Unisound AI Technology (SEHK:9678): Does the Current Valuation Reflect Future Growth Potential?

Reviewed by Simply Wall St

Unisound AI Technology (SEHK:9678) caught the attention of investors this week with a move in its share price, prompting debate about what might be driving momentum, or if it signals fresh risks or opportunity for the company. While there hasn’t been a clear event or announcement to point to, these kinds of movements often act as a spark for investors to take a closer look at what’s happening under the hood, especially when it comes to future prospects versus the current price tag.

Stepping back, Unisound AI Technology’s performance over the year has painted a mixed picture. After gaining nearly 99% year-to-date, the stock has seen a more subdued run lately, with a modest uptick over the past day but declines across the month and week. For a company with ambitions in AI technology, such swings are a reminder that investors are constantly fine-tuning their expectations, whether that’s in response to sector enthusiasm, competitive concerns, or changes in risk appetite.

So is the recent slip a sign that the shares are set up for a rebound, or are markets wisely factoring in the next chapter of growth already? Let’s dig into the valuation to see what the numbers tell us.

Price-to-Sales of 22.3x: Is it justified?

Unisound AI Technology currently trades at a price-to-sales (P/S) ratio of 22.3, making it appear significantly more expensive than both the Hong Kong Software industry average (2.8x) and its closest peers (6.3x).

The price-to-sales ratio compares a company’s market value to its revenue, serving as a key measure for businesses that are not yet profitable. For technology and software firms, investors often use P/S when earnings are negative or volatile, as it provides a way to assess how much the market is willing to pay for each unit of sales.

A P/S ratio this elevated suggests investors are pricing in substantial growth or market dominance in the future. However, such a premium also signals heightened expectations. Unisound must deliver meaningful revenue acceleration to justify this multiple, especially given its current unprofitability.

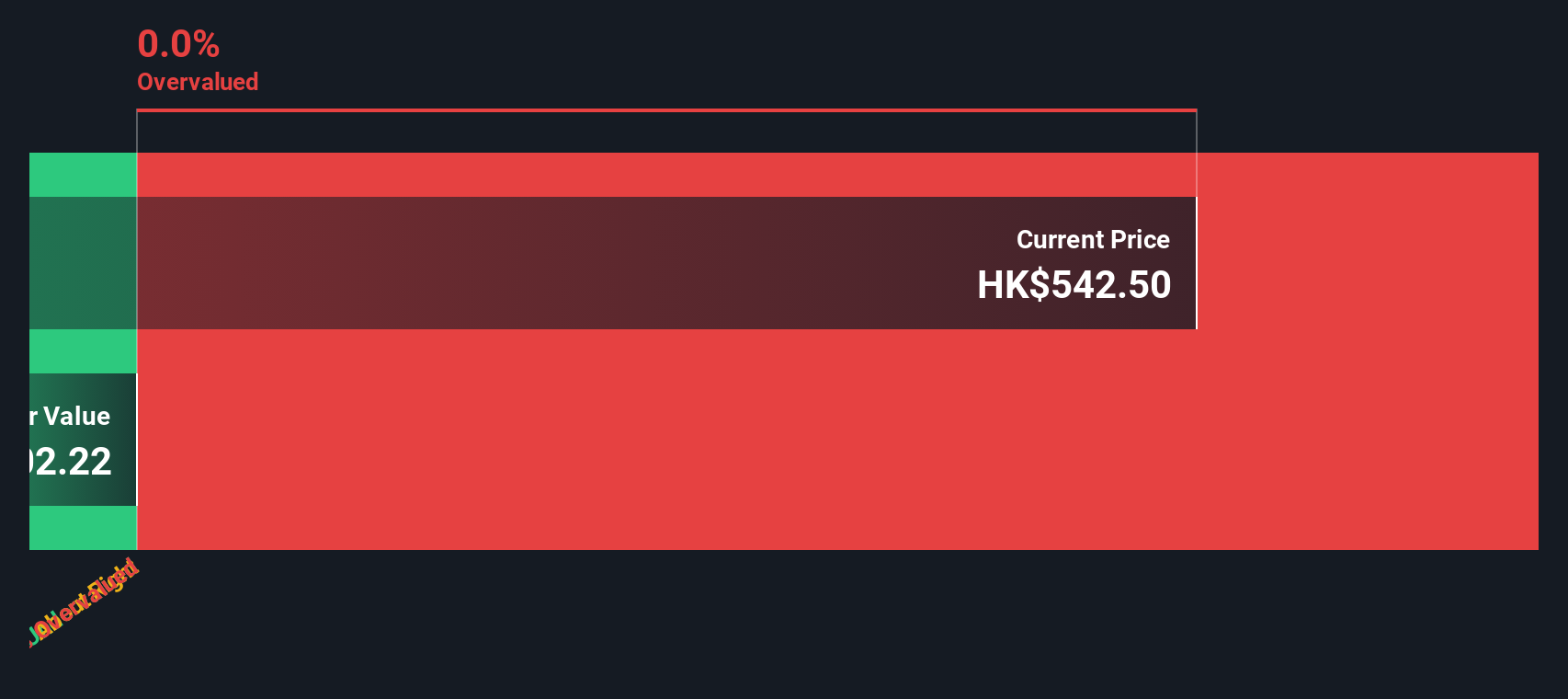

Result: Fair Value of $589.00 (OVERVALUED)

See our latest analysis for Unisound AI Technology.However, weak revenue growth and sustained losses remain key risks. These factors could undermine the high valuation and dampen near-term investor confidence.

Find out about the key risks to this Unisound AI Technology narrative.Another View: What Does Our DCF Model Say?

Taking a different approach, our SWS DCF model also sizes up Unisound AI Technology but finds no reason to challenge the lofty price. It flags the stock as overvalued based on future cash flows. Could this reinforce market caution, or is there still something the market sees that is missed in the numbers?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Unisound AI Technology Narrative

If you have a different perspective or want to dig into the numbers yourself, you can easily craft your own assessment in just a few minutes. Do it your way.

A great starting point for your Unisound AI Technology research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors keep their eyes open for every opportunity. Don’t limit your research to one stock when you could be finding tomorrow’s standouts right now.

- Spot undervalued companies with robust cash flow using our powerful tool for those seeking undervalued stocks based on cash flows in overlooked corners of the market: undervalued stocks based on cash flows

- Unlock the income potential of markets and track high-yield opportunities with our selection of dividend stocks with yields > 3%: dividend stocks with yields > 3%

- Stay on the forefront of digital innovation by tracking the movers and shakers among cryptocurrency and blockchain stocks that are powering the next financial revolution: cryptocurrency and blockchain stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9678

Unisound AI Technology

Provides artificial intelligence products and solutions for daily life and healthcare related application scenarios in the People’s Republic of China.

Excellent balance sheet with minimal risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.