Does Vixtel Technologies Holdings (HKG:1782) Have A Healthy Balance Sheet?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Vixtel Technologies Holdings Limited (HKG:1782) does use debt in its business. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Vixtel Technologies Holdings

How Much Debt Does Vixtel Technologies Holdings Carry?

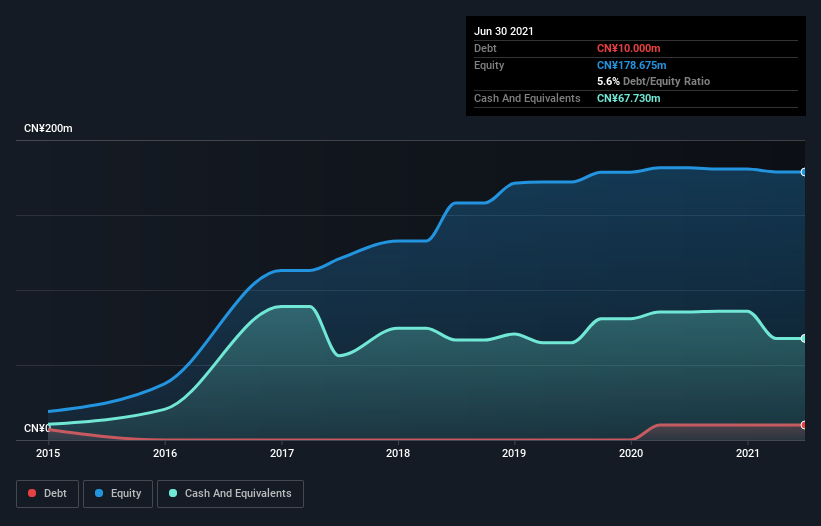

As you can see below, Vixtel Technologies Holdings had CN¥10.0m of debt, at June 2021, which is about the same as the year before. You can click the chart for greater detail. However, its balance sheet shows it holds CN¥67.7m in cash, so it actually has CN¥57.7m net cash.

A Look At Vixtel Technologies Holdings' Liabilities

According to the last reported balance sheet, Vixtel Technologies Holdings had liabilities of CN¥32.2m due within 12 months, and liabilities of CN¥2.22m due beyond 12 months. Offsetting this, it had CN¥67.7m in cash and CN¥111.1m in receivables that were due within 12 months. So it actually has CN¥144.4m more liquid assets than total liabilities.

This surplus liquidity suggests that Vixtel Technologies Holdings' balance sheet could take a hit just as well as Homer Simpson's head can take a punch. With this in mind one could posit that its balance sheet means the company is able to handle some adversity. Succinctly put, Vixtel Technologies Holdings boasts net cash, so it's fair to say it does not have a heavy debt load! When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Vixtel Technologies Holdings will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Vixtel Technologies Holdings had a loss before interest and tax, and actually shrunk its revenue by 2.0%, to CN¥87m. That's not what we would hope to see.

So How Risky Is Vixtel Technologies Holdings?

While Vixtel Technologies Holdings lost money on an earnings before interest and tax (EBIT) level, it actually booked a paper profit of CN¥1.8m. So taking that on face value, and considering the cash, we don't think its very risky in the near term. There's no doubt the next few years will be crucial to how the business matures. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 5 warning signs for Vixtel Technologies Holdings (1 is concerning!) that you should be aware of before investing here.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1782

International Business Digital Technology

An investment holding company, provides Internet and Web application performance management (APM) products and services to telecommunication operators and large enterprises in Mainland China, Taiwan, and Hong Kong.

Excellent balance sheet with minimal risk.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The Hidden Gem of AI Hardware – Solving the Data Center Bottleneck

Moving from "Science Fiction" to "Science Fact" – A Bullish Valuation Case

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026