As global markets grapple with volatility, particularly amid U.S.-China trade tensions and shifts in monetary policy, the Asian tech sector remains a focal point for investors seeking high growth opportunities. In this dynamic environment, identifying promising tech stocks involves assessing factors such as innovation potential, market positioning, and adaptability to evolving economic conditions.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 31.77% | 34.18% | ★★★★★★ |

| Fositek | 35.21% | 46.95% | ★★★★★★ |

| Eoptolink Technology | 38.08% | 35.42% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| Zhongji Innolight | 28.99% | 31.11% | ★★★★★★ |

| Shengyi Electronics | 23.36% | 30.38% | ★★★★★★ |

| Foxconn Industrial Internet | 28.55% | 27.95% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| ISU Petasys | 20.23% | 31.71% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

Kingdee International Software Group (SEHK:268)

Simply Wall St Growth Rating: ★★★★☆☆

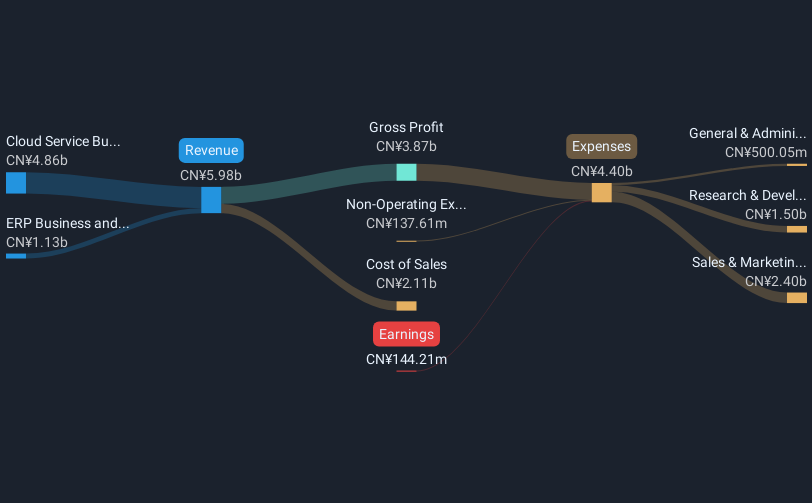

Overview: Kingdee International Software Group Company Limited is an investment holding company focused on enterprise resource planning solutions, with a market capitalization of HK$52.91 billion.

Operations: The company operates in the enterprise resource planning sector, generating revenue primarily through software solutions and related services. Its business model is centered around providing comprehensive ERP solutions to businesses, leveraging its expertise in software development and implementation.

Kingdee International Software Group has demonstrated resilience with a significant reduction in net loss to CNY 97.74 million from CNY 217.85 million year-over-year, alongside a sales increase to CNY 3,192.5 million. This recovery is underscored by strategic share repurchases totaling HKD 660.7 million, enhancing shareholder value amidst challenging market conditions. With earnings expected to grow by an impressive annual rate of 45.71%, Kingdee is positioning itself strongly within the competitive software sector in Asia, leveraging increased R&D investments aimed at fostering innovation and capturing emerging market trends in cloud-based solutions and AI integration.

Shenzhen Topband (SZSE:002139)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Topband Co., Ltd. specializes in the research, development, production, and sale of intelligent control system solutions both domestically and internationally, with a market cap of CN¥17.38 billion.

Operations: The company generates revenue primarily from the Intelligent Control Electronics Industry, amounting to CN¥10.99 billion.

Shenzhen Topband's recent earnings report shows resilience with a revenue increase to CNY 5.5 billion from CNY 5 billion, despite a slight dip in net income to CNY 330.08 million from CNY 388.83 million year-over-year. The company is navigating the competitive electronics sector with an annualized revenue growth of 15.6% and earnings growth projected at an impressive rate of 27% per year, outpacing the Chinese market average by a small margin. With substantial R&D investments aimed at innovation—particularly in smart appliance solutions—Topband is well-positioned to leverage emerging technological trends, though its Return on Equity forecast of just 12.6% suggests potential challenges in achieving higher profitability levels.

- Click to explore a detailed breakdown of our findings in Shenzhen Topband's health report.

Explore historical data to track Shenzhen Topband's performance over time in our Past section.

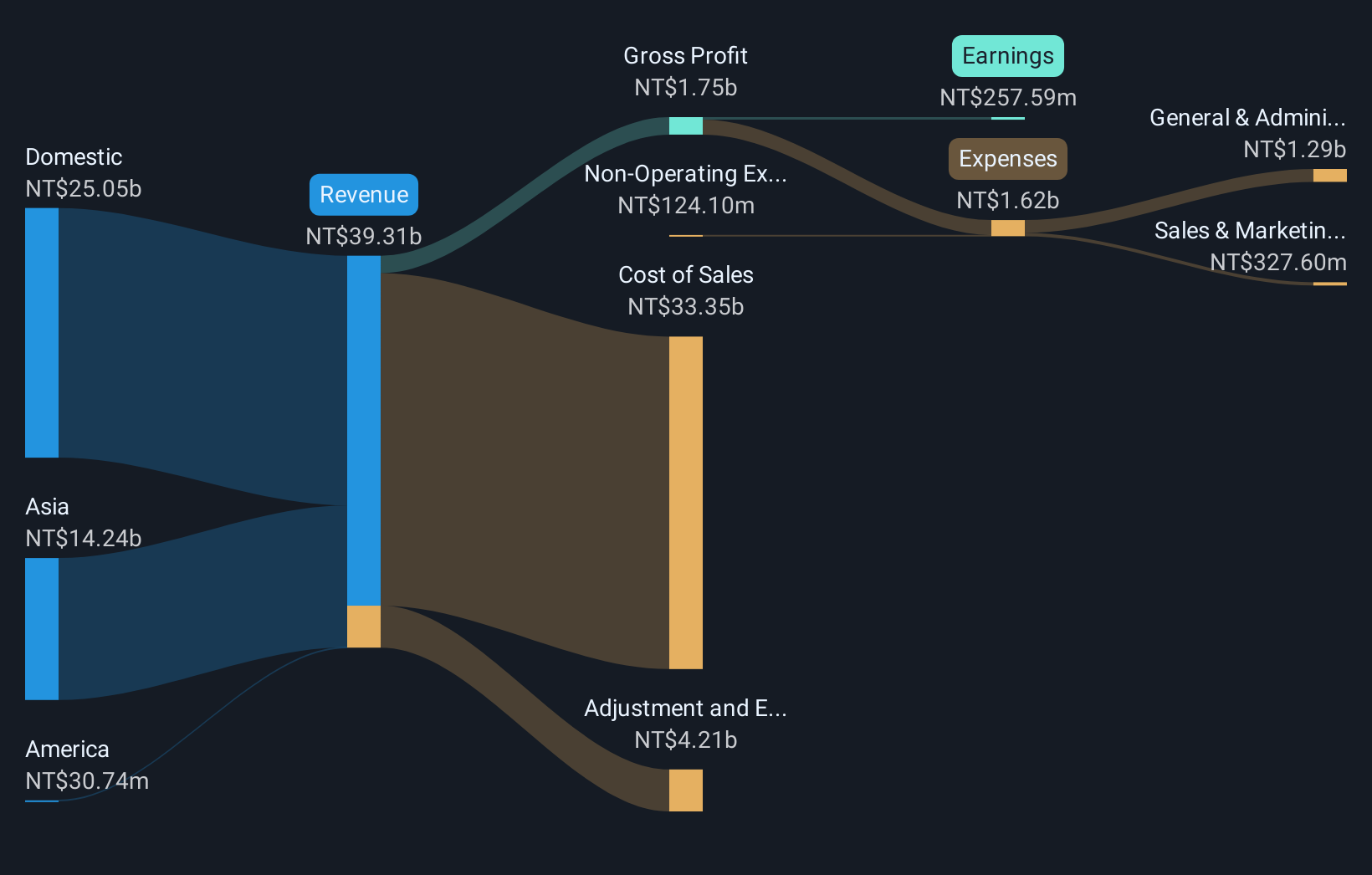

Nan Ya Printed Circuit Board (TWSE:8046)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Nan Ya Printed Circuit Board Corporation specializes in the manufacturing and sale of printed circuit boards across Taiwan, the United States, Mainland China, Korea, and other international markets with a market cap of NT$176.73 billion.

Operations: The company generates revenue primarily from the sale of printed circuit boards, with significant contributions from domestic sales amounting to NT$25.05 billion and Asian markets at NT$14.24 billion.

Nan Ya Printed Circuit Board is navigating a challenging landscape with a notable rebound in sales to TWD 18.04 billion, up from TWD 15.22 billion, demonstrating resilience amid market fluctuations. Despite facing a net loss in the second quarter, the company's annualized earnings growth forecast at an impressive 83.7% suggests robust future potential. With R&D expenses aligning closely with revenue growth trends—21% annually—the firm is strategically investing in innovation to secure its position in the competitive tech sector of Asia. This approach could well position Nan Ya for significant advancements within its industry segment, leveraging high-profile clients and cutting-edge technology developments.

- Click here to discover the nuances of Nan Ya Printed Circuit Board with our detailed analytical health report.

Gain insights into Nan Ya Printed Circuit Board's past trends and performance with our Past report.

Make It Happen

- Take a closer look at our Asian High Growth Tech and AI Stocks list of 187 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Kingdee International Software Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:268

Kingdee International Software Group

An investment holding company, engages in the enterprise resource planning business.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)