As global markets respond to the Federal Reserve's interest rate adjustments, small-cap indices like the Russell 2000 have shown resilience, reflecting a broader sentiment of cautious optimism despite challenges such as technology stock valuation concerns and AI infrastructure spending. In this context, identifying high-growth tech stocks in Asia requires a focus on companies that demonstrate strong fundamentals and adaptability to shifting economic landscapes, with Beisen Holding being one such example.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 34.73% | 40.54% | ★★★★★★ |

| Suzhou TFC Optical Communication | 35.80% | 36.87% | ★★★★★★ |

| Zhongji Innolight | 35.08% | 35.94% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.48% | 32.83% | ★★★★★★ |

| Fositek | 37.83% | 51.54% | ★★★★★★ |

| Gold Circuit Electronics | 29.41% | 37.22% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| Knowmerce | 42.51% | 33.23% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

Beisen Holding (SEHK:9669)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beisen Holding Limited is an investment holding company that offers cloud-based human capital management solutions for enterprises in China, with a market capitalization of HK$5.16 billion.

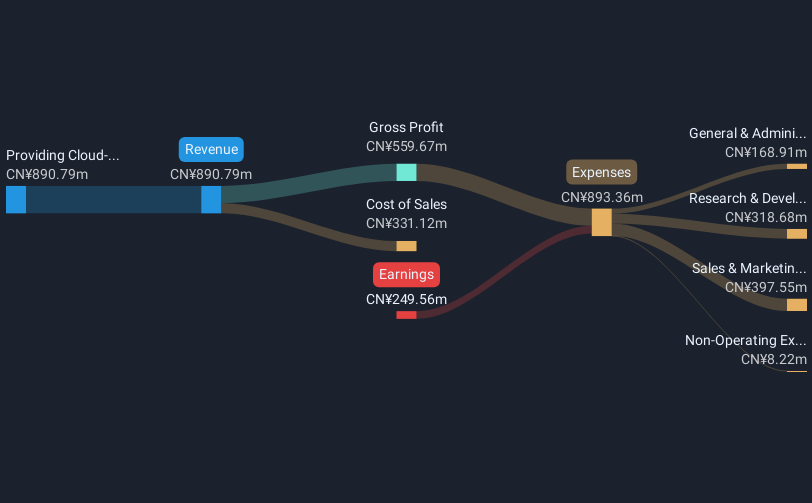

Operations: The company generates revenue primarily through providing cloud-based human capital management solutions and related professional services, amounting to CN¥1.02 billion.

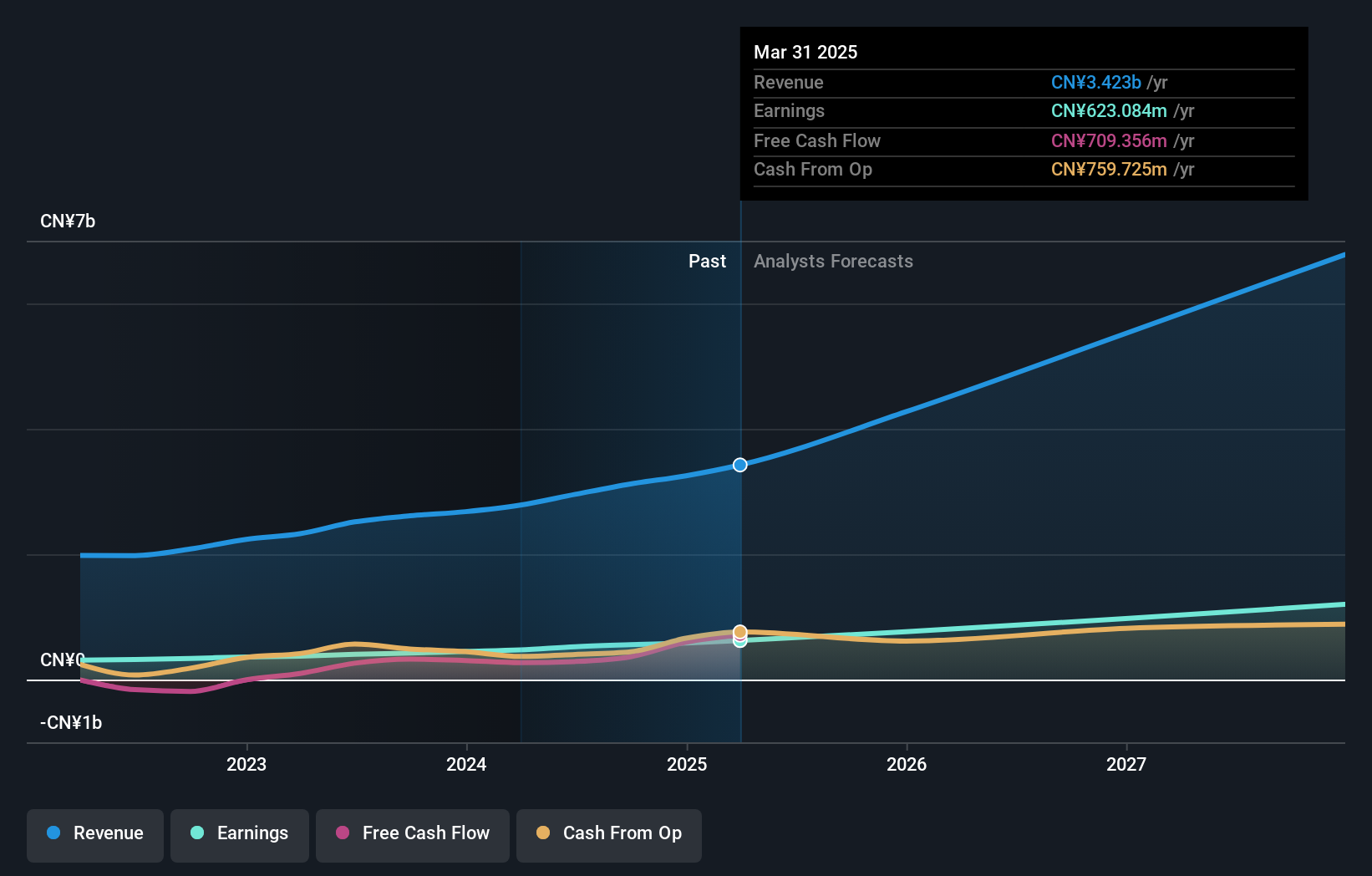

Beisen Holding, navigating the competitive tech landscape in Asia, has shown significant resilience and strategic acumen. Recently reporting a substantial reduction in net loss from CNY 99.04 million to CNY 18.41 million year-over-year and an increase in sales to CNY 515.97 million, the company is demonstrating robust revenue growth of 14.4% annually. This performance is complemented by an aggressive share repurchase initiative, enhancing shareholder value by targeting up to 10% of its issued capital for buyback. The firm's commitment to innovation is evident from its R&D investments aimed at refining its software solutions, positioning it well for anticipated profitability within three years amidst a challenging yet growing market environment where annual earnings are expected to surge by 112%.

- Get an in-depth perspective on Beisen Holding's performance by reading our health report here.

Evaluate Beisen Holding's historical performance by accessing our past performance report.

Shanghai Huace Navigation Technology (SZSE:300627)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shanghai Huace Navigation Technology Ltd. specializes in providing high-precision navigation and positioning solutions, with a market cap of CN¥24.81 billion.

Operations: Huace Navigation Technology generates revenue primarily through high-precision navigation and positioning solutions. The company focuses on delivering advanced technologies to various industries, enhancing their operational efficiency and accuracy.

Shanghai Huace Navigation Technology, amid a vibrant tech scene in Asia, has reported impressive financial strides with a revenue increase to CNY 2.62 billion, up from CNY 2.27 billion the previous year. This growth is complemented by a net income rise to CNY 492.61 million, reflecting strong operational execution and market expansion strategies. The company's recent strategic partnership with CNH Industrial marks a significant step into precision agriculture, enhancing its product reach and technological integration within global markets. This collaboration not only diversifies CHCNAV's business but also solidifies its position in high-growth sectors by providing innovative solutions that cater to evolving agricultural needs.

BrainPad (TSE:3655)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BrainPad Inc. provides digital marketing and consulting services in Japan with a market capitalization of ¥56.11 billion.

Operations: The company generates revenue through its digital marketing and consulting services in Japan. With a market capitalization of ¥56.11 billion, it focuses on leveraging data analytics to optimize client strategies and enhance business performance.

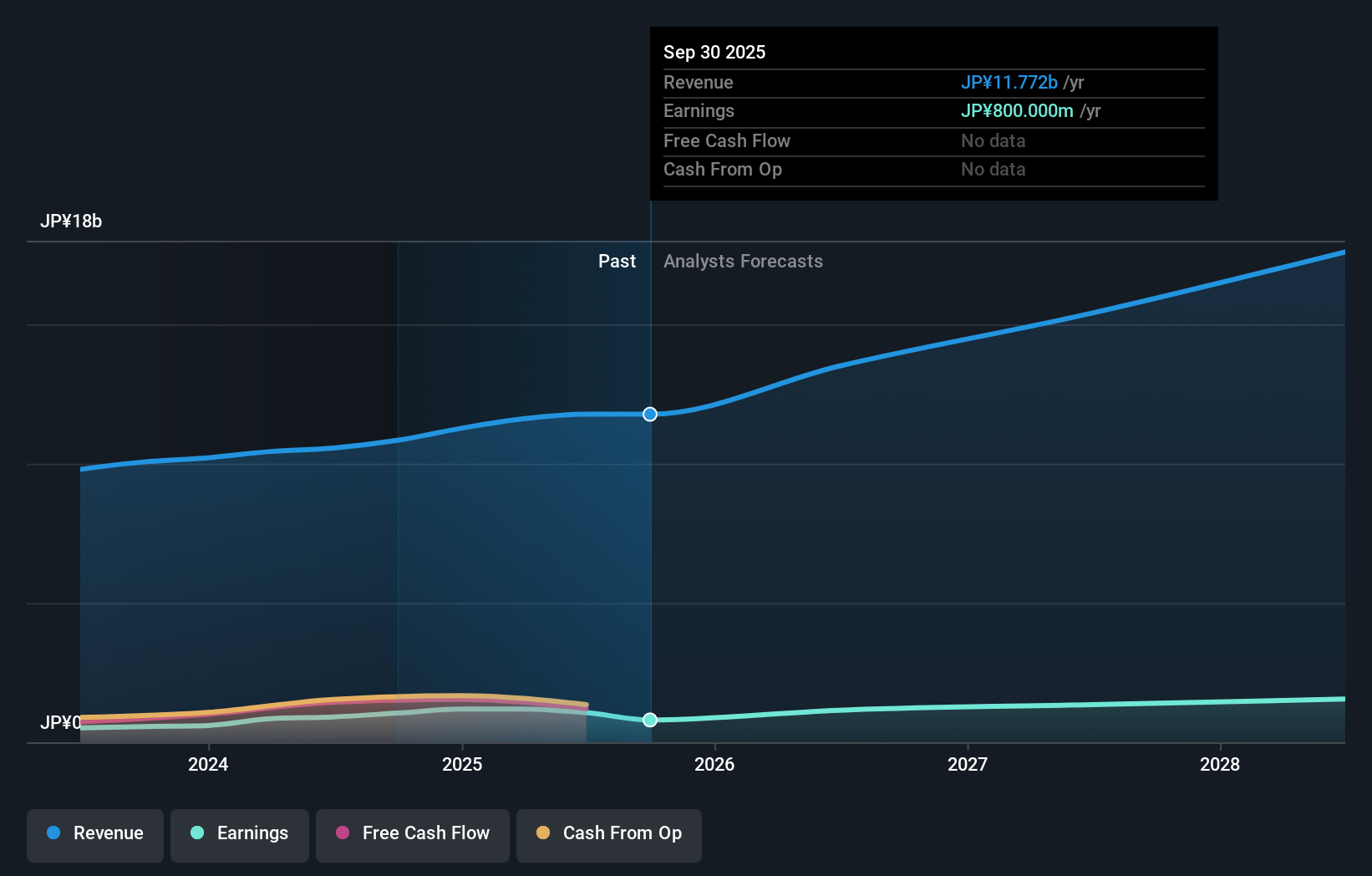

BrainPad's recent acquisition by Fujitsu for ¥56.6 billion underscores its strategic value in the tech sector, particularly highlighting its robust revenue growth at 14.4% annually and an impressive earnings forecast of 21.5% per year. Despite not distributing dividends this fiscal year, BrainPad is focusing on long-term shareholder returns with a policy aiming for a consolidated payout ratio of at least 40%. This move could potentially reshape its market approach, enhancing competitiveness in an industry where innovation and financial agility are paramount.

- Click here to discover the nuances of BrainPad with our detailed analytical health report.

Understand BrainPad's track record by examining our Past report.

Key Takeaways

- Investigate our full lineup of 189 Asian High Growth Tech and AI Stocks right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if BrainPad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3655

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)