As global markets edge toward record highs, driven by U.S. stock indexes and a surge in the Nasdaq Composite, investors are navigating a landscape marked by rising inflation and cautious monetary policy. In this context, penny stocks—often smaller or newer companies—remain an intriguing investment area despite the term's dated connotation. These stocks can offer growth opportunities when backed by strong financials, presenting potential for significant returns as they reveal hidden value in quality companies.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$3.85 | HK$44.2B | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.525 | MYR2.61B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.97 | £479.09M | ★★★★★★ |

| Warpaint London (AIM:W7L) | £4.10 | £331.23M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.33 | MYR918.11M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.94 | £149.81M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.835 | MYR277.17M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.70 | MYR414.16M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £4.04 | £459.09M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

Click here to see the full list of 5,669 stocks from our Penny Stocks screener.

Let's dive into some prime choices out of the screener.

CSPC Pharmaceutical Group (SEHK:1093)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: CSPC Pharmaceutical Group Limited is an investment holding company involved in the research, development, manufacture, and sale of pharmaceutical products across China, other Asian regions, North America, Europe, and globally with a market cap of approximately HK$54.64 billion.

Operations: The company's revenue is primarily derived from Finished Drugs, which generated CN¥24.97 billion, followed by Bulk Products - Vitamin C at CN¥1.91 billion, Functional Food and Others with CN¥2.02 billion, and Bulk Products - Antibiotics contributing CN¥1.82 billion.

Market Cap: HK$54.64B

CSPC Pharmaceutical Group, with a market cap of HK$54.64 billion, is advancing its pharmaceutical portfolio through significant R&D investments and clinical trial approvals. Despite recent negative earnings growth and lower profit margins compared to last year, the company maintains strong financial health with more cash than debt and high-quality earnings. It has launched several promising drugs, including SYH2059 Tablets for interstitial lung disease approved by the FDA for U.S. trials, enhancing its innovative pipeline. However, challenges include a decline in revenue from functional ingredients due to falling caffeine prices impacting overall performance in 2024.

- Dive into the specifics of CSPC Pharmaceutical Group here with our thorough balance sheet health report.

- Explore CSPC Pharmaceutical Group's analyst forecasts in our growth report.

CStone Pharmaceuticals (SEHK:2616)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: CStone Pharmaceuticals is a biopharmaceutical company that focuses on researching, developing, and commercializing immuno-oncology and precision medicines to meet the unmet medical needs of cancer patients in China and internationally, with a market cap of HK$3.54 billion.

Operations: The company's revenue is primarily derived from its pharmaceuticals segment, totaling CN¥456.53 million.

Market Cap: HK$3.54B

CStone Pharmaceuticals, with a market cap of HK$3.54 billion, is making significant strides in the biopharmaceutical sector despite being currently unprofitable. The company has secured approvals for its key product, sugemalimab, in major markets like China and the EU for treating advanced NSCLC. Recent strategic partnerships, such as with SteinCares and Pharmalink, are expected to enhance global commercialization efforts across Latin America and MENA regions. Although CStone's debt-to-equity ratio has risen over five years to 65.5%, it maintains a strong cash position exceeding its total debt and short-term liabilities coverage by CN¥1.2 billion in assets against CN¥713.2 million liabilities.

- Click here to discover the nuances of CStone Pharmaceuticals with our detailed analytical financial health report.

- Examine CStone Pharmaceuticals' earnings growth report to understand how analysts expect it to perform.

Youzan Technology (SEHK:8083)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Youzan Technology Limited is an investment holding company offering online and offline e-commerce solutions in China, Japan, and Canada, with a market cap of HK$4.09 billion.

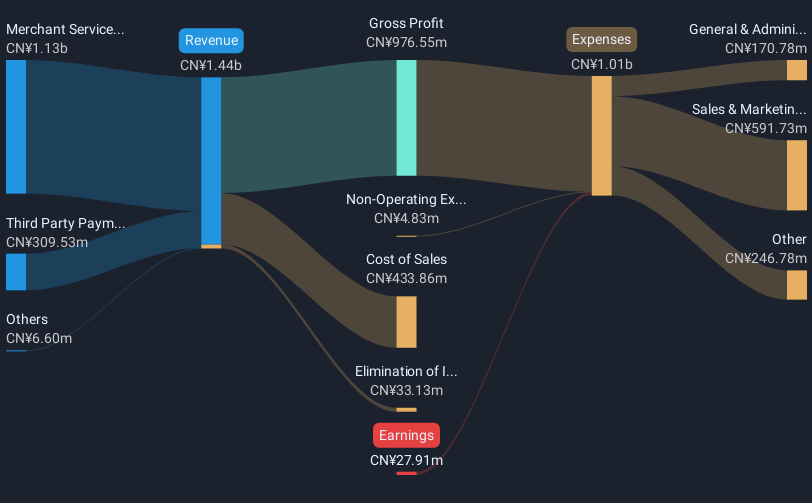

Operations: The company's revenue is primarily derived from Merchant Services, generating CN¥1.13 billion, and Third Party Payment Services, contributing CN¥309.53 million.

Market Cap: HK$4.09B

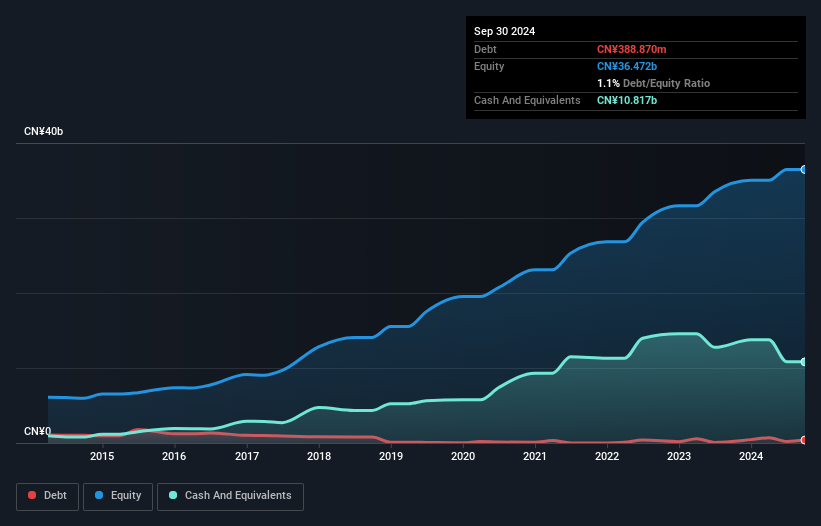

Youzan Technology Limited, with a market cap of HK$4.09 billion, is unprofitable but has reduced its losses by 5.5% annually over the past five years. The company generates substantial revenue from Merchant Services and Third Party Payment Services totaling CN¥1.44 billion. Despite high volatility in share price and negative return on equity at -3.55%, Youzan has a strong cash position exceeding both short-term liabilities (CN¥4 billion) and long-term liabilities (CN¥719.8 million), supported by positive free cash flow growth of 22.7% per year, ensuring a cash runway for over three years without significant shareholder dilution recently noted.

- Unlock comprehensive insights into our analysis of Youzan Technology stock in this financial health report.

- Understand Youzan Technology's earnings outlook by examining our growth report.

Key Takeaways

- Embark on your investment journey to our 5,669 Penny Stocks selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:8083

Youzan Technology

An investment holding company, provides online and offline e-commerce solutions in the People’s Republic of China, Japan, and Canada.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives