Is Kingdee International Software Group (HKG:268) A Risky Investment?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Kingdee International Software Group Company Limited (HKG:268) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Kingdee International Software Group

What Is Kingdee International Software Group's Net Debt?

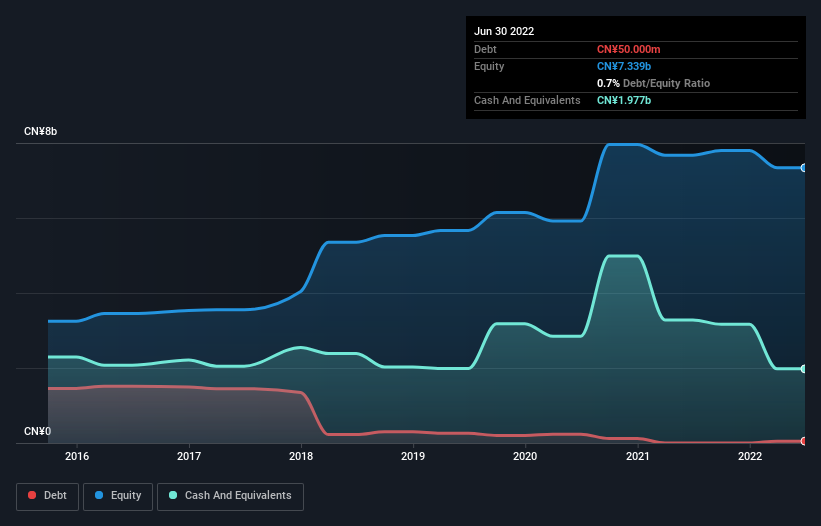

As you can see below, at the end of June 2022, Kingdee International Software Group had CN¥50.0m of debt, up from none a year ago. Click the image for more detail. But on the other hand it also has CN¥1.98b in cash, leading to a CN¥1.93b net cash position.

How Healthy Is Kingdee International Software Group's Balance Sheet?

The latest balance sheet data shows that Kingdee International Software Group had liabilities of CN¥3.29b due within a year, and liabilities of CN¥178.7m falling due after that. On the other hand, it had cash of CN¥1.98b and CN¥1.03b worth of receivables due within a year. So it has liabilities totalling CN¥458.4m more than its cash and near-term receivables, combined.

This state of affairs indicates that Kingdee International Software Group's balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So it's very unlikely that the CN¥48.4b company is short on cash, but still worth keeping an eye on the balance sheet. While it does have liabilities worth noting, Kingdee International Software Group also has more cash than debt, so we're pretty confident it can manage its debt safely. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Kingdee International Software Group can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

In the last year Kingdee International Software Group wasn't profitable at an EBIT level, but managed to grow its revenue by 17%, to CN¥4.5b. We usually like to see faster growth from unprofitable companies, but each to their own.

So How Risky Is Kingdee International Software Group?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And the fact is that over the last twelve months Kingdee International Software Group lost money at the earnings before interest and tax (EBIT) line. Indeed, in that time it burnt through CN¥147m of cash and made a loss of CN¥411m. With only CN¥1.93b on the balance sheet, it would appear that its going to need to raise capital again soon. Summing up, we're a little skeptical of this one, as it seems fairly risky in the absence of free cashflow. For riskier companies like Kingdee International Software Group I always like to keep an eye on whether insiders are buying or selling. So click here if you want to find out for yourself.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if Kingdee International Software Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:268

Kingdee International Software Group

An investment holding company, engages in the enterprise resource planning business.

Excellent balance sheet with reasonable growth potential.