- Hong Kong

- /

- Communications

- /

- SEHK:285

High Growth Tech Stocks Including BYD Electronic International And Two Others

Reviewed by Simply Wall St

Amidst a backdrop of cautious Federal Reserve commentary and looming political uncertainties, global markets have experienced notable fluctuations, with smaller-cap indexes facing significant challenges. As investors navigate these turbulent times, identifying high growth tech stocks like BYD Electronic International can offer potential opportunities for those seeking to balance risk and reward in a rapidly evolving economic landscape.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.34% | 70.30% | ★★★★★★ |

| TG Therapeutics | 34.86% | 56.98% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1274 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

BYD Electronic (International) (SEHK:285)

Simply Wall St Growth Rating: ★★★★☆☆

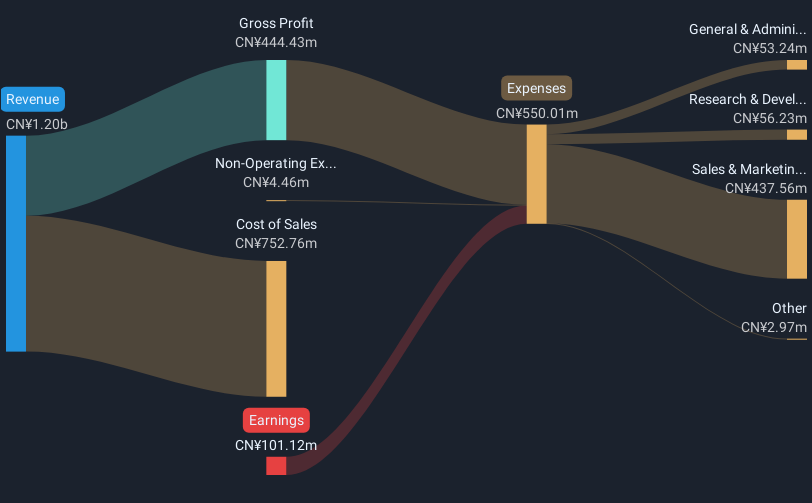

Overview: BYD Electronic (International) Company Limited is an investment holding company that focuses on designing, manufacturing, assembling, and selling mobile handset components and modules in China and internationally, with a market capitalization of approximately HK$89 billion.

Operations: The company generates revenue primarily from the manufacture, assembly, and sale of mobile handset components and modules, amounting to CN¥152.36 billion.

BYD Electronic (International) has demonstrated robust growth, with earnings surging by 47.6% over the past year, outpacing the Communications industry's decline of 15.6%. This significant growth is underpinned by a strategic focus on R&D, with expenses detailed in recent financial reports showing a commitment to innovation. The company's revenue is also on an upward trajectory, growing at 12.7% annually, faster than Hong Kong's market average of 7.8%. Looking ahead, BYD Electronic is poised for continued expansion with projected annual earnings growth of 24.7%, which starkly contrasts with the broader market forecast of 11.5%. These figures reflect not only the company’s strong operational performance but also its potential to capitalize on emerging tech trends and maintain a competitive edge in its sector.

COL GroupLtd (SZSE:300364)

Simply Wall St Growth Rating: ★★★★★☆

Overview: COL Group Co., Ltd. operates in the digital publishing sector in China with a market capitalization of CN¥19.09 billion.

Operations: The company focuses on digital publishing in China, generating revenue primarily through content distribution and licensing. Its market capitalization stands at CN¥19.09 billion.

COL GroupLtd has faced challenges, as evidenced by a significant revenue drop to CNY 808.05 million from CNY 1,019.71 million year-over-year and transitioning from a net profit to a net loss of CNY 188.12 million. Despite this downturn, the company actively repurchased shares worth CNY 20.05 million, signaling confidence in its future prospects. This strategy is underpinned by an aggressive focus on R&D spending aimed at fostering innovation and recovery—crucial as the tech industry rapidly evolves with increasing demands for cutting-edge solutions.

- Unlock comprehensive insights into our analysis of COL GroupLtd stock in this health report.

Evaluate COL GroupLtd's historical performance by accessing our past performance report.

Quanta Computer (TWSE:2382)

Simply Wall St Growth Rating: ★★★★★☆

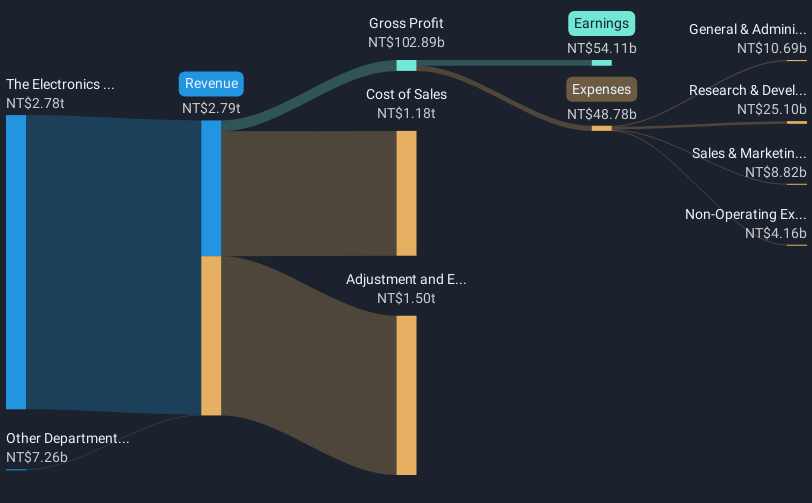

Overview: Quanta Computer Inc. is a global manufacturer and seller of notebook computers with a market capitalization of NT$1.11 trillion.

Operations: Quanta Computer Inc. primarily operates in the electronics sector, generating revenue of NT$2.78 billion from this segment. The company is involved in manufacturing and selling notebook computers across various international markets.

Quanta Computer, amidst a robust tech landscape, has demonstrated substantial growth with a 36.9% annual increase in revenue and an impressive 19.7% rise in earnings. This performance is underpinned by significant R&D investments, which have reached TWD 50 billion this year alone, representing a strategic commitment to innovation and market leadership in computing solutions. Recent presentations at multiple investment forums underscore the company's proactive engagement with investors and its focus on future tech trends, further solidifying its position in the competitive tech arena.

- Dive into the specifics of Quanta Computer here with our thorough health report.

Explore historical data to track Quanta Computer's performance over time in our Past section.

Turning Ideas Into Actions

- Take a closer look at our High Growth Tech and AI Stocks list of 1274 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BYD Electronic (International) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:285

BYD Electronic (International)

An investment holding company, primarily engages in the design, manufacture, assembly, and sale of mobile handset components, modules, and other products in the People’s Republic of China and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives