- Hong Kong

- /

- Semiconductors

- /

- SEHK:981

Semiconductor Manufacturing International (SEHK:981) Is Down 19.4% After US-China Trade Tensions Impact Rare Earth Controls Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Asian stock markets pulled back earlier this week as renewed trade tensions between Beijing and Washington escalated over China's decision to maintain rare earth export controls in response to pending US tariffs.

- This development has drawn investor attention to technology sectors, particularly those, like semiconductors, most exposed to cross-border supply chain risks and international regulatory shifts.

- We'll look at how continued export and tariff tensions between the US and China could influence Semiconductor Manufacturing International's long-term growth prospects.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Semiconductor Manufacturing International Investment Narrative Recap

To be a shareholder in Semiconductor Manufacturing International, you need conviction in the long-term potential for China’s semiconductor self-sufficiency, despite shorter-term swings driven by trade friction and sector volatility. The recent rare earth export controls and tariff threats add uncertainty to SMIC’s most crucial catalyst, its aggressive wafer capacity expansion targeting rising domestic demand, but do not appear to materially change the biggest current risk: ongoing pricing pressure and margin compression from elevated supply and tepid growth in international markets.

One recent development of particular relevance is SMIC’s guidance for third-quarter 2025, which projects a 5% to 7% sequential revenue increase and gross margins of 18% to 20%. This outlook is important as it addresses immediate expectations for capacity utilization and profitability against the backdrop of intensifying US-China trade disputes, factors closely watched by investors who see sustained high utilization and domestic orders as key to navigating cross-border risks.

By contrast, the implications for SMIC’s ability to maintain stable margins amid global supply chain reconfiguration is information investors should be aware of, especially as…

Read the full narrative on Semiconductor Manufacturing International (it's free!)

Semiconductor Manufacturing International's outlook anticipates $12.6 billion in revenue and $1.5 billion in earnings by 2028. This is based on an assumed annual revenue growth rate of 12.7% and an increase in earnings of approximately $923 million from current earnings of $576.9 million.

Uncover how Semiconductor Manufacturing International's forecasts yield a HK$53.81 fair value, a 27% downside to its current price.

Exploring Other Perspectives

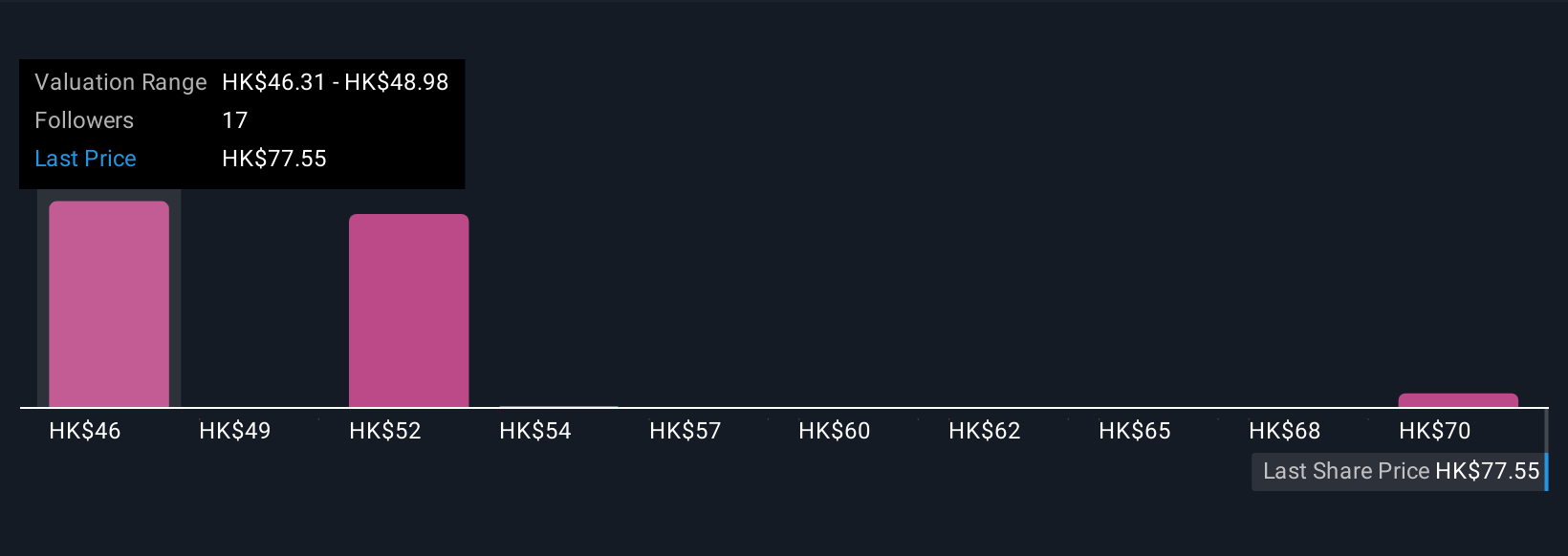

Six fair value estimates from the Simply Wall St Community range from HK$46.31 to HK$73.00 per share. As opinions differ widely, consider that ongoing weakness in pricing and margins continues to test confidence in SMIC’s earnings resilience over time.

Explore 6 other fair value estimates on Semiconductor Manufacturing International - why the stock might be worth as much as HK$73.00!

Build Your Own Semiconductor Manufacturing International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Semiconductor Manufacturing International research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Semiconductor Manufacturing International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Semiconductor Manufacturing International's overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:981

Semiconductor Manufacturing International

An investment holding company, engages in the manufacture, testing, and sale of integrated circuits wafer and various compound semiconductors in the United States, China, and Eurasia.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives