- Hong Kong

- /

- Semiconductors

- /

- SEHK:712

Market Might Still Lack Some Conviction On Comtec Solar Systems Group Limited (HKG:712) Even After 37% Share Price Boost

Comtec Solar Systems Group Limited (HKG:712) shares have continued their recent momentum with a 37% gain in the last month alone. Unfortunately, despite the strong performance over the last month, the full year gain of 9.8% isn't as attractive.

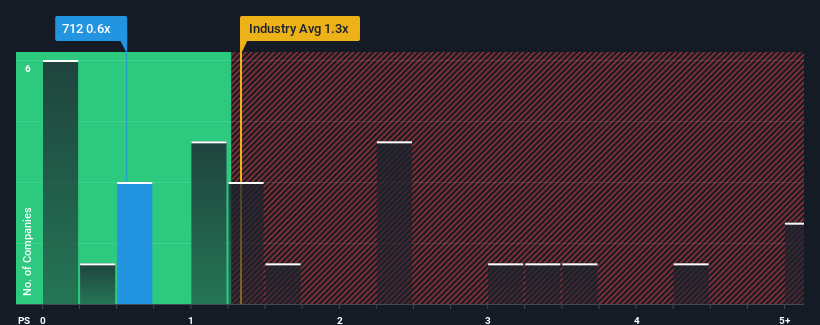

Even after such a large jump in price, it would still be understandable if you think Comtec Solar Systems Group is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.6x, considering almost half the companies in Hong Kong's Semiconductor industry have P/S ratios above 1.3x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Comtec Solar Systems Group

What Does Comtec Solar Systems Group's P/S Mean For Shareholders?

Recent times have been quite advantageous for Comtec Solar Systems Group as its revenue has been rising very briskly. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Comtec Solar Systems Group will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For Comtec Solar Systems Group?

The only time you'd be truly comfortable seeing a P/S as low as Comtec Solar Systems Group's is when the company's growth is on track to lag the industry.

Taking a look back first, we see that the company's revenues underwent some rampant growth over the last 12 months. The latest three year period has also seen an excellent 181% overall rise in revenue, aided by its incredible short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

When compared to the industry's one-year growth forecast of 19%, the most recent medium-term revenue trajectory is noticeably more alluring

With this in mind, we find it intriguing that Comtec Solar Systems Group's P/S isn't as high compared to that of its industry peers. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Bottom Line On Comtec Solar Systems Group's P/S

Comtec Solar Systems Group's stock price has surged recently, but its but its P/S still remains modest. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We're very surprised to see Comtec Solar Systems Group currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see strong revenue with faster-than-industry growth, we assume there are some significant underlying risks to the company's ability to make money which is applying downwards pressure on the P/S ratio. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to perceive a likelihood of revenue fluctuations in the future.

We don't want to rain on the parade too much, but we did also find 5 warning signs for Comtec Solar Systems Group (2 make us uncomfortable!) that you need to be mindful of.

If these risks are making you reconsider your opinion on Comtec Solar Systems Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:712

Comtec Solar Systems Group

An investment holding company, provides logistics services to the factories, manufacturers, raw material providers in the People’s Republic of China and Hong Kong.

Imperfect balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)