Most Shareholders Will Probably Agree With ITE (Holdings) Limited's (HKG:8092) CEO Compensation

Key Insights

- ITE (Holdings) to hold its Annual General Meeting on 4th of August

- CEO Vincent Lau's total compensation includes salary of HK$1.54m

- Total compensation is similar to the industry average

- ITE (Holdings)'s EPS declined by 31% over the past three years while total shareholder return over the past three years was 37%

ITE (Holdings) Limited (HKG:8092) has exhibited strong share price growth in the past few years. However, its earnings growth has not kept up, suggesting that there may be something amiss. These concerns will be at the front of shareholders' minds as they go into the AGM coming up on 4th of August. It would also be an opportunity for them to influence management through exercising their voting power on company resolutions, including CEO and executive remuneration, which could impact on firm performance in the future. From the data that we gathered, we think that shareholders should hold off on a raise on CEO compensation until performance starts to show some improvement.

View our latest analysis for ITE (Holdings)

How Does Total Compensation For Vincent Lau Compare With Other Companies In The Industry?

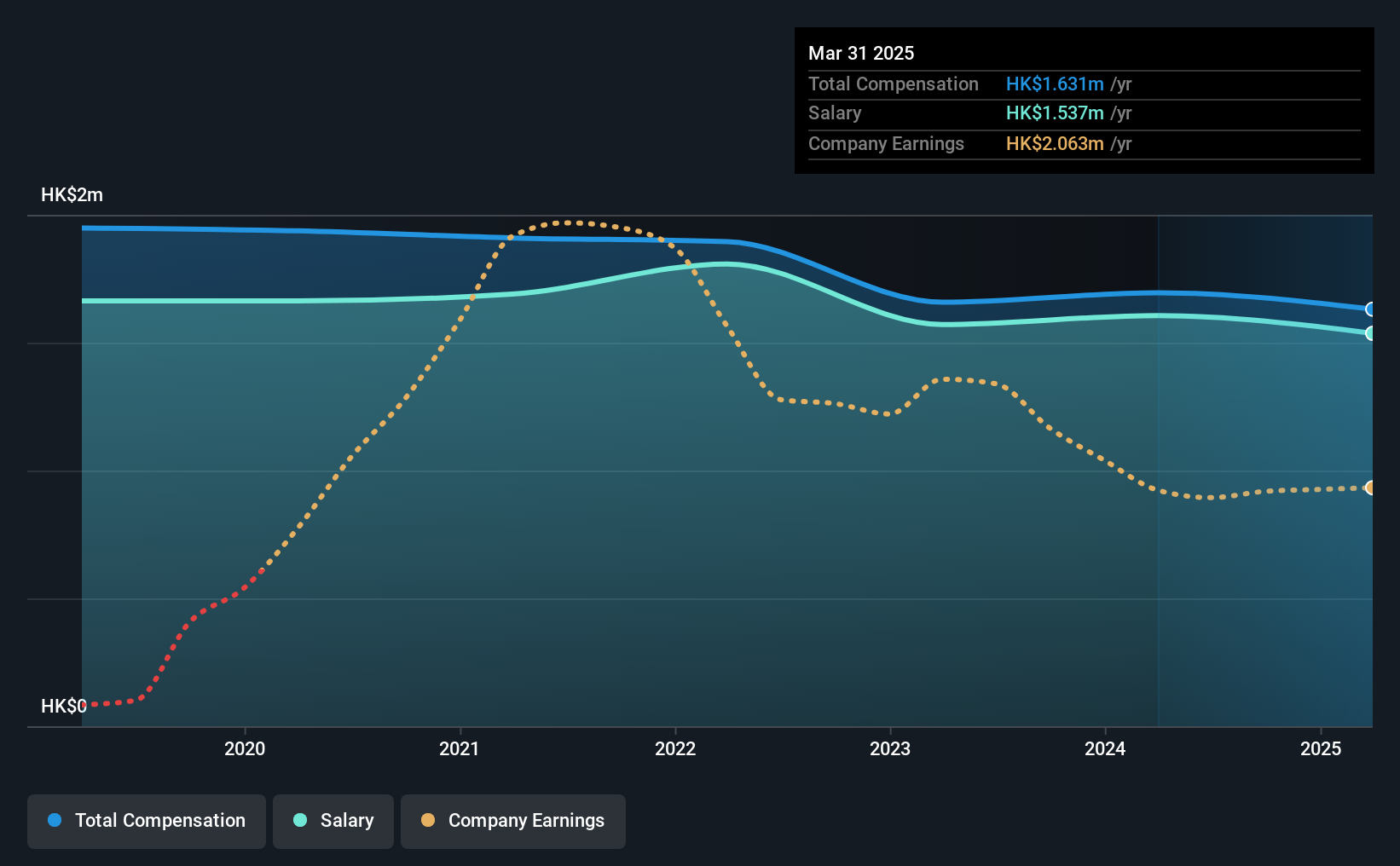

Our data indicates that ITE (Holdings) Limited has a market capitalization of HK$29m, and total annual CEO compensation was reported as HK$1.6m for the year to March 2025. That's slightly lower by 3.8% over the previous year. We note that the salary portion, which stands at HK$1.54m constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the Hong Kong IT industry with market capitalizations below HK$1.6b, reported a median total CEO compensation of HK$1.4m. This suggests that ITE (Holdings) remunerates its CEO largely in line with the industry average.

| Component | 2025 | 2024 | Proportion (2025) |

| Salary | HK$1.5m | HK$1.6m | 94% |

| Other | HK$94k | HK$89k | 6% |

| Total Compensation | HK$1.6m | HK$1.7m | 100% |

On an industry level, around 90% of total compensation represents salary and 10% is other remuneration. There isn't a significant difference between ITE (Holdings) and the broader market, in terms of salary allocation in the overall compensation package. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

ITE (Holdings) Limited's Growth

ITE (Holdings) Limited has reduced its earnings per share by 31% a year over the last three years. In the last year, its revenue changed by just 0.2%.

Few shareholders would be pleased to read that EPS have declined. And the flat revenue is seriously uninspiring. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has ITE (Holdings) Limited Been A Good Investment?

Most shareholders would probably be pleased with ITE (Holdings) Limited for providing a total return of 37% over three years. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

Although shareholders would be quite happy with the returns they have earned on their initial investment, earnings have failed to grow and this could mean returns may be hard to keep up. The upcoming AGM will provide shareholders the opportunity to revisit the company’s remuneration policies and evaluate if the board’s judgement and decision-making is aligned with that of the company’s shareholders.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. In our study, we found 5 warning signs for ITE (Holdings) you should be aware of, and 3 of them don't sit too well with us.

Important note: ITE (Holdings) is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8092

ITE (Holdings)

An investment holding company, provides smartcard systems, radio frequency identification (RFID) products, and information technology (IT) and related services to the public and private sectors in Hong Kong and Macao.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026