- Hong Kong

- /

- Real Estate

- /

- SEHK:8426

IPM Holdings Leads The Charge With 2 Other Prominent Penny Stocks

Reviewed by Simply Wall St

Global markets have been navigating a challenging landscape, with U.S. stocks experiencing declines amid cautious Federal Reserve commentary and political uncertainty surrounding a potential government shutdown. Despite these broader market fluctuations, certain investment opportunities continue to capture attention, particularly in areas that offer unique growth potential. Penny stocks, though often seen as a relic of past market eras, remain relevant by offering affordability and the possibility of significant growth when backed by robust financials.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.42 | MYR1.17B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.73 | MYR431.91M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.13 | HK$45.48B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.94 | £148.28M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.55 | £67.7M | ★★★★☆☆ |

Click here to see the full list of 5,847 stocks from our Penny Stocks screener.

Let's dive into some prime choices out of the screener.

IPM Holdings (PSE:IPM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: IPM Holdings, Inc., operating through its subsidiary Basic Environmental Systems and Technologies, Inc., offers waste disposal services in the Philippines with a market cap of ₱1.72 billion.

Operations: The company's revenue segment is entirely derived from the Philippines, amounting to ₱282.07 million.

Market Cap: ₱1.72B

IPM Holdings, Inc. has demonstrated significant earnings growth over the past year, increasing by 357.6%, which surpasses both its industry peers and its own five-year average growth rate. Despite this, the company's revenue remains modest at ₱282 million. Its financial health is supported by strong short-term assets exceeding liabilities and a reduction in debt-to-equity ratio from 8% to 1.8% over five years. The company also benefits from experienced management and board teams with long tenures, while maintaining high-quality earnings and well-covered interest payments on debt through EBIT coverage of 21.7 times.

- Dive into the specifics of IPM Holdings here with our thorough balance sheet health report.

- Understand IPM Holdings' track record by examining our performance history report.

Modern Living Investments Holdings (SEHK:8426)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Modern Living Investments Holdings Limited is an investment holding company that provides property management services for public housing in Hong Kong, with a market cap of HK$264 million.

Operations: The company generates revenue of HK$357.28 million from its property management services segment.

