Cowell e Holdings And 2 Asian Stocks That Might Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by geopolitical tensions and economic fluctuations, Asian stocks have shown resilience, with indices like Japan's Nikkei 225 and China's CSI 300 posting notable gains. In this environment, identifying undervalued stocks can be particularly rewarding as investors seek opportunities that may offer potential value amidst broader market movements.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Tibet GaoZheng Explosive (SZSE:002827) | CN¥37.79 | CN¥74.69 | 49.4% |

| Nippon Chemi-Con (TSE:6997) | ¥1630.00 | ¥3218.06 | 49.3% |

| Ningxia Building Materials GroupLtd (SHSE:600449) | CN¥13.37 | CN¥26.40 | 49.4% |

| Lotes (TWSE:3533) | NT$1425.00 | NT$2830.44 | 49.7% |

| Kinsus Interconnect Technology (TWSE:3189) | NT$145.00 | NT$284.52 | 49% |

| Insource (TSE:6200) | ¥911.00 | ¥1806.40 | 49.6% |

| COVER (TSE:5253) | ¥1872.00 | ¥3693.77 | 49.3% |

| Anhui Ronds Science & Technology (SHSE:688768) | CN¥47.65 | CN¥95.09 | 49.9% |

| Andes Technology (TWSE:6533) | NT$270.50 | NT$531.74 | 49.1% |

| Aecc Aero Science and TechnologyLtd (SHSE:600391) | CN¥27.55 | CN¥54.29 | 49.3% |

Here we highlight a subset of our preferred stocks from the screener.

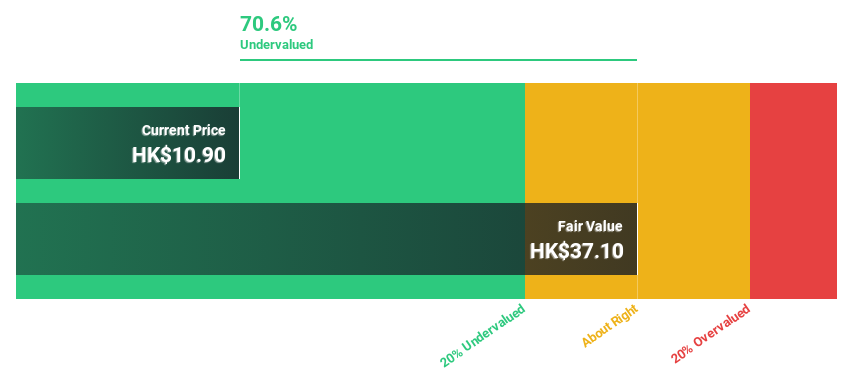

Cowell e Holdings (SEHK:1415)

Overview: Cowell e Holdings Inc. is an investment holding company that designs, develops, manufactures and sells modules and system integration products for smartphones, multimedia tablets and other mobile devices, with a market capitalization of approximately HK$28.96 billion.

Operations: The company generates revenue of $3.27 billion from its Photographic Equipment & Supplies segment.

Estimated Discount To Fair Value: 36%

Cowell e Holdings is trading at 36% below its estimated fair value of HK$52.13, making it highly undervalued based on discounted cash flow analysis. The company reported a significant earnings growth of 282.1% over the past year, with net income reaching US$67.4 million for the half-year ended June 30, 2025. Earnings are expected to grow significantly at an annual rate of 21.5%, outpacing the Hong Kong market's growth forecast.

- Upon reviewing our latest growth report, Cowell e Holdings' projected financial performance appears quite optimistic.

- Dive into the specifics of Cowell e Holdings here with our thorough financial health report.

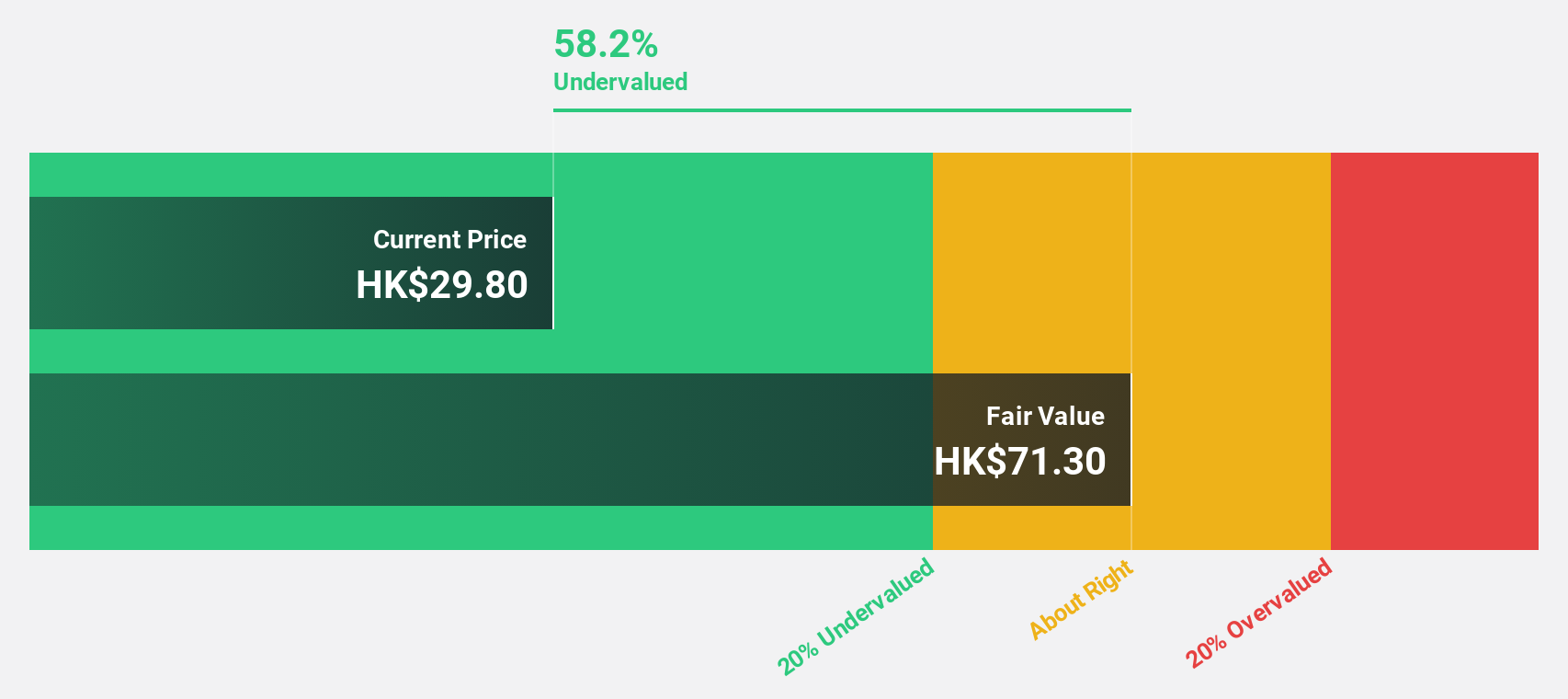

Kingdee International Software Group (SEHK:268)

Overview: Kingdee International Software Group Company Limited is an investment holding company involved in the enterprise resource planning business, with a market capitalization of HK$52.56 billion.

Operations: Kingdee International Software Group's revenue segments include enterprise resource planning solutions, with a market capitalization of HK$52.56 billion.

Estimated Discount To Fair Value: 36.1%

Kingdee International Software Group is trading 36.1% below its estimated fair value of HK$23.18, presenting a potentially undervalued opportunity based on discounted cash flow analysis. Despite recent insider selling, the company has shown improved financial performance with sales increasing to CNY 3.19 billion and net loss narrowing to CNY 97.74 million for H1 2025. Analysts anticipate profitability within three years, supported by expected earnings growth of 45.39% annually and revenue growth outpacing the Hong Kong market at 14%.

- The growth report we've compiled suggests that Kingdee International Software Group's future prospects could be on the up.

- Take a closer look at Kingdee International Software Group's balance sheet health here in our report.

