As global markets navigate through a period of heightened inflation and fluctuating interest rates, U.S. stock indexes are climbing toward record highs, with growth stocks outperforming their value counterparts. In this environment, identifying undervalued stocks can be a strategic move for investors seeking opportunities amidst economic uncertainties and shifting market dynamics.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Provident Financial Services (NYSE:PFS) | US$18.65 | US$36.99 | 49.6% |

| Hunan Jiudian Pharmaceutical (SZSE:300705) | CN¥16.23 | CN¥32.07 | 49.4% |

| Hancom (KOSDAQ:A030520) | ₩24650.00 | ₩49085.96 | 49.8% |

| Alarum Technologies (TASE:ALAR) | ₪3.297 | ₪6.55 | 49.7% |

| Insyde Software (TPEX:6231) | NT$422.00 | NT$843.52 | 50% |

| Nuvoton Technology (TWSE:4919) | NT$96.10 | NT$191.31 | 49.8% |

| IDP Education (ASX:IEL) | A$12.12 | A$24.11 | 49.7% |

| Solum (KOSE:A248070) | ₩17580.00 | ₩34896.79 | 49.6% |

| Com2uS (KOSDAQ:A078340) | ₩48200.00 | ₩96034.13 | 49.8% |

| Array Technologies (NasdaqGM:ARRY) | US$6.79 | US$13.53 | 49.8% |

Underneath we present a selection of stocks filtered out by our screen.

Yadea Group Holdings (SEHK:1585)

Overview: Yadea Group Holdings Ltd. is an investment holding company involved in the development, manufacture, and sale of electric two-wheeled vehicles and related accessories in the People’s Republic of China, with a market cap of HK$38.39 billion.

Operations: The company's revenue segments include CN¥31.76 billion from electric two-wheeled vehicles and related accessories, and CN¥5.23 billion from batteries and electric drive.