Market Cap: HK$264M

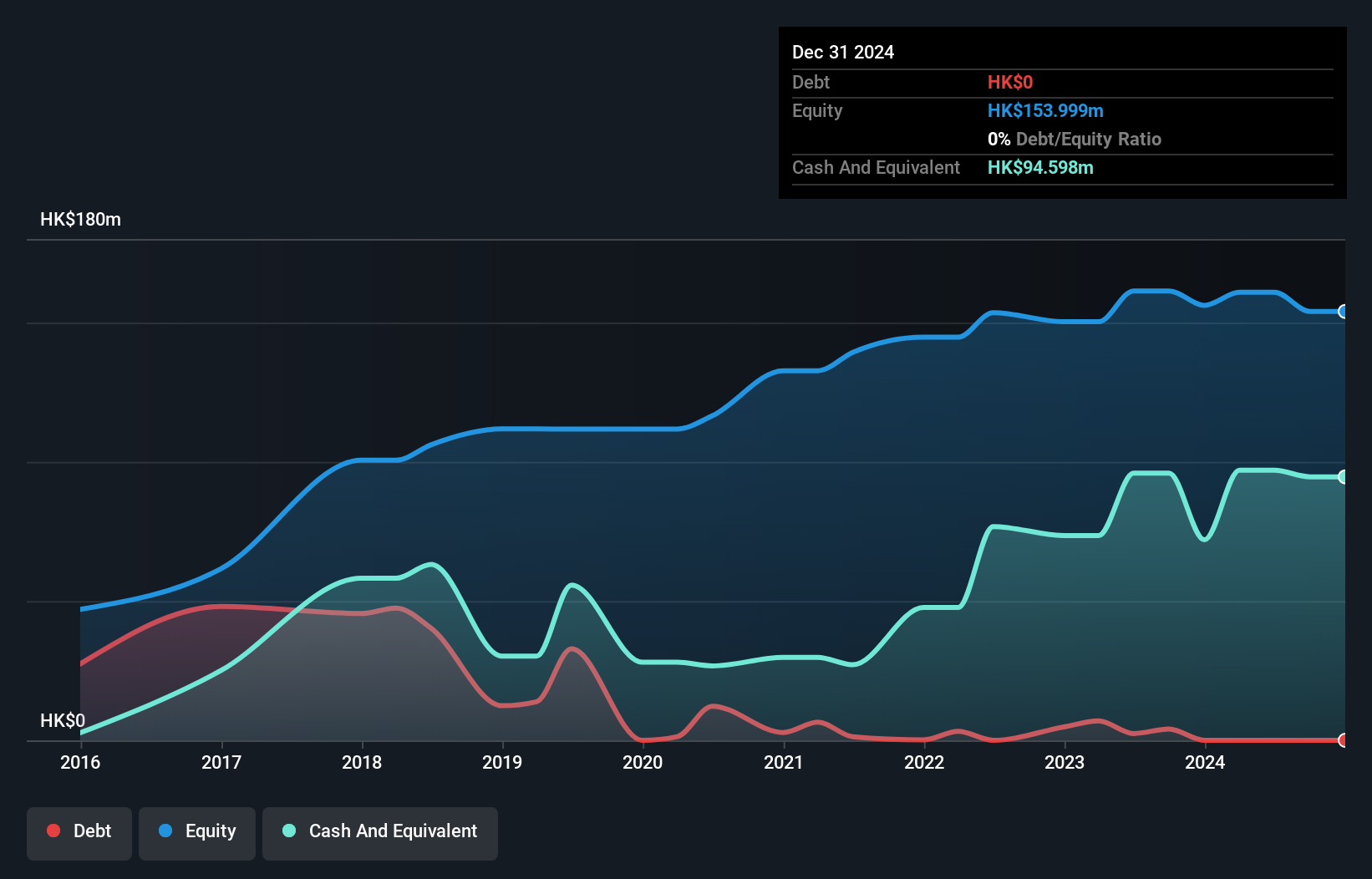

Modern Living Investments Holdings Limited, with a market cap of HK$264 million, generates HK$357.28 million in revenue from property management services in Hong Kong. Despite being debt-free and having short-term assets significantly exceeding liabilities, the company faces challenges such as a recent decline in net profit margins from 6.7% to 4.3% and negative earnings growth over the past year. The management team and board are relatively new, which may impact strategic continuity. Additionally, while dividends are attractive at 6.14%, they are not well covered by earnings, indicating potential sustainability concerns.

- Take a closer look at Modern Living Investments Holdings' potential here in our financial health report.

- Explore historical data to track Modern Living Investments Holdings' performance over time in our past results report.

Exasol (XTRA:EXL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Exasol AG develops databases for analytics and data warehousing across Germany, Austria, Switzerland, Great Britain, North America, and internationally, with a market cap of €63.54 million.

Operations: The company's revenue is primarily derived from the DACH region at €24.64 million, followed by North America at €6.06 million, the Rest of The World at €3.72 million, and Great Britain at €2.42 million.

Market Cap: €63.54M

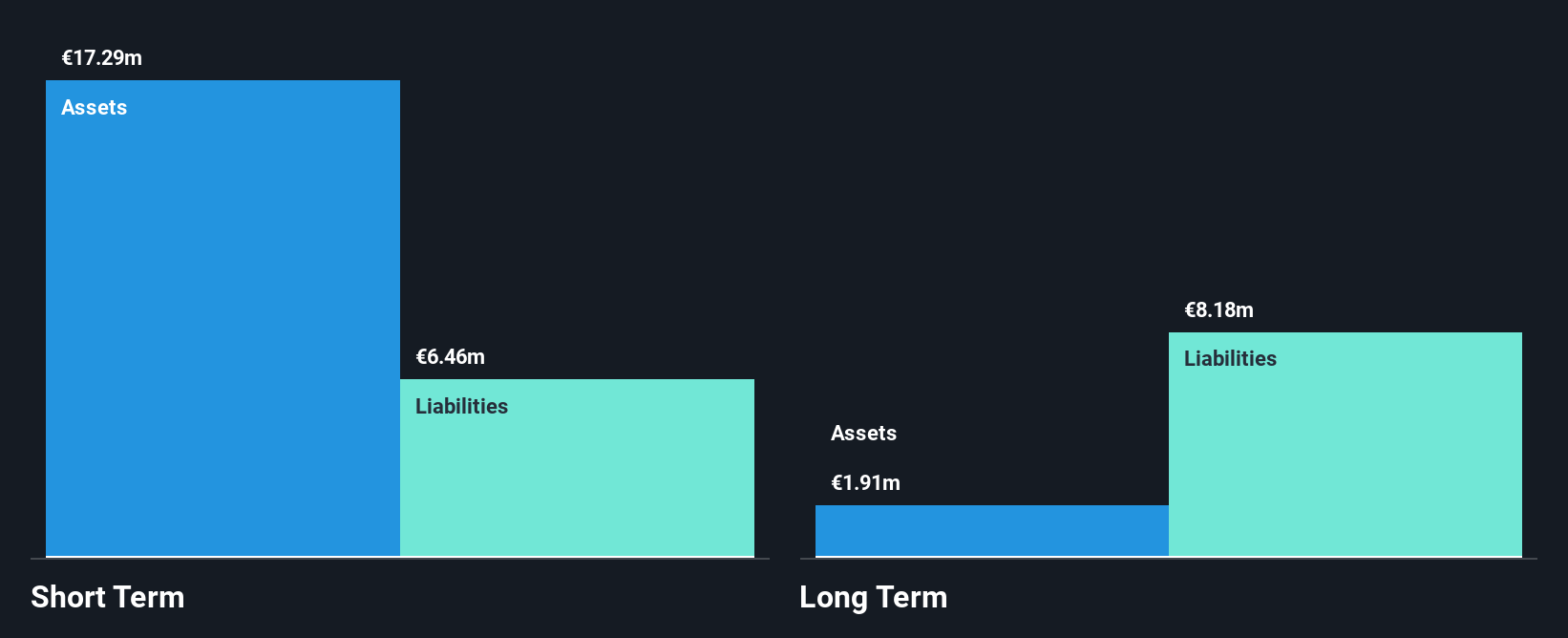

Exasol AG, with a market cap of €63.54 million, operates primarily in the DACH region and has shown revenue growth despite being unprofitable. The company is debt-free and its short-term assets exceed both short- and long-term liabilities, providing financial stability. Although the board lacks extensive experience, the management team is considered seasoned with an average tenure of 2.6 years. Exasol's share price has been highly volatile recently but trades significantly below estimated fair value. Earnings are forecasted to grow substantially by 63.73% annually, supported by positive free cash flow and a sufficient cash runway for over three years.

- Jump into the full analysis health report here for a deeper understanding of Exasol.

- Understand Exasol's earnings outlook by examining our growth report.

Next Steps

- Take a closer look at our Penny Stocks list of 5,847 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:8426

Modern Living Investments Holdings

An investment holding company, provides property management services for public housing in Hong Kong.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives