall St Value Rating: ★★★★★☆

Overview: Wasion Holdings Limited is an investment holding company that focuses on the research, development, production, and sale of energy metering and energy efficiency management solutions for energy supply industries across various regions including China, Africa, the United States, Europe, and Asia; it has a market cap of approximately HK$5.66 billion.

Operations: Wasion Holdings generates revenue primarily from three segments: Power Advanced Metering Infrastructure (CN¥2.99 billion), Advanced Distribution Operations (CN¥2.51 billion), and Communication and Fluid Advanced Metering Infrastructure (CN¥2.42 billion).

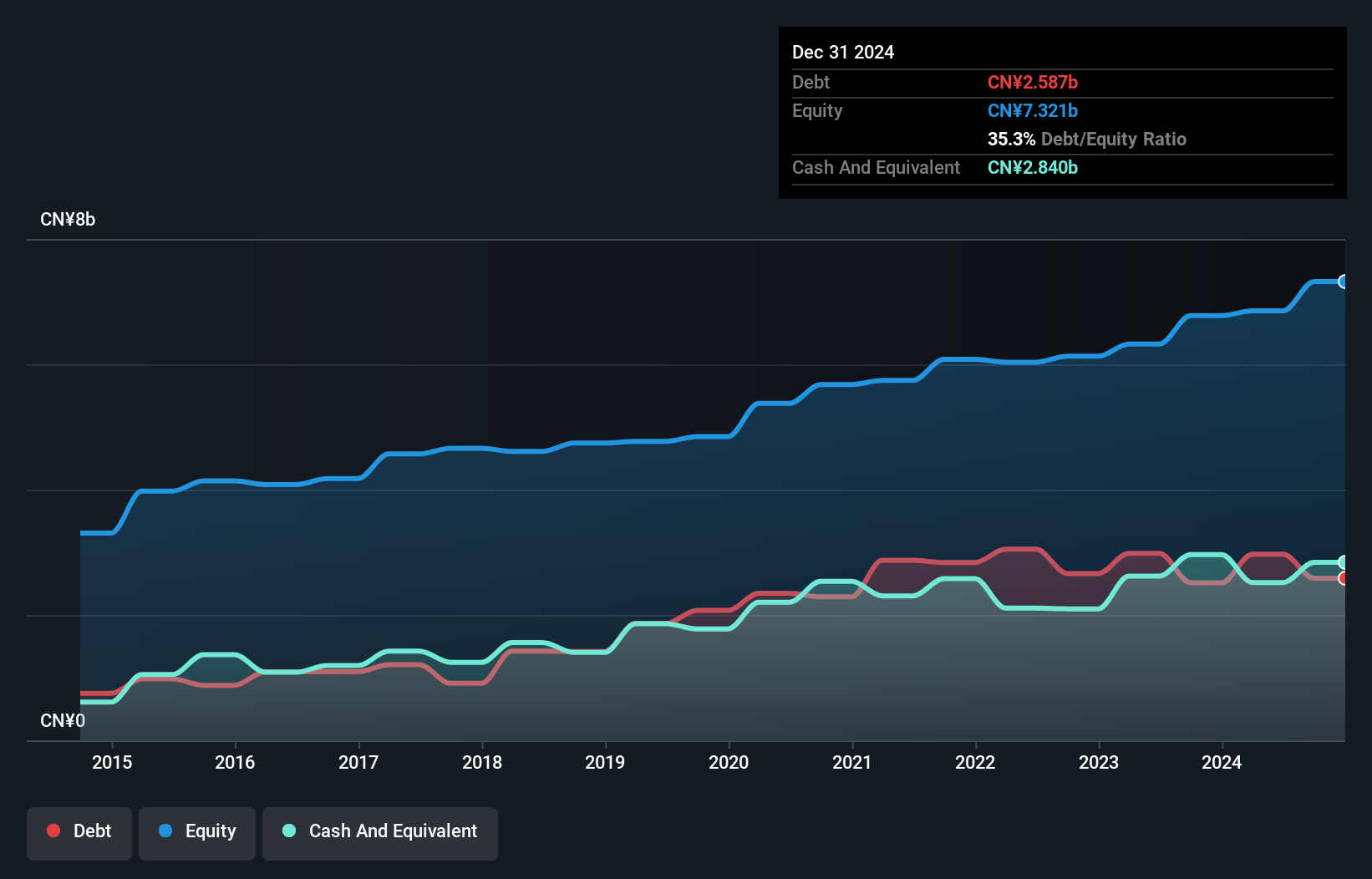

Wasion Holdings reported half-year sales of CNY 3.74 billion, up from CNY 3.23 billion last year, with net income rising to CNY 331.03 million from CNY 213.82 million. Basic earnings per share increased to CNY 0.335 from CNY 0.217 a year ago, indicating solid growth driven by effective cost control measures and higher sales revenue. The company secured significant smart meter contracts worth EUR 31.62 million in Hungary and USD 15.16 million across Singapore and Malaysia, reflecting its expanding international footprint and client recognition in the smart grid industry.

- Click to explore a detailed breakdown of our findings in Wasion Holdings' health report.

Gain insights into Wasion Holdings' historical performance by reviewing our past performance report.

Taking Advantage

- Get an in-depth perspective on all 172 SEHK Undiscovered Gems With Strong Fundamentals by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1401

Sprocomm Intelligence

An investment holding company, engages in the research and development, design, manufacture, and sale of mobile phones in the People’s Republic of China, India, Algeria, Bangladesh, and internationally.

Excellent balance sheet with acceptable track record.