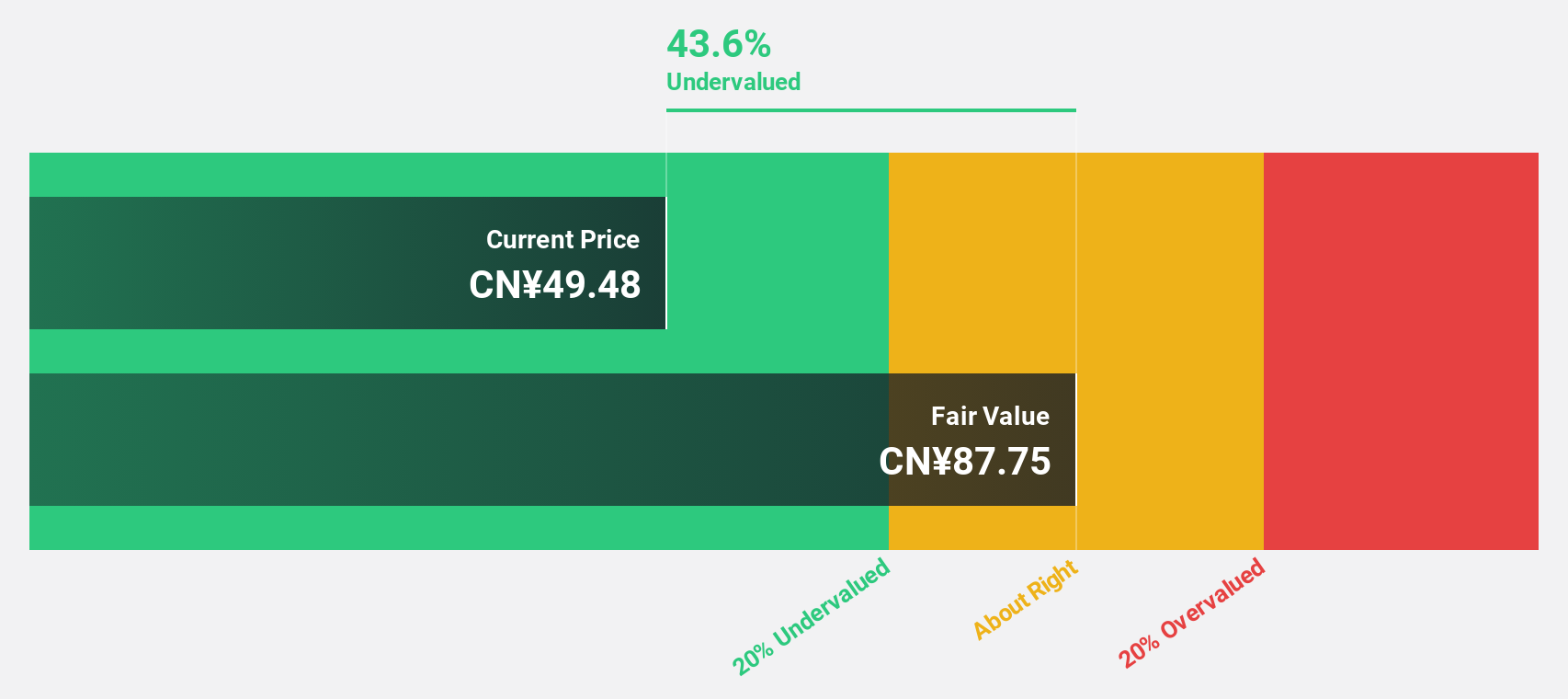

Suzhou Hengmingda Electronic Technology (SZSE:002947)

Overview: Suzhou Hengmingda Electronic Technology Co., Ltd. operates in the electronics sector and has a market capitalization of approximately CN¥11.84 billion.

Operations: Suzhou Hengmingda Electronic Technology Co., Ltd. generates its revenue from various segments within the electronics sector.

Estimated Discount To Fair Value: 45.9%

Suzhou Hengmingda Electronic Technology is trading at CN¥47.47, significantly below its fair value estimate of CN¥87.75, highlighting a potential undervaluation based on cash flows. The company reported strong revenue growth of CN¥1,962.56 million for the first nine months of 2025, up from CN¥1,699.07 million last year. Despite an unstable dividend record, its earnings are forecast to grow at 23.9% annually over the next three years with a high return on equity expected to reach 20%.

- According our earnings growth report, there's an indication that Suzhou Hengmingda Electronic Technology might be ready to expand.

- Click to explore a detailed breakdown of our findings in Suzhou Hengmingda Electronic Technology's balance sheet health report.

Seize The Opportunity

- Unlock our comprehensive list of 271 Undervalued Asian Stocks Based On Cash Flows by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Kingdee International Software Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:268

Kingdee International Software Group

An investment holding company, engages in the enterprise resource planning business.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)