- Hong Kong

- /

- Diversified Financial

- /

- SEHK:818

How Much is Hi Sun Technology (China)'s (HKG:818) CEO Getting Paid?

Man Chun Kui is the CEO of Hi Sun Technology (China) Limited (HKG:818), and in this article, we analyze the executive's compensation package with respect to the overall performance of the company. This analysis will also assess whether Hi Sun Technology (China) pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

View our latest analysis for Hi Sun Technology (China)

Comparing Hi Sun Technology (China) Limited's CEO Compensation With the industry

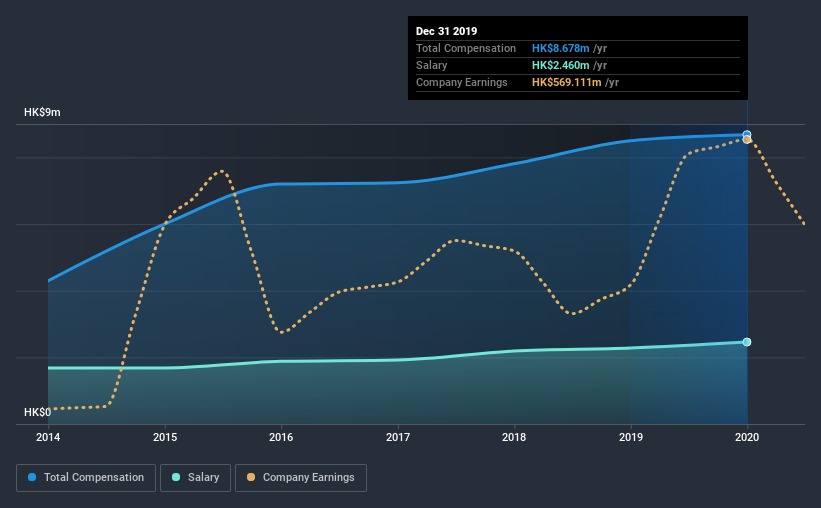

According to our data, Hi Sun Technology (China) Limited has a market capitalization of HK$2.4b, and paid its CEO total annual compensation worth HK$8.7m over the year to December 2019. That's mostly flat as compared to the prior year's compensation. We think total compensation is more important but our data shows that the CEO salary is lower, at HK$2.5m.

For comparison, other companies in the same industry with market capitalizations ranging between HK$1.6b and HK$6.2b had a median total CEO compensation of HK$4.2m. This suggests that Man Chun Kui is paid more than the median for the industry. What's more, Man Chun Kui holds HK$613m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | HK$2.5m | HK$2.3m | 28% |

| Other | HK$6.2m | HK$6.2m | 72% |

| Total Compensation | HK$8.7m | HK$8.5m | 100% |

On an industry level, around 60% of total compensation represents salary and 40% is other remuneration. It's interesting to note that Hi Sun Technology (China) allocates a smaller portion of compensation to salary in comparison to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Hi Sun Technology (China) Limited's Growth

Hi Sun Technology (China) Limited has seen its earnings per share (EPS) increase by 2.7% a year over the past three years. Its revenue is down 20% over the previous year.

We generally like to see a little revenue growth, but the modest EPSgrowth gives us some relief. It's hard to reach a conclusion about business performance right now. This may be one to watch. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Hi Sun Technology (China) Limited Been A Good Investment?

With a three year total loss of 38% for the shareholders, Hi Sun Technology (China) Limited would certainly have some dissatisfied shareholders. So shareholders would probably want the company to be lessto generous with CEO compensation.

To Conclude...

As we touched on above, Hi Sun Technology (China) Limited is currently paying its CEO higher than the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. The growth in the business has been uninspiring, but the shareholder returns for Hi Sun Technology (China) have arguably been worse, over the last three years. And the situation doesn't look all that good when you see Man Chun is remunerated higher than the industry average. With such poor returns, we would understand if shareholders had concerns related to the CEO's pay.

Whatever your view on compensation, you might want to check if insiders are buying or selling Hi Sun Technology (China) shares (free trial).

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you decide to trade Hi Sun Technology (China), use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hi Sun Technology (China) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:818

Hi Sun Technology (China)

An investment holding company, provides payment and digital services, fintech services, and platform operation and financial solutions in Hong Kong, Mainland China, and internationally.

Good value with mediocre balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)