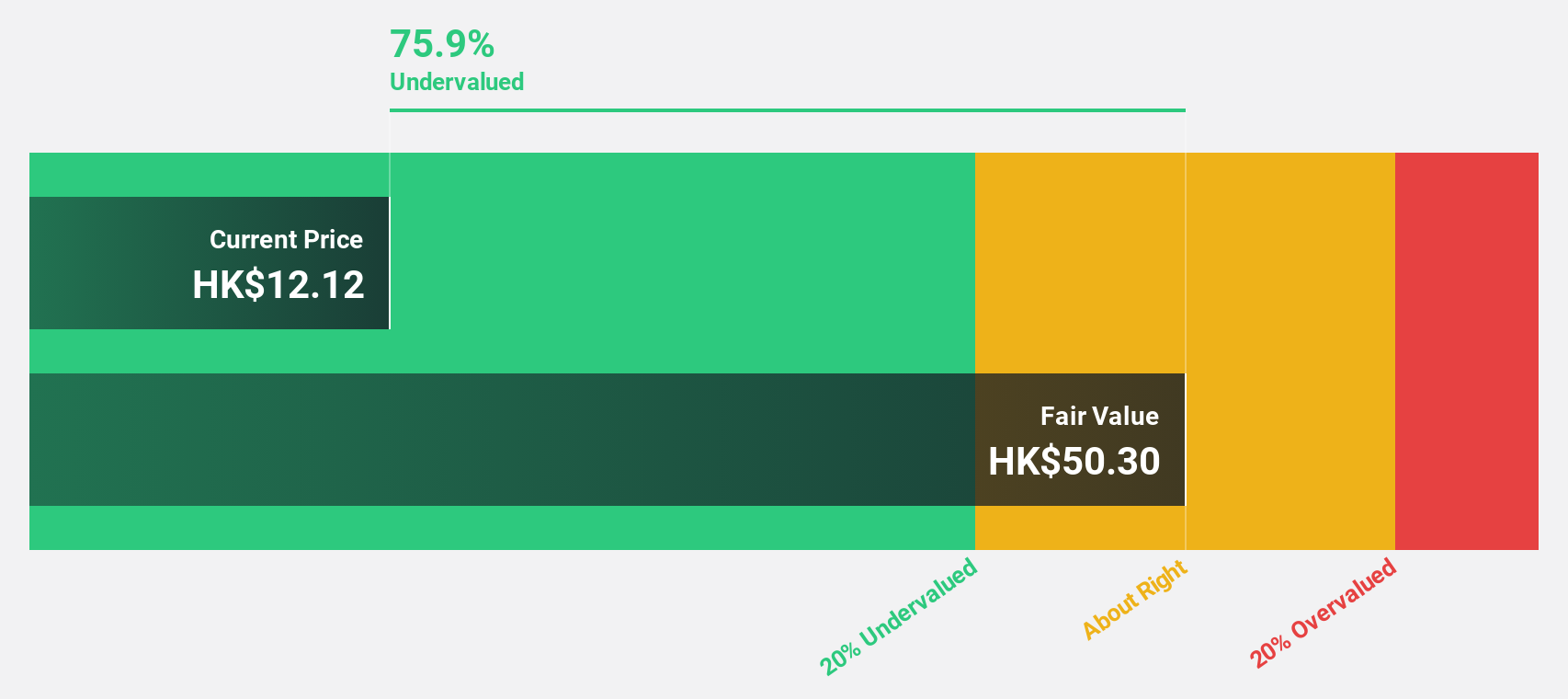

Estimated Discount To Fair Value: 25.3%

Yadea Group Holdings is trading at HK$13.3, significantly below its estimated fair value of HK$17.81, indicating potential undervaluation based on discounted cash flows. Despite a forecasted earnings growth of 18.2% per year, surpassing the Hong Kong market's 11.7%, recent guidance suggests a net profit decline due to inventory destocking and price reductions for existing models to clear stock, impacting short-term profitability despite strong long-term growth prospects.

- Insights from our recent growth report point to a promising forecast for Yadea Group Holdings' business outlook.

- Navigate through the intricacies of Yadea Group Holdings with our comprehensive financial health report here.

XD (SEHK:2400)

Overview: XD Inc. is an investment holding company that develops, publishes, operates, and distributes mobile and web games in Mainland China and internationally, with a market cap of HK$15.20 billion.

Operations: The company's revenue segments comprise CN¥2.43 billion from games and CN¥1.43 billion from the TapTap platform.

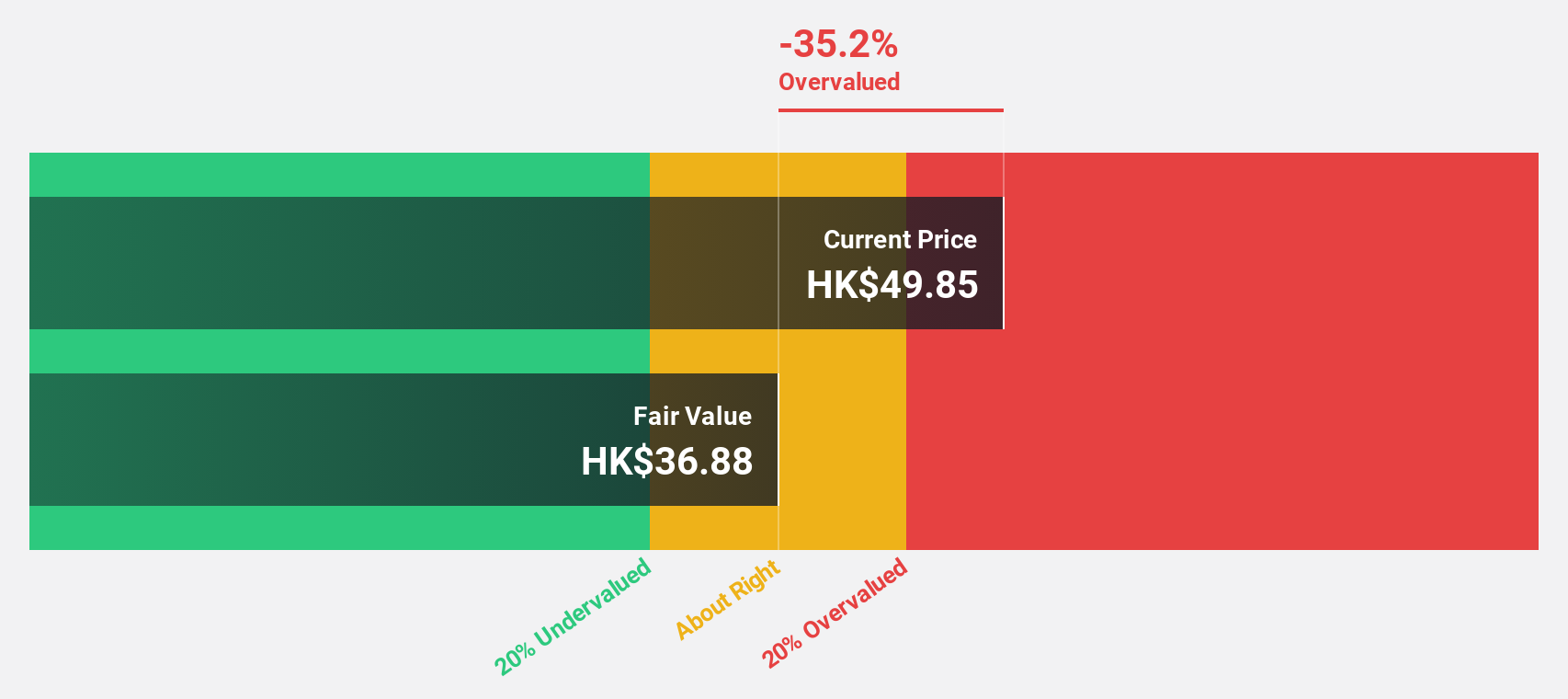

Estimated Discount To Fair Value: 14.3%

XD is trading at HK$34.75, below its estimated fair value of HK$40.54, highlighting potential undervaluation based on discounted cash flows. The company has become profitable this year, with earnings forecast to grow significantly at 52.1% annually over the next three years, outpacing the Hong Kong market's growth rate. However, revenue growth is expected to be moderate at 15.2% per year but still above the market average of 7.8%.

- Our expertly prepared growth report on XD implies its future financial outlook may be stronger than recent results.

- Take a closer look at XD's balance sheet health here in our report.

Kingdee International Software Group (SEHK:268)

Overview: Kingdee International Software Group Company Limited is an investment holding company focused on enterprise resource planning, with a market cap of HK$53.34 billion.

Operations: The company generates revenue primarily from its Cloud Service Business, contributing CN¥4.86 billion, and its ERP Business and Others segment, which accounts for CN¥1.13 billion.

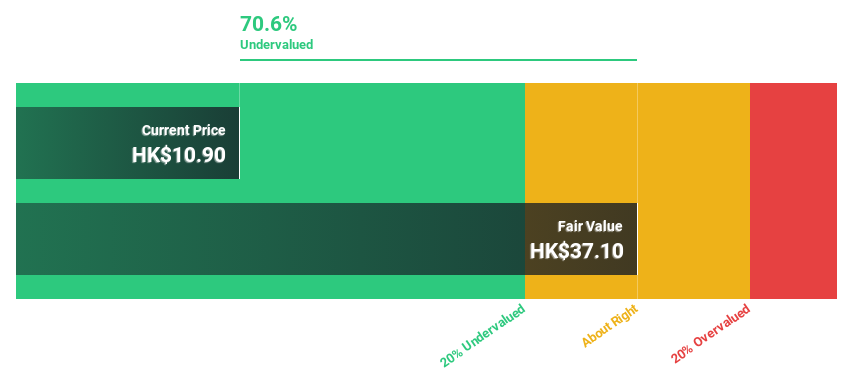

Estimated Discount To Fair Value: 18.4%

Kingdee International Software Group is trading at HK$14.3, below its estimated fair value of HK$17.52, suggesting potential undervaluation based on discounted cash flows. While revenue growth is forecast at 14.5% annually—slower than 20% but above the Hong Kong market's 7.8%—earnings are expected to grow significantly at 36.51% per year, with profitability anticipated within three years despite a low future return on equity of 3.8%.

- Our growth report here indicates Kingdee International Software Group may be poised for an improving outlook.

- Click here to discover the nuances of Kingdee International Software Group with our detailed financial health report.

Turning Ideas Into Actions

- Investigate our full lineup of 917 Undervalued Stocks Based On Cash Flows right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kingdee International Software Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:268

Kingdee International Software Group

An investment holding company, engages in the enterprise resource planning business.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives