A Fresh Look at Horizon Robotics (SEHK:9660) Valuation After Recent Pullback in Tech Stocks

Reviewed by Kshitija Bhandaru

Horizon Robotics (SEHK:9660) stock has been on investors’ radar lately following a recent dip, closing at HK$9.08. Over the past month, shares have declined by 11% as broader sector shifts affected Hong Kong’s tech market.

See our latest analysis for Horizon Robotics.

Horizon Robotics has seen a remarkable shift in momentum this year, with the share price return up 158% year-to-date despite a recent pullback. After rallying hard through recent quarters, the short-term dip seems more like a breather than a reversal. This reflects ongoing optimism about growth potential amid some shifting risk perceptions in the tech sector.

If Horizon’s run has you thinking about what else is gaining traction in the space, why not check out the latest movers in the tech and AI world using See the full list for free.

With the stock trading around 30% below analyst price targets and recent gains still holding, the question now is whether Horizon Robotics is genuinely undervalued or if the market has already factored in future growth expectations.

Price-to-Earnings of 52.2x: Is it justified?

Despite a pullback, Horizon Robotics trades at a price-to-earnings (P/E) ratio of 52.2, just under the peer average but well above the wider Asian software sector.

The price-to-earnings ratio measures how much investors pay for each dollar of earnings. In Horizon’s case, it indicates a strong growth premium, reflecting the company’s impressive shift to profitability over the last year and investors’ anticipation of further gains.

This P/E is slightly below its direct peer average of 53.7. Although the market is assigning a high value to expected future earnings, it is still in line with competition for now. Compared to the broader Asian software industry average of 29.6, Horizon’s valuation looks expensive. This signals high investor conviction in the company’s future performance, but any slowdown in growth could see this premium challenged.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 52.2x (ABOUT RIGHT)

However, slower revenue or profit growth could quickly challenge the high valuation, particularly if sector sentiment remains fragile in the coming months.

Find out about the key risks to this Horizon Robotics narrative.

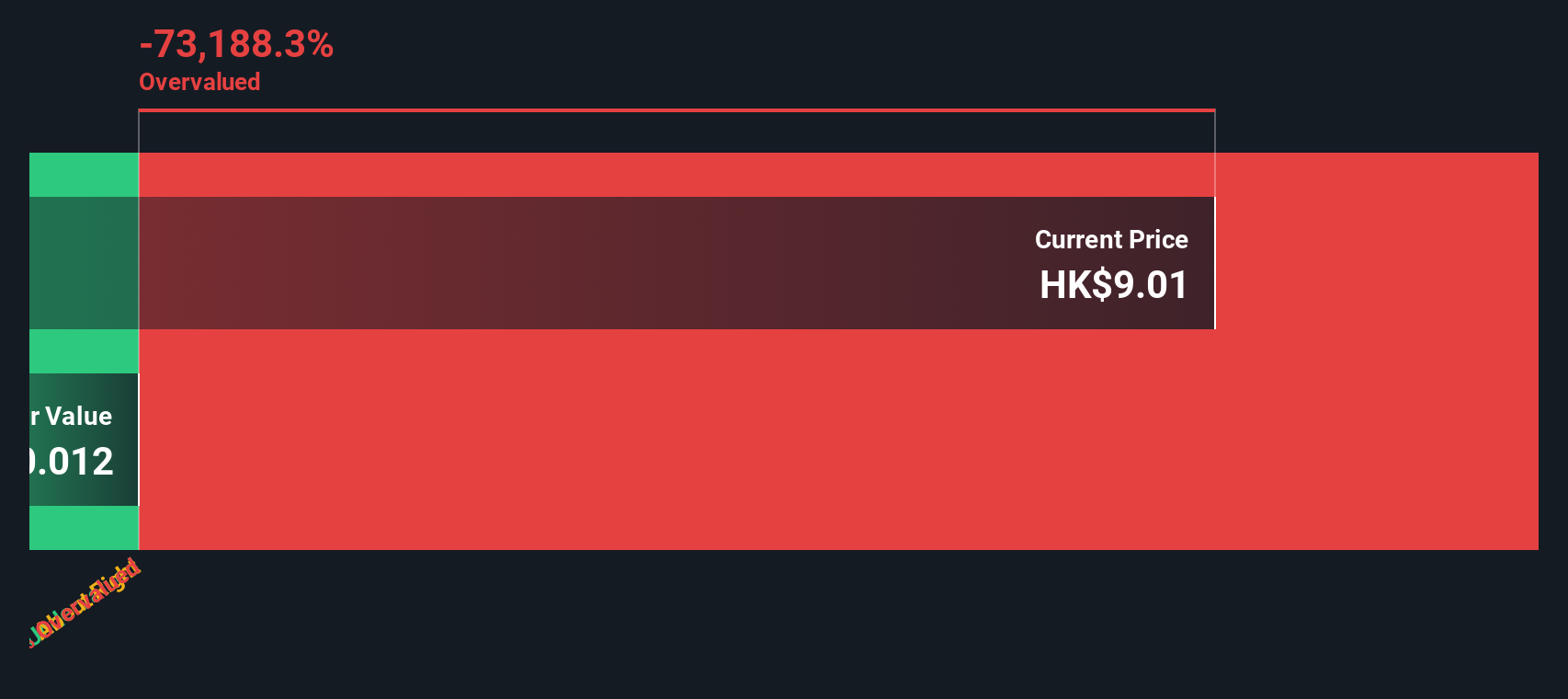

Another View: Fair Value Estimate Paints a Different Picture

Looking at Horizon Robotics from the perspective of our DCF model, the numbers tell a contrasting story. According to this approach, the share price is actually trading well above its estimated fair value, suggesting the market may be overpricing future growth. Is this a warning sign, or does it miss the mark on Horizon's potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Horizon Robotics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Horizon Robotics Narrative

If you have your own angle or want to dig deeper into the numbers yourself, you can build your own Horizon Robotics story in just a few minutes. Do it your way

A great starting point for your Horizon Robotics research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Stay ahead of the crowd and take control of your investing game. Don’t miss out on these hand-picked opportunities. The next big mover could be just one click away.

- Capture income potential by checking out these 19 dividend stocks with yields > 3% featuring companies offering yields over 3% and strong track records.

- Tap into the artificial intelligence boom as you review these 24 AI penny stocks packed with emerging names at the forefront of tech innovation.

- Position yourself early in tomorrow’s leaders by browsing these 3587 penny stocks with strong financials with robust balance sheets and financials that stand out in their class.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Horizon Robotics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9660

Horizon Robotics

An investment holding company, provides automotive solutions for passenger vehicles in China.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.