As global markets adjust to recent interest rate cuts and ongoing trade negotiations, Asia's economic landscape presents a mix of challenges and opportunities. In this context, growth companies with high insider ownership are particularly appealing, as they often signal strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Leapmotor Technology (SEHK:9863) | 14.6% | 57.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| Samyang Foods (KOSE:A003230) | 11.7% | 28.6% |

| Oscotec (KOSDAQ:A039200) | 12.7% | 104.1% |

| Novoray (SHSE:688300) | 23.6% | 30.3% |

| Laopu Gold (SEHK:6181) | 35.5% | 34% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 24.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.8% | 50.7% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 91.9% |

We'll examine a selection from our screener results.

Kingdee International Software Group (SEHK:268)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kingdee International Software Group Company Limited is an investment holding company that operates in the enterprise resource planning business with a market capitalization of HK$61.75 billion.

Operations: Kingdee International Software Group Company Limited generates revenue primarily from its enterprise resource planning business.

Insider Ownership: 19.9%

Earnings Growth Forecast: 45.7% p.a.

Kingdee International Software Group, trading at 24.5% below its estimated fair value, has shown a solid growth trajectory with earnings forecasted to grow 45.71% annually. Despite no substantial insider buying recently, insiders have bought more shares than sold over the past three months. The company reported a narrowed net loss for H1 2025 and completed significant share buybacks totaling HK$660.7 million, indicating confidence in its long-term potential amidst high insider ownership levels.

- Take a closer look at Kingdee International Software Group's potential here in our earnings growth report.

- Upon reviewing our latest valuation report, Kingdee International Software Group's share price might be too pessimistic.

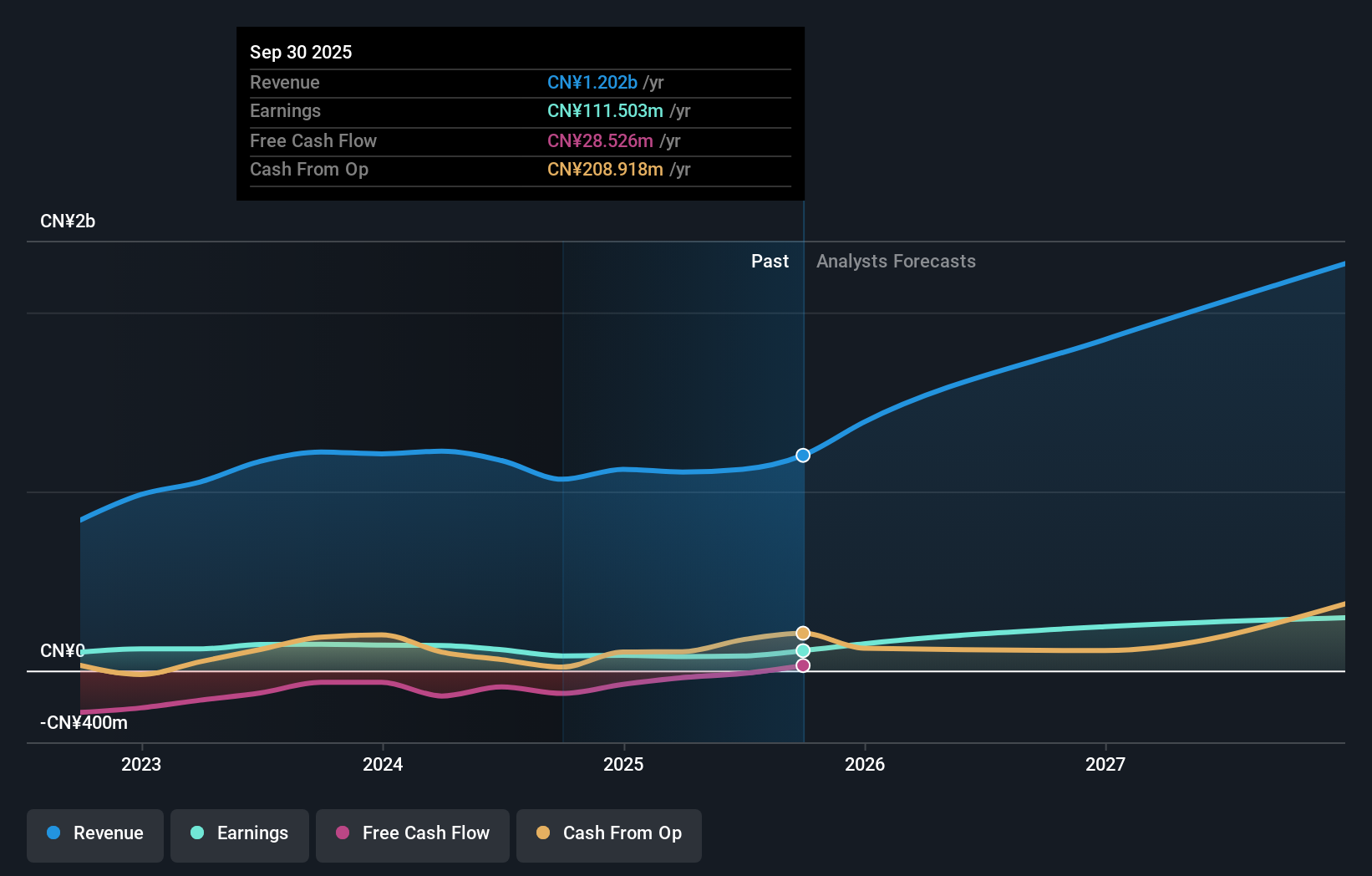

Nanjing Develop Advanced Manufacturing (SHSE:688377)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Nanjing Develop Advanced Manufacturing Co., Ltd. operates in the advanced manufacturing sector and has a market cap of CN¥7.49 billion.

Operations: Nanjing Develop Advanced Manufacturing Co., Ltd. does not have specified revenue segments available in the provided text.

Insider Ownership: 39.7%

Earnings Growth Forecast: 43.9% p.a.

Nanjing Develop Advanced Manufacturing is expected to achieve robust growth, with revenue projected to rise by 27.6% annually and earnings by 43.94%, both outpacing the Chinese market averages. Despite a slight decline in recent half-year net income (CNY 51.53 million), insider ownership remains high, reflecting confidence in its future prospects. The company's Return on Equity is forecasted to be modest at 12.4% over three years, suggesting room for operational improvement amidst strong growth potential.

- Click here and access our complete growth analysis report to understand the dynamics of Nanjing Develop Advanced Manufacturing.

- Insights from our recent valuation report point to the potential overvaluation of Nanjing Develop Advanced Manufacturing shares in the market.

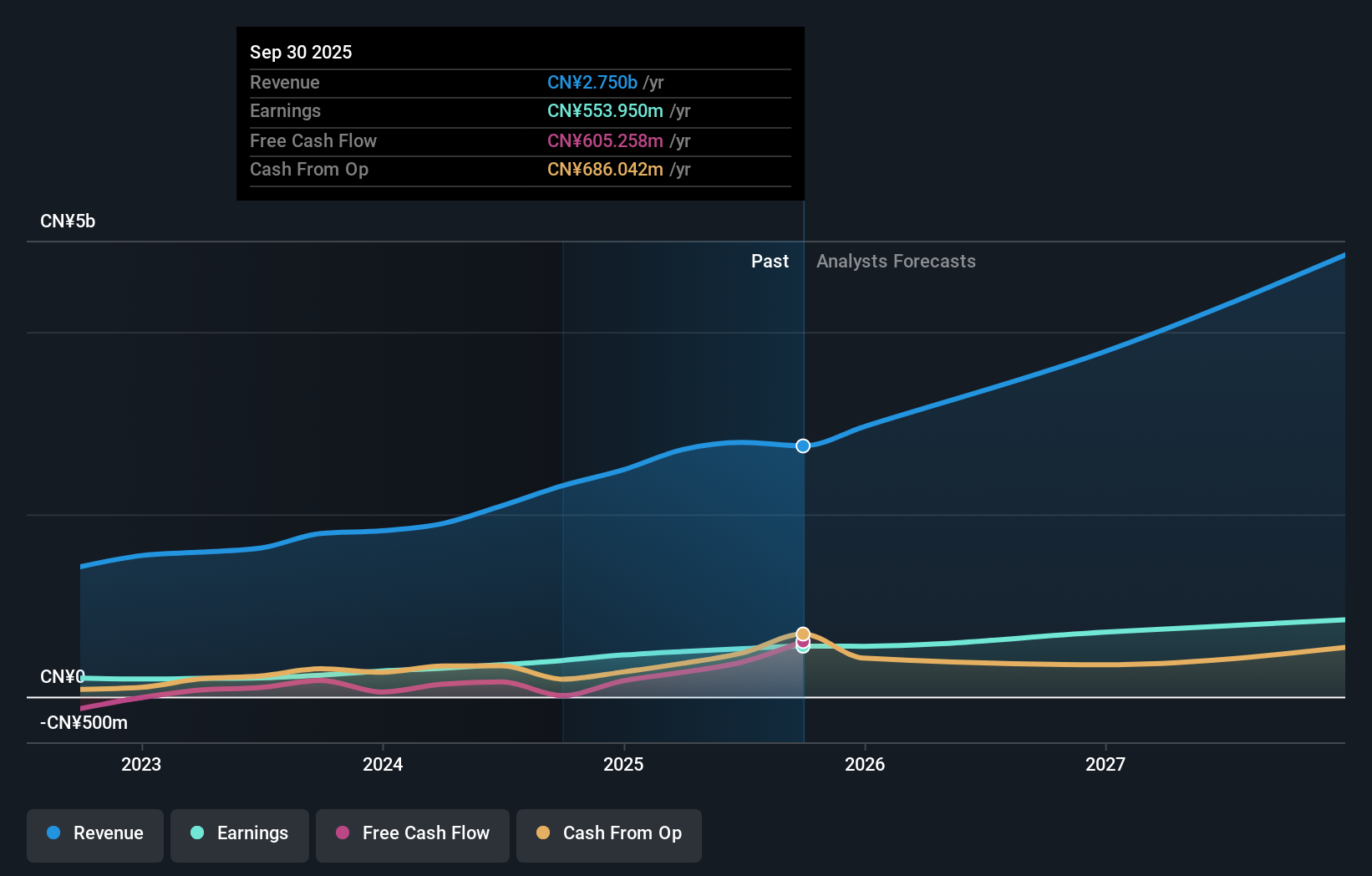

Suzhou Hengmingda Electronic Technology (SZSE:002947)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Suzhou Hengmingda Electronic Technology Co., Ltd. operates in the electronics sector and has a market capitalization of approximately CN¥12.21 billion.

Operations: The company's revenue is primarily derived from Precision Flexible Structural Parts, which contribute CN¥2.35 billion, followed by Precision Metal Structural Parts at CN¥399.44 million.

Insider Ownership: 36.4%

Earnings Growth Forecast: 23.8% p.a.

Suzhou Hengmingda Electronic Technology demonstrates strong growth potential with revenue forecasted to increase by 32.8% annually, outpacing the Chinese market. Recent earnings results showed significant improvement, with net income rising to CNY 234.32 million from CNY 163.85 million year-over-year. The stock trades at a substantial discount to its estimated fair value and offers good relative value compared to peers, though its Return on Equity is expected to remain low at 20% in three years.

- Navigate through the intricacies of Suzhou Hengmingda Electronic Technology with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of Suzhou Hengmingda Electronic Technology shares in the market.

Next Steps

- Explore the 614 names from our Fast Growing Asian Companies With High Insider Ownership screener here.

- Searching for a Fresh Perspective? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Kingdee International Software Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:268

Kingdee International Software Group

An investment holding company, engages in the enterprise resource planning business.